Denied Water Damage Insurance Attorney

Water damage can be a devastating experience for homeowners. Whether it’s caused by a broken pipe, a leaking roof, or a natural disaster, understanding how to file a water damage claim and the process of getting reimbursed for losses can be complicated. If your water damage insurance claim was denied, a water damage insurance dispute lawyer can help protect your rights and fight for the compensation you may be entitled to for necessary repairs. Contact Wallace Law today for a free legal consultation.

Water Damage Insurance Claims: The Basics

A water damage insurance claim involves submitting such claim to your property insurance company in order to seek reimbursement for the costs associated with repairing water damage caused to your property. To be successful, homeowners must provide proof that the damage was caused by a covered event in their insurance policy, such as a burst pipe or severe weather. Additionally, they must also have documentation of all associated costs in order to receive payment from the insurer.

Types of Insurance Claims

We can help with multiple types of insurance disputes.

Property Insurance Dispute Lawyer

Commercial Property Insurance Dispute Lawyer

Wisconsin Insurance Dispute Lawyer

Common Causes of Water Damage

Water damage can be caused by a variety of sources, ranging from natural disasters to small plumbing issues. Some of the most common causes of water damage include:

- Flooding: Floods are a common cause of water damage, as they can quickly overwhelm homes and businesses with large amounts of water in a short period of time.

- Leaking pipes: Leaks in your home’s plumbing system are a common cause of water damage, often leading to mold growth and other problems.

- Appliance malfunctions: Faulty or broken appliances such as washing machines, dishwashers, and refrigerators can cause water damage.

- Foundation cracks: Cracks in the foundation of a house can allow water to enter the basement and cause damage.

- Overflowing toilets: A toilet that is blocked or malfunctioning can cause water to overflow and seep into the floor or walls.

- Natural disasters: Heavy rains and other natural disasters can quickly overwhelm homes and businesses with large amounts of water.

- Poor drainage: Poor drainage systems on a property can lead to water pooling and eventually seeping into the home’s structure.

- Firefighting efforts: Firefighters will often use large amounts of water to put out fires, which can lead to extensive water damage on top of the damage caused by the fire and smoke.

How Common Are Water Damage Insurance Claims?

Water damage is a common problem, with millions of homeowners filing water damage insurance claims every year. From overflowing toilets to burst pipes, water damage can be caused by many different issues. Unfortunately, water damage is the second most common cause of home insurance claims in the US. According to recent estimates, close to 24 percent of all home insurance claims are related to water damage.

