There is no telling when tragedies like winter storms, tornados, hurricanes, fires, or property theft will strike. The aftermath of weather-related accidents and other unforeseen incidents harms property and business owners in more ways than one, including damaged property or building structures, supply chain disruptions, and loss of business.

While commercial property insurance is meant to be a helpful financial safety net to mitigate financial losses after disaster strikes, many property owners need help with the commercial property claims process, including denied, delayed, or underpaid claims.

There are other options than accepting your insurance company’s low offer or outright denial, or fighting them on your own in a never-ending battle. Instead of leaving money on the table, contact an experienced commercial property insurance lawyer with Wallace Law instead.

We tackle tough insurance disputes and help companies and individuals with property damage recover money from denied and underpaid insurance claims. Take matters into your own hands today, protect your business, and learn how to handle denied commercial insurance claims with ease.

Types of Insurance Claims

We can help with multiple types of insurance disputes.

Denied Renters Insurance Claims Lawyer

Insurance Dispute Lawyer

Long-Term Care Insurance Denials Lawyer

Bad Faith Insurance Attorney

Wisconsin Insurance Dispute Lawyer

Travel Insurance Dispute Lawyer

What is Commercial Property Insurance?

Starting and running a business successfully takes time, money, and energy. Companies potentially have a lot to lose when the unexpected happens. Unplanned accidents like extreme weather and property theft can leave business owners without income, expensive repairs, and other costly disruptions.

Losses occur more often than most businesses think and do not come with a small price tag. A recent small business commercial property study shows that a fire costs nearly $35,000, and wind and hail damage is a $26,000 financial hit.

Commercial property insurance coverage is a company’s best defense against unforeseen issues, as it protects physical assets like tools, equipment, and property from serious financial losses. It is one of the most important insurance policies when trouble strikes.

Insurers are legally bound to uphold the contractual obligations of your commercial insurance policy, though this does not always happen. A commercial property claims lawyer with Wallace Law can offer legal guidance if your claim was wrongfully denied or rejected.

What Does Commercial Property Insurance Typically Cover?

Commercial insurance usually covers everything from minor hiccups to major losses for properties like retail stores, housing complexes, hotels and malls, office buildings, warehouses, and other similar commercial buildings. Some of the most commonly filed commercial claims include burglary and theft, water and freezing damage, wind and hail damage, and fires.

One of the best ways to prepare for the unexpected is with commercial property insurance. Nearly half of small businesses, within ten years of operation, will submit some insurance claim, according to a commercial claims insurance study.

Policies usually support the following:

- Damage to the exterior of the building, outdoor signage, or other elements

- Destruction of any movable furniture, equipment, and valuable documents

- Costs of repairs

- Internal damage to the structure of the building

- Losses due to business interruption, such as lost income

Natural disasters and theft can immediately impact business operations, property, and employees, as restoration and repairs take time and money.

If your insurance company is dragging its feet on reimbursement or is refusing a fair settlement offer, take action and consult an experienced commercial property insurance claims lawyer. Our bad faith insurance law firm knows what it takes to secure successful outcomes when unfair insurers that take advantage of policyholders.

Why Are Commercial Property Insurance Claims Denied?

Commercial property claims get denied, rejected, or paid. Insurance companies must make daily judgment calls regarding claim approval or denial, which can be legitimate or unfair. The problem is that most policyholders do not know if their claim has been rightfully or wrongfully declined.

The most common reasons commercial property insurance claims get denied include the following:

- Late or absent premiums

- Insufficient documentation of damages or missing information

- Suspicion of insurance fraud

- Lack of coverage or coverage restrictions under the policy

- Coverage limitations have been met or exceeded

- Bad faith insurance practices such as a poor investigation into the claim or intentional rejection, denial, or delaying of the claim to avoid a payout

Remember that a notice of denial from the insurance company should contain specific information and reasons the insurer denied coverage. For example, if your coverage was denied because of coverage limits and your policy states otherwise, this could be a red flag. Denial letters should be clear and concise and provide sound reasoning for the insurer’s decision.

Policyholders are often left with few choices, such as accepting the decision, filing an appeal, or other ineffective methods when fighting against a large insurance company. So what is next?

If you feel your coverage was wrongfully denied, turn to Wallace Law for help. Our legal services are designed to help vulnerable policyholders fight back against unjust insurance claims practices. Contact us today to learn if you may qualify to file a bad faith commercial property insurance lawsuit.

