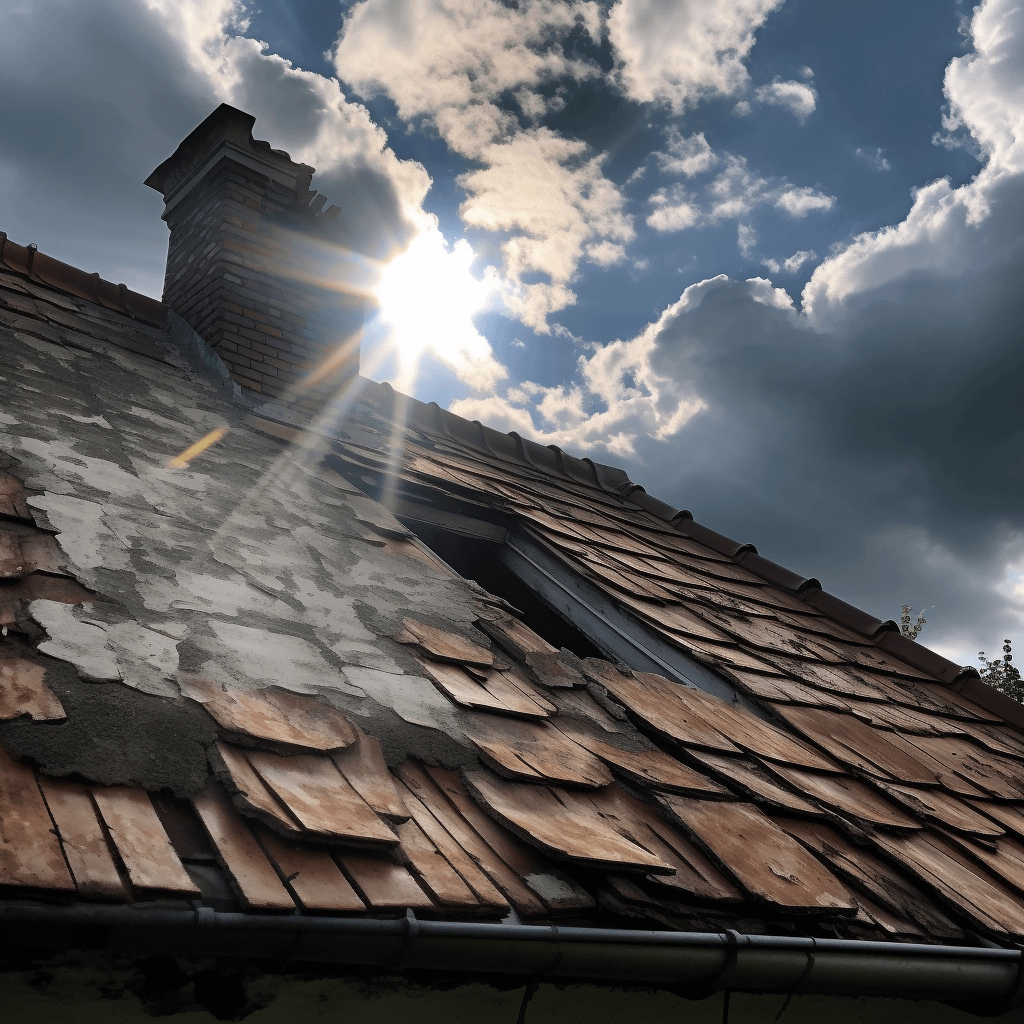

Years of harsh weather, extreme hot and cold conditions, hail, and unpredictable storms can break the toughest roofs. Homeowners in Wisconsin and similar states that experience seasons of fickle weather are no strangers to the property issues these conditions can cause, especially roof damage.

Roofs are the most impacted by conditions like wind, hail, and water damage. Weather events are the most prevalent reasons for property insurance claims worldwide. Sadly, many insurance companies use sketchy tactics to deny or reject these claims to improve their bottom lines. When that happens, homeowners are stuck paying for expensive roof repairs or a replacement out-of-pocket.

It is simple: Paying for insurance coverage entitles you to reimbursement as long as the policy covers roof damage and the event that caused it. If your insurance company fails to compensate you properly, a roof damage insurance claim lawyer can help you get paid what you may be entitled to.

Wallace Law is an insurance dispute firm that fights for policyholders to help them get what they are owed under the terms of their policy. From life to health to property insurance and more, Wallace Law has the industry expertise to beat the big insurance companies at their own game.

We believe policyholders should actually benefit from the benefits their insurance company advertises. That all starts with learning more about roof damage, what insurers are supposed to cover, and how to contest a bad faith claim to get what is rightfully yours.