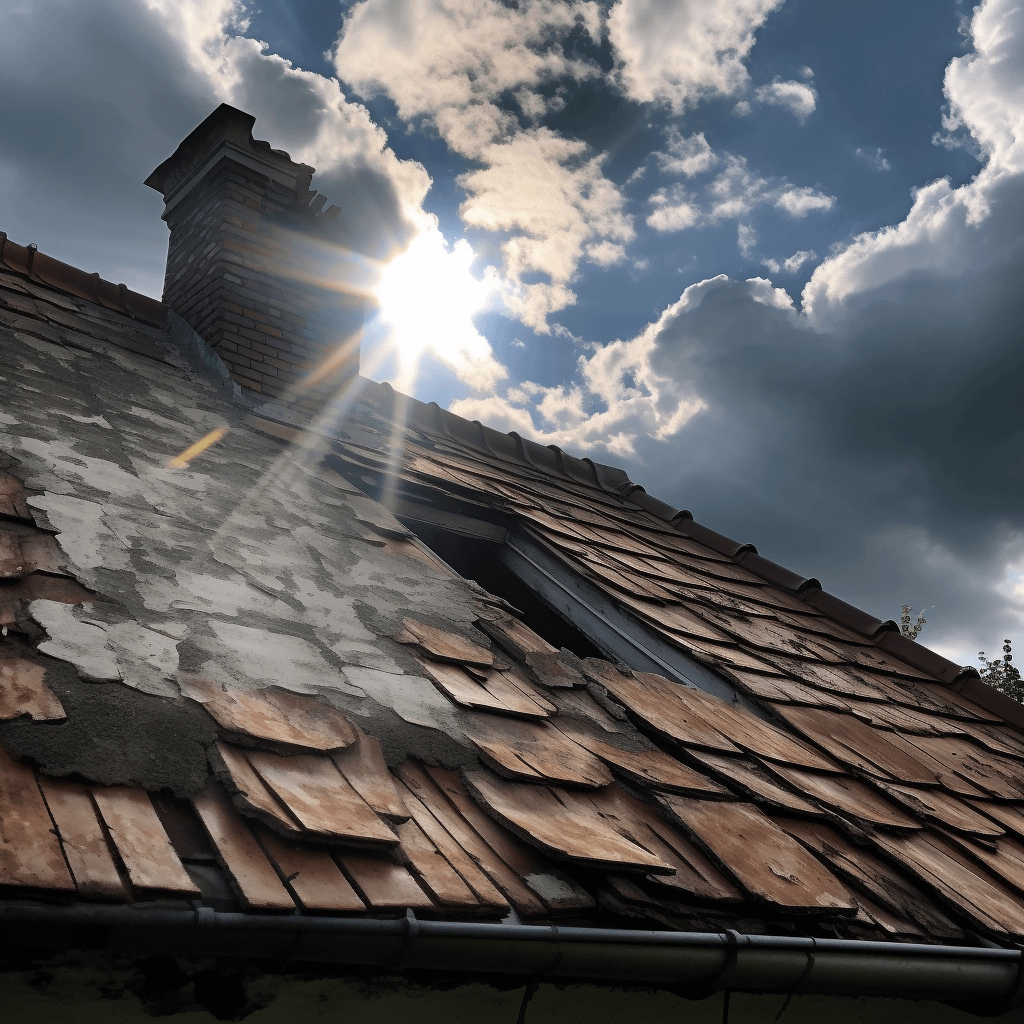

The most common causes of water damage include burst pipes, flooding, sewage backup, leaky roofs and windows, and malfunctioning appliances. It’s important to note that regular maintenance often prevents these issues. Homeowners should inspect their plumbing and roofing at least once a year to identify any potential problems before they cause significant damage.

Close to 24 percent of all home insurance claims are related to water damage.

Signs of Water Damage

Water damage can have devastating consequences on your home, so it’s important to be aware of the signs that could indicate an issue. It’s not always easy to detect water damage, but here are a few key indicators to be on the lookout for:

- Visible water pooling or staining on walls and floors

- Discoloration or bubbling of paint and wallpaper

- Warping or buckling of hardwood floors

- Peeling paint and discolored drywall

- Mold on walls, ceilings, and floors

- A musty smell in the home

- Cracked or loose tiles

- Leaking pipes or plumbing fixtures

- Wet insulation or sagging ceilings

- Swollen door and window frames

Long-Term Consequences of Water Damage

Water damage can have serious and long-lasting effects on your home if not properly addressed. While the initial damage may seem minimal, it can quickly turn into a much more expensive problem if not handled right away. Some of the most common long-term consequences of water damage include:

- Mold and Mildew: Mold and mildew can easily spread after a water damage incident. This can cause further damage to your home, such as wood rot and weakened walls, as well as health problems like respiratory illnesses and allergic reactions.

- Structural Damage: Water damage can affect the structural stability of walls, floors, ceilings, and roofs due to rotting wood and other materials. This can eventually lead to a collapse of the structure if left unchecked.

- Electrical Issues: Water and electricity don’t mix, so water damage can cause electrical shorts or fires if it comes in contact with any wiring or outlets in your home.

- Health Problems: In addition to mold and mildew, standing water can be a breeding ground for bacteria and viruses. This can lead to a host of health issues for those living in the affected home.

- Property Value Decrease: Water damage can significantly decrease the value of your property due to the repair costs involved. This can be especially damaging if you are trying to sell your home.

Water damage should never be taken lightly. It is important to address water damage as soon as possible to avoid the many potential long-term consequences that come with it. Taking proactive steps such as regularly inspecting your home for signs of water damage can help you keep your home safe and free from these costly issues.

Homeowners Insurance Claim For Water Damage

Home insurance policies typically cover water damage caused by sudden, accidental events such as a burst pipe or a leaking roof. This type of damage is generally classified as a “covered peril” in most home insurance policies. However, water damage caused by a homeowner’s negligence or lack of maintenance may not be covered. Additionally, floods caused by heavy rains or storms are generally not covered by traditional home insurance policies and would require additional flood insurance.

Why Home Insurers May Try to Deny Water Damage Insurance Claims

Homeowners may be shocked to discover that their home insurance company is trying to deny a water damage claim. Insurance companies often look for any excuse they can to reduce their costs, and denying claims is one of the more common methods. In some cases, the company may try to argue that the damage was caused by homeowner negligence or failure to maintain the property. They may also deny the claim if they believe that the damage was caused by an uncovered event or the damage was outside of the policy limits. It’s important for homeowners to understand their policy details and know their rights in order to successfully fight a denied water damage claim. If your insurer denied your water damage insurance claim, an insurance dispute attorney can guide you through the process of appealing the denied claim.

How Homeowners Can Fight a Denied or Undervalued Water Damage Claim

Homeowners who experience water damage to their homes and have their claim denied or undervalued by their insurance company can fight back. The first step is to consult with an experienced water damage insurance dispute lawyer who can review the claim and your policy and advise you of your rights and options. An insurance dispute lawyer can help you determine whether the denial was reasonable or done in bad faith and whether or not an insurer’s offer is sufficient. They can also help you determine what evidence is needed to support your case, such as photographs and invoices for repairs.

Your lawyer may be able to negotiate a settlement with the insurer on your behalf that covers the costs associated with the water damage. If the insurer still refuses to cover the costs, your lawyer may file a lawsuit against the insurance company. This will require you to present your case in court in order to get compensation for the damage caused by the water. This is where an experienced insurance dispute lawyer can come in handy–they can advise you on how best to proceed with this type of claim and represent you in court if needed.

Overall, fighting back against a denied or undervalued water damage insurance claim can be difficult and time-consuming. However, with the help of an experienced water damage insurance dispute lawyer, you may be able to get your claim approved or receive a satisfactory settlement.

Water Damage Claim Denied? Contact a Water Damage Insurance Dispute Lawyer

If your water damage insurance claim was denied or undervalued, an experienced insurance dispute attorney can help. At Wallace Law, we have more than a decade of experience defending the rights of policyholders and holding insurers responsible. Contact us today for a free case review.