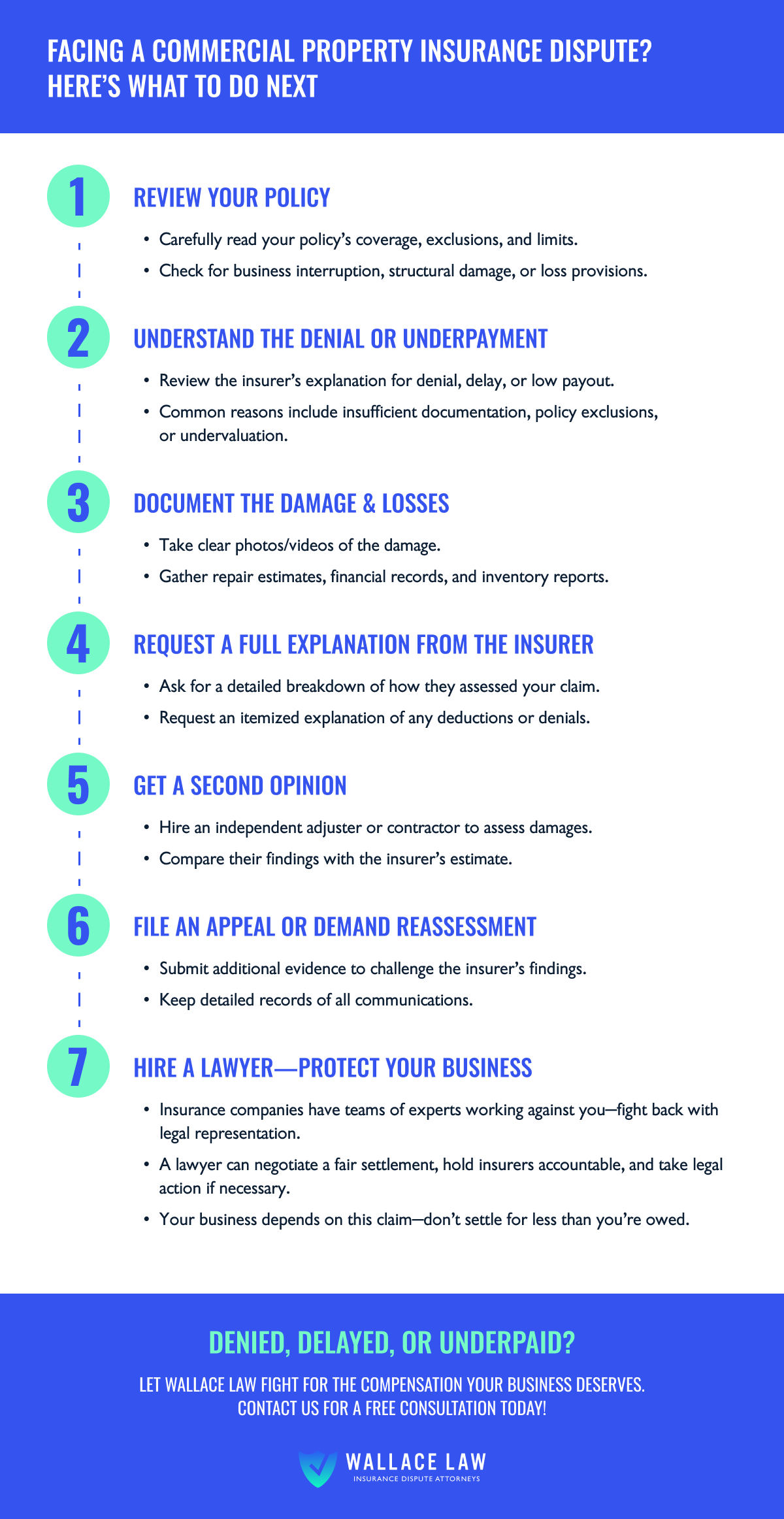

What Should I Do if My Commercial Property Claim Was Denied?

Insurance companies deny claims for many reasons; some decisions are justified, while others are not. There is usually some gray area, and it is easy to jump to conclusions and panic regarding a denied or rejected claim. However, it is better to consider other alternatives that might improve your situation—and legal intervention is one of them.

Policyholders usually turn to helpful legal resources for answers, as well as the services of Wallace Law, when all other methods to reach a resolution have failed. These might include persistent follow-up with the insurer, an ineffective appeals process, or delayed or lack of communication from the insurance company altogether. All hope is not lost, as you might have the makings of a bad faith claims case.

When dealing with a tricky claims process and a commercial property insurance dispute, keeping detailed records of your communication with the insurer, copies of the appeals process, and any other historical information regarding your situation is important as it can help your case later.

The details are helpful to our commercial property insurance dispute attorneys as we can quickly determine if you have grounds to sue your insurance company. We are skilled in handling tough insurers and have helped hundreds of people and businesses recover funds from companies hurt by bad faith insurance claims practices.

How Can a Commercial Bad Faith Insurance Lawyer Help?

As a business owner, you want things to return to “business as usual” as quickly as possible after a natural disaster or unfortunate property theft incident. Large insurance companies, unfortunately, do not always fight fair during the commercial claims process and may try to avoid reimbursement at all costs by dragging out or delaying the process.

The average claims process can take anywhere from weeks to several months, depending on the severity and type of damage. Many states do not have any laws in place to regulate the claims process or control the time frame, so the question becomes—can you afford to lose time, business, and money for months?

You have a choice in the matter and by retaining the services of Wallace Law, your chances of recovering the money you need to return to business as usual are much higher. Large insurers that play hardball with policyholders sometimes only respond to an aggressive legal approach as they take it more seriously. Hiring a team of insurance dispute attorneys who know the industry tricks is only to your advantage.

Insurance companies might have armies of lawyers to defend them, but Wallace Law is your weapon against their bad faith insurance practices. Our business is built on helping individuals and companies get fair reimbursement for denied or underpaid insurance claims.

If you believe your commercial property insurance claim has been denied for unlawful reasons or are stuck with a low settlement offer that will not cover your repairs or expenses, consider speaking with an experienced commercial insurance claim attorney. If we do not get you more money than your insurance company offers, you owe us nothing.

Get started on your potential commercial insurance dispute case, and contact us today.