The Most Common Causes of Roof Damage: What You Should Know

The roof is one of the most critical features of a home, and regular exposure to storms, snow, hail, and more can leave your dwelling vulnerable to serious damage. Roof problems can happen overnight or take months or years to surface.

Here are four common reasons for roof damage:

- Extreme weather conditions: Extreme heat or freezing temperatures, high winds, heavy rain, and hail or storms, may lead to rapid roof damage. This could include leaks, broken or cracked shingles, clogged gutters, and water damage on walls and ceilings.

- Poor maintenance: Inadequate upkeep is one of the leading causes of premature roof failure. Failure to inspect your roof regularly for leaks or minor damages can lead to major problems later.

- Time: Roofs can fall prey to cracks and breaks with old age.

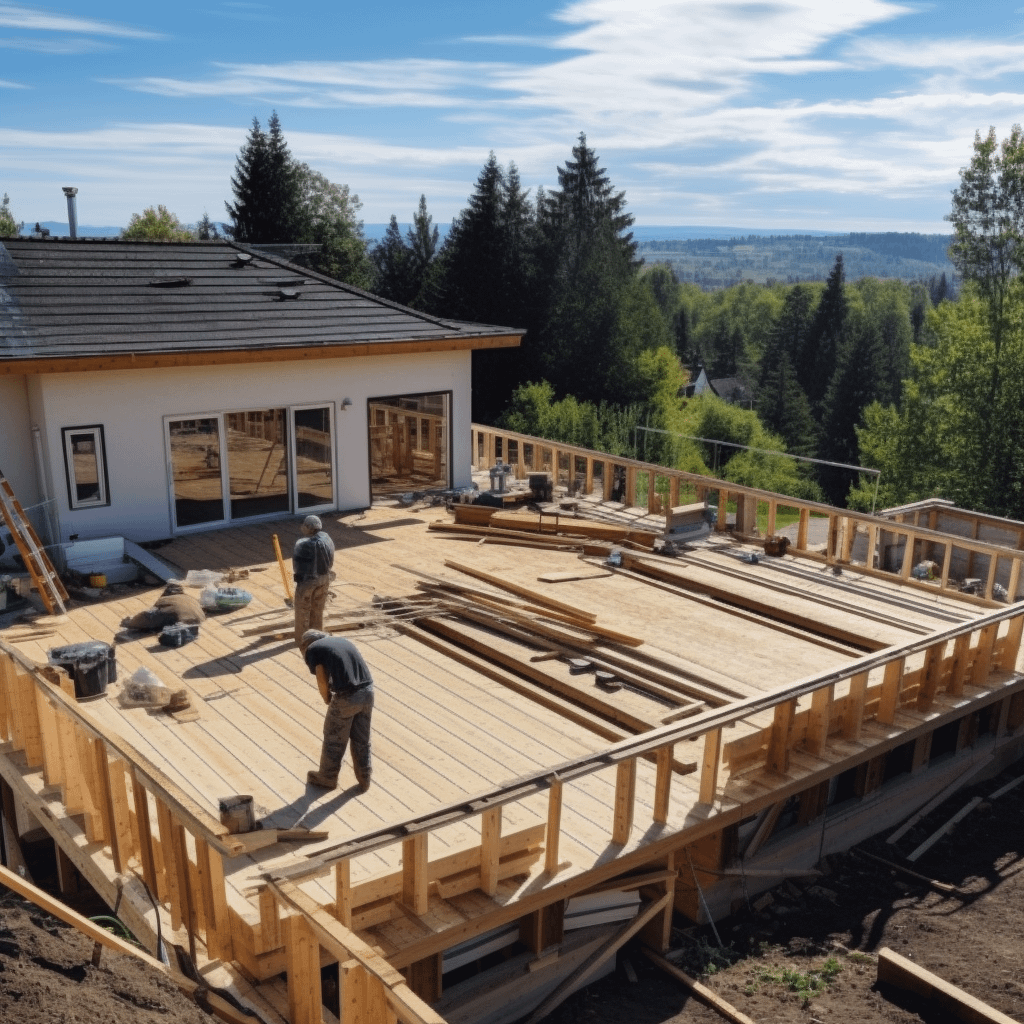

- Build issues: Careless installation, shortcuts, and low-quality materials can shorten a roof’s lifespan.

No one can control the weather, but every homeowner can protect their investment. Following a routine maintenance plan can prevent needing significant repairs down the road.

What Kind of Roof Damage Is Covered By Insurance?

Most property insurance policies include dwelling coverage, which protects your home’s structure. Covered perils usually include fire, wind, and hail damage.

Say, for example, a tree falls on your home after a tornado and causes your roof to cave in. This is a good example of a typical qualifying event. The cost to repair or replace your roof would be covered by homeowners insurance (unless otherwise specified).

Insurers that offer coverage in states more prone to wind and hail storms often have a clause that excludes damage related to those conditions. Every insurance policy should state the event and types of damage it covers.

