Denied Life Insurance Claims

Life insurance is meant to be a comfort and support to the bereaved. Most insurers do the right thing and pay beneficiaries without causing more worries. However, when a life insurance claim is denied by the insurer it can cause more grief and hardship at a sensitive and difficult time.

When you are in a period of transition and mourning, the last thing you should have to do is handle a run-around from the insurance company. If your life insurance claim has been wrongfully denied, Wallace Law is ready to assist you. Our expert team can take on all of the paperwork, follow-up, legal and bureaucratic concerns to ensure that you get the best representation possible. Your loved one’s plans to provide for you in the event of their passing deserve the best possible defense and legal support when they are challenged by an insurance company. Wallace Law is a team of expert life insurance insurance dispute attorneys ready to assist you during this difficult period.

Types of Insurance Claims

We can help with multiple types of insurance disputes.

Property Insurance Dispute Lawyer

Health Insurance Dispute Lawyer

Travel Insurance Dispute Lawyer

Commercial Property Insurance Dispute Lawyer

Wisconsin Insurance Dispute Lawyer

Financial Planning and Life Insurance

Around 52% of adults in the US carry some form of life insurance policy. This kind of financial planning is considered by many as important as drafting a will. Life insurance can be an effective way to protect your family and loved ones from unexpected costs, debts, or financial hardship in the event of your passing. Life insurance is especially important if one adult in your family is a primary breadwinner. 44% of families say that they would experience financial hardship within half a year of losing the primary provider in their household. 28% of families say that this financial concern would arise within just one month of their loss.

However, insurance companies can throw a wrench into the best laid plans, whether through valid concerns, misguided actions, or even malicious tactics to protect their own profits.

Why Would a Life Insurance Claim Be Denied?

There are several reasons why an insurance company might deny your claim. Some of them may be contestable in order to still receive benefits. Some reasons why a life insurance claim might be denied include:

Lapsed Premiums

Being behind on payments may be a reason for an insurer to deny a life insurance claim. However, some insurers offer a 30-day grace period after a payment’s due date. Under certain conditions, you may be able to reinstate a lapsed life insurance policy and still receive a payout.

Failure to Disclose Information

Life insurance premiums are based on an assessment of risk factors. Some information considered may include medical history, risky behaviors or criminal convictions, substance use or abuse, extreme sports activities, dangerous employment, and more. In cases where a significant amount of information is not disclosed, an insurance company may deny paying the beneficiary.

For instance, if there was an undisclosed history of DUI convictions or other risky driving behaviors and your loved one died in a traffic accident, the insurance company may raise a red flag, or even refuse to pay. This can be a difficult case for an insurance dispute attorney, but not an impossible one. On the other hand, if your loved one was a mountain biker and died in an unrelated traffic accident and the insurance company denies your claim solely because of their pre-existing risk factor (extreme sports), you may have a more clear-cut case to fight the denial. Either way, an insurance dispute attorney can help you find the best path forward towards appealing an unfair insurance decision and building the strongest possible case.

Cause of Death

In certain cases, such as death by suicide, an insurance company may refund premiums as opposed to making a payout.

Contestability Period

Many life insurance policies carry a contestability period, usually two years. If the death occurs during this period, an insurer may deny your claim. In cases where an otherwise covered loss occurs during this period, a life insurance dispute attorney’s help can be invaluable in negotiating with an insurer.

Can You Appeal a Life Insurance Claim Denial?

Yes, you can appeal a life insurance claim denial. Most insurers require you to go through their initial appeals process in-house before filing a separate legal claim. You may also be able to consult with your state’s department of insurance in order to get more information about what to do next.

If you need help with your insurance claim, the appeals process, or any other insurance dispute issue surrounding the life insurance claim, a qualified life insurance dispute attorney can support you and represent you both throughout negotiations and in court.

