Having your property insurance claim denied can be a frustrating and stressful experience. You may find yourself wondering what went wrong and how you can go about fixing it. While there can be a number of factors involved, understanding the most common reasons why your claim was denied can help you take the necessary steps to appeal the decision and make sure it doesn’t happen again.

If your property insurance claim was denied, an insurance dispute lawyer can help protect your legal rights. Contact Wallace Law today for more information.

1. The Claim Was Filed Too Late

When filing a property insurance claim, it is critical to make sure the claim is submitted within the allotted time frame. Generally, this means that you need to file the claim as soon as possible after the damage occurred or was discovered. If your claim is filed after the allotted time frame, it could be denied by the insurer.

The time frame for filing a claim will vary from policy to policy, so it is important to make sure you understand the specific requirements of your insurance agreement. Additionally, some policies may require that an initial notification must be made in writing within a certain period of time, even if the formal claim has not been filed yet.

If your claim has been denied due to being filed too late, you may be able to dispute the denial with your insurer. The best way to do this is to provide documentation that proves that you were not aware of the damage until after the filing deadline and that you promptly reported the issue once it was discovered.

2. The Policy Does Not Cover Your Damage

One of the most common reasons why a property insurance claim may be denied is because the damage being claimed is not covered by the insurance policy. If you are filing a claim for damage not covered by your policy, it won’t matter how much evidence or paperwork you provide—the insurer will not cover it.

To make sure you have the right coverage in place before filing a claim, review your policy documents and contact your insurance agent or broker. Be sure to read the fine print in your policy documents so that you understand exactly what type of coverage you have and what is excluded from your policy. If your policy covers your damages but your claim is still denied, you have the right to fight back and appeal the decision. An experienced insurance dispute lawyer can help make sure your rights are protected, and you are paid what you could be owed.