What Are the Consequences of Roof Damage?

The roof is a home’s primary source of exterior and interior protection; a typical roof can only last so long with damage. Broken or missing shingles, leaks, sagging spots, or an entirely missing roof can be unfortunate realities for many homeowners after a serious storm.

Continued exposure to outside elements can result in water damage and issues like mold or mildew as water, snow, or ice seeps into the walls and structure. Untreated water issues can weaken the home’s structural integrity, rust metal and corrode the plumbing, ruin electrical systems, and destroy ceilings and walls.

Hail, heavy ice and snow, and strong winds are the perfect storm (literally) to shorten a roof’s lifespan and cause other problems. Do not wait for your roof damage claim to resolve on its own or trust your insurance company to do the right thing. Speak with a reliable insurance dispute firm, like Wallace Law, that acts fast and in your best interest.

How to File a Homeowners Insurance Claim for Roof Damage

The less information you have about the property insurance claims process, the more ammo insurance companies have to deceive you.

The following tips can increase your chances of filing a successful property insurance claim:

- Take diligent before and after photos of your home, and at multiple angles, for comparison and record-keeping purposes.

- Seek second opinions from trusted experts in the field. Request multiple quotes from contractors, adjusters, and other professionals. Maintain records of inspections, reports, renovations, and maintenance.

- File the claim promptly and within the insurance company’s submission window. Failing to file as soon as possible gives the insurance company an advantage and could likely result in claim denial.

- Avoid settling and accepting any financial offers from your insurance company. They might attempt to undervalue your claim, and there is no going back if you accept a smaller settlement.

- Consider all your options, including the benefits of working with a roof damage attorney rather than facing your insurance company alone, accepting a denied claim, or settling for less money.

Insurers know all the tricks and traps that policyholders are most likely to fall for — but we know them too. Wallace Law specializes in disputing property insurance claims. We can help you file a claim, challenge a denial, and negotiate a fair settlement.

Why Do Insurance Companies Deny Roof Damage Claims?

A roof damage claim does not always result in a payout, and there are reasons for this. Claim approvals or denials are based on various factors, and multiple people are usually involved in the decision-making process.

Here are a few reasons insurance companies deny roof damage claims:

- Roof damage is present, but a prior and uncovered event caused it.

- There is partial roof damage, but it does not qualify for repair.

- General wear and tear are to blame for the roof’s condition, not a qualifying event.

- Product defects, such as roofing materials that degraded long before the intended life expectancy, are evident.

- The claim was filed outside of the policy’s timeframe.

- The adjuster missed important signs of damage due to a lack of experience or knowledge, immediately denying the claim.

Corrupt business practices, or bad faith claims processes, are another reason for denied roof damage claims. Despite their legal obligations, some insurers try to say the damage was not caused by a covered weather event, and the repairs should have been made before the storm. If policyholders pay their monthly premiums and roof damage is covered, their insurance company must pay.

What to Do if My Insurance Denied My Roof Claim

Dishonest insurance companies make policyholders take unnecessary steps to submit a roof damage insurance claim. After a long, drawn-out process, they sometimes force policyholders to accept a lowball settlement offer or frustrate them enough to drop the claim altogether.

There might come a time when you have to contest a denied claim. You can request a re-inspection of your home and file an appeal asking your insurer to reconsider their decision. If the insurance company is unwilling to cooperate after the appeal, you can retain the services of an experienced roof damage lawyer who can help you arrive at a fair negotiation.

Roof damage can be expensive to fix. Roof repairs can cost anywhere from $150 to $7,000. Replacing a roof can cost around $8,000 or more.

Benefits of Hiring a Roof Damage Insurance Claim Lawyer

Fixing or replacing a roof is not cheap or quick when insurance does not pay for your roof damage claim. The numbers speak for themselves. Minor repairs can cost anywhere from $150 to $1,500, while significant repairs run upwards of $7,000. According to Forbes, roof replacement is one of the most costly, with estimates of $8,000 or more.

A roof damage insurance lawyer can take the claims process off your plate, and increase your chances of settling your claim for what it is worth.

Get the Most Out of Your Claim: Contact a Roof Damage Insurance Claim Lawyer

Settling for anything less than what your roof damage claim is worth does not have to be your story. Wallace Law and our roof damage attorneys want more policyholders to challenge unfair claims processes and win.

Justin Wallace, founding partner of Wallace Law, and our team of seasoned insurance dispute attorneys help clients overcome impossible hurdles, get the money they deserve, and hold unethical insurers accountable.

If you are tired of the constant rejection and unexplained claim denials and want a better outcome, a fresh start begins here. Our philosophy is if you do not win, you do not pay.

Contact us today for a free case evaluation.