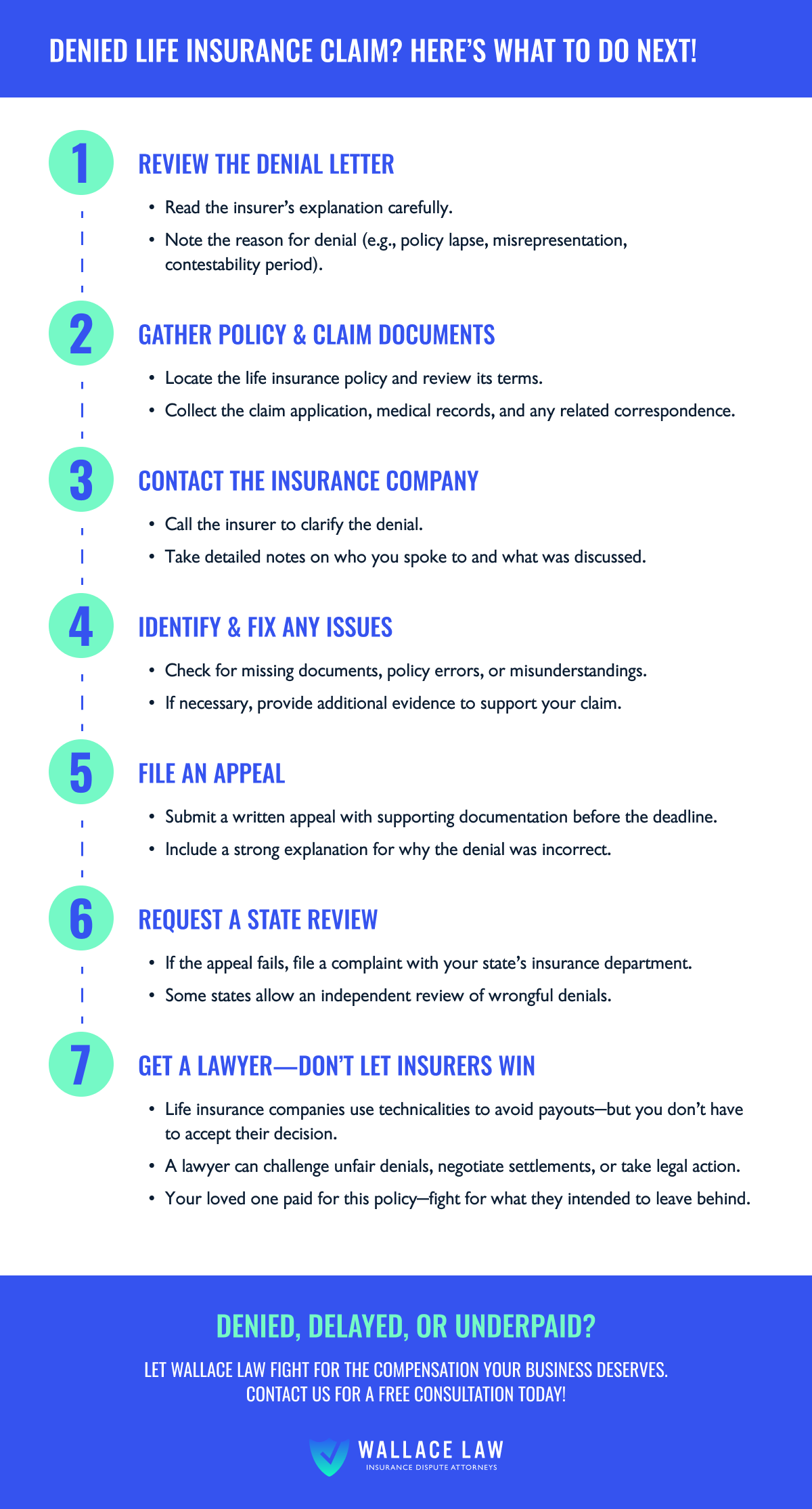

What to Do if You Think Your Life Insurance Claim Was Wrongly Denied

If your life insurance claim was denied, there is help available. There are several steps you can take on your own, but the best action is to bring the case to an insurance dispute attorney so that they can bring their professional experience to bear on the issue.

If you have received a life insurance claim denial, the following can help you begin your appeals process:

- Get your claim denial in writing. Ask for a written copy of the insurance company’s reasoning, as opposed to a decision made over the phone.

- Gather documents that support your claim. You will need a signed death certificate, proof of paid life insurance premiums, and a copy of the policy to get started. You may require other documents, such as medical records or more, in order to follow up on an appeals process.

- Contact an insurance dispute attorney. Share the aforementioned documents with them, as well as any other information that can help shed light on the situation.

How a Life Insurance Dispute Lawyer Can Help

An insurance dispute lawyer will be able to assist you in many ways when an insurance company is challenging your life insurance claim. Our firm can:

- Assist you with filing your insurance claim, and ensure that all the details are properly taken care of.

- Provide insight into standard operating procedure for life insurance payouts and benefits.

- Raise a red flag at concerning insurance company behavior.

- Liaise with the insurer and/or your employer in order to follow through on paperwork and filing needs.

- Closely analyze your insurance policy and comb through the fine print in order to build the strongest possible claim.

- Communicate with other professionals in order to flesh out your case for an insurance appeal process.

- Provide guidance throughout both the initial claim process, and the claims appeal process if necessary.

- Prepare your legal appeal if necessary.

- Collect and keep documentation in order to present the strongest possible case, both during the insurance and possible legal process.

- File a lawsuit if necessary.

- Negotiate with the insurance company at every turn to try to bring the best and swiftest end to the situation.

- Represent you in court if the insurance claim is formally denied.

- Represent you in appellate court as a final recourse.

Denied Life Insurance Claim? Contact Wallace Law Today

Save yourself hardship and heartache by speaking to an insurance dispute lawyer at the first sign of a problem from the insurance company. If you are concerned about your life insurance claim being challenged or denied, contact our insurance dispute law firm today to ensure that your needs are met and your loved one’s wishes are looked after. Learn how our law firm can help during a complimentary legal consultation.