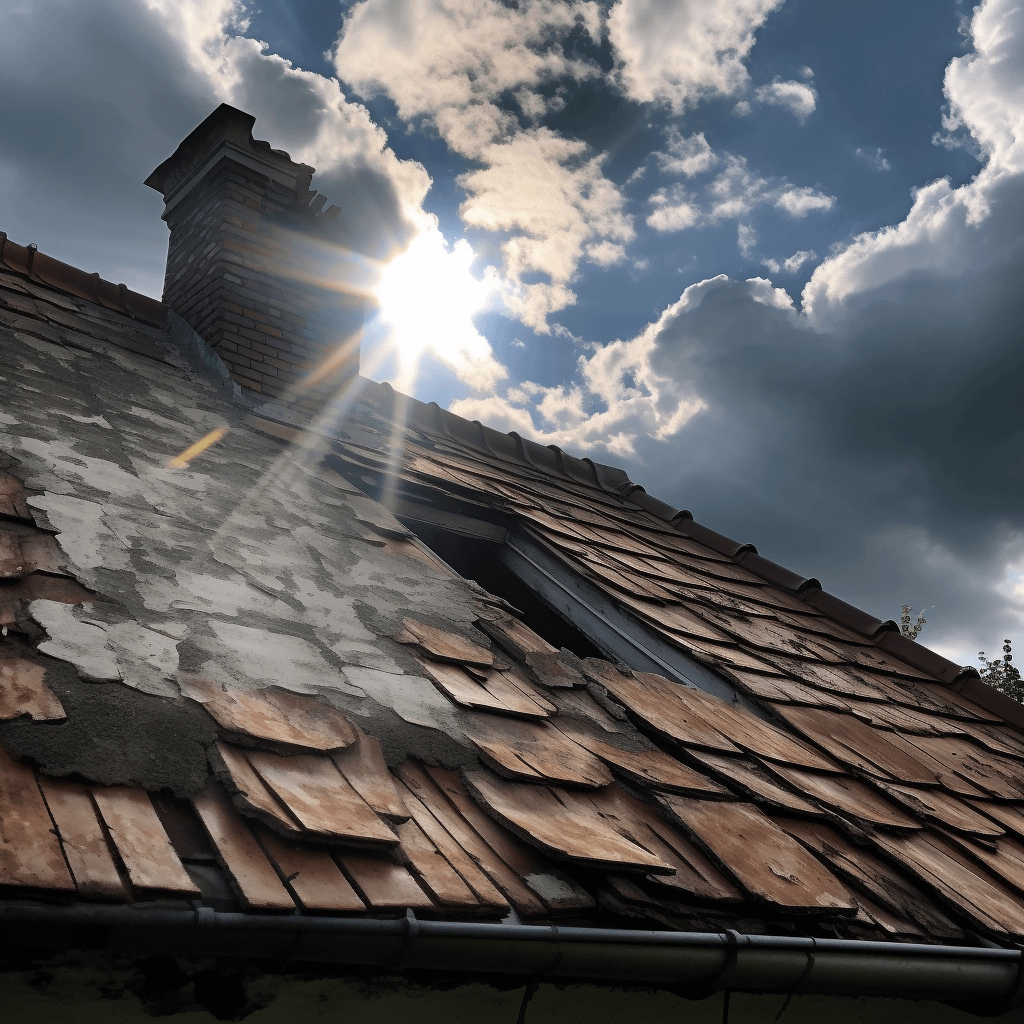

3. The Claim Lacked Sufficient Evidence Showing the Damage

When filing an insurance claim, it is important to provide sufficient evidence, including photos and videos, to back up the claim. If there is not enough evidence, or the evidence provided is not strong enough, it can lead to a denial of the claim. Claims may also be denied for missing information, failing to fill out required forms, or incomplete records.

In addition to photos and videos, you should also keep any receipts for any repairs that have been done to fix the damage, as well as any other documentation that is relevant to the claim. By gathering all of this evidence, it can help prove that the damage was indeed caused by what you said it was and can help prevent any denials due to lack of sufficient evidence. The insurance claim dispute lawyers of Wallace Law can review your claim and correspondence with your insurance company in order to gather the necessary documentation to support your claim.

4. You Missed a Payment on Your Policy

Missing a payment on your property insurance policy can be a major issue when it comes to getting your claim approved. Your insurer may deny your claim if they find out that you have failed to make a premium payment. If you do happen to miss a payment, try to rectify the situation as soon as possible by reaching out to your insurer and making the payment right away.

If the insurer denies your claim due to non-payment, they are obligated to explain why they took that action and provide instructions on how to appeal the decision. You may be able to fight this type of denial if the insurer did not warn you or give you a grace period before ending your coverage.

5. The Denial Was Made in Bad Faith

When an insurance company denies a valid claim, it is referred to as a bad faith claim denial. This means that the insurer is not acting in good faith and is not meeting its obligation to uphold the terms of the insurance policy. Bad faith claim denials can occur for various reasons, such as if the insurer has failed to investigate the claim in a timely manner or if the insurer has unreasonably rejected a claim that should have been approved.

When dealing with bad faith claim denials, the best thing to do is to take action. First, you should check the insurance policy that you purchased to ensure that the insurance company is providing you with the coverage you were promised. If you believe your claim was denied in bad faith, you should contact the insurer and explain why you feel they are not upholding the terms of the policy. You should also contact an insurance dispute attorney to help guide you through the process of resolving the dispute.

It is crucial to remember that insurers are in business to make a profit, so they may be reluctant to pay out on claims they think they can deny. This is why it can be beneficial to have an experienced insurance claim attorney on your side to help ensure that your rights are protected and that your valid claim is not wrongfully denied.

How an Insurance Claim Lawyer Can Help

If your property insurance claim has been denied, it is important to understand that you have the right to dispute the decision. Hiring an insurance claims lawyer can help ensure your rights are protected and that you are not taken advantage of by the insurance company.

An experienced insurance dispute lawyer can help you through the claims process by looking at your policy paperwork and determining whether there are any legal grounds for contesting the decision. They may be able to determine if there was a mistake made or if the insurer’s decision is based on incorrect information. If the claim is denied due to a technicality, a lawyer can help by finding out what it is and helping you rectify the issue. Your lawyer can also represent you in any court proceedings that may arise as a result of your dispute. The insurer may have strong evidence to support their decision, which could make it difficult for you to argue against them on your own. A lawyer will be able to make sure that your case is presented in the best possible light and will work hard to ensure that your rights are respected and that your claim is taken seriously.

Additionally, an insurance claims lawyer will also be able to advise you of any options that may be available to you, such as filing an appeal, seeking reimbursement for the costs incurred in filing the claim, and any other potential legal remedies. They will be able to provide you with experienced guidance throughout the entire process and can help you navigate the complexities of insurance law.

Denied Property Insurance Claim? Contact Wallace Law

At Wallace Law, our insurance dispute attorneys are dedicated to protecting the rights of policyholders and helping them get their claims paid. We know how stressful dealing with a denied property insurance claim to be and are here to help. Contact us today for a free legal case review.