Lightning Damage Insurance Claim

Lightning is an unpredictable and destructive force of nature that often leads to severe damage to property. While most insurance companies cover lightning property damage claims, some insurers may attempt to deny your claim or delay payments.

An insurance claims dispute lawyer from Wallace Law can guide you through the legal process of disputing your denied, delayed, or underpaid lightning damage insurance claim. Choosing the right lightning damage insurance dispute lawyer can increase your chance of securing the compensation you deserve. Contact us today to learn more about how we can help.

Lightning Damage: Statistics

Each year, lightning strikes U.S. soil nearly 40 million times. Besides the risk of severe or fatal injury to the body, lighting can also severely damage your home.

While the number of lightning damage insurance claims has declined from 85,000 in 2017 to just over 60,000 in 2021, the cost of each claim has risen substantially.

According to the Insurance Information Institute, the costs of an average lightning damage claim went from $10,781 in 2017 to $21,578 in 2021, or more than double in a matter of five years.

What Damage Can Lightning Cause?

While most people associate lightning with fires, it also causes extensive damage in many other ways. Understanding the different types of damage lightning can cause is essential to protect yourself and your property. Common types of lightning damage include:

- Fires: Lightning causes sparks that may ignite a fire which can spread quickly, leading to extensive property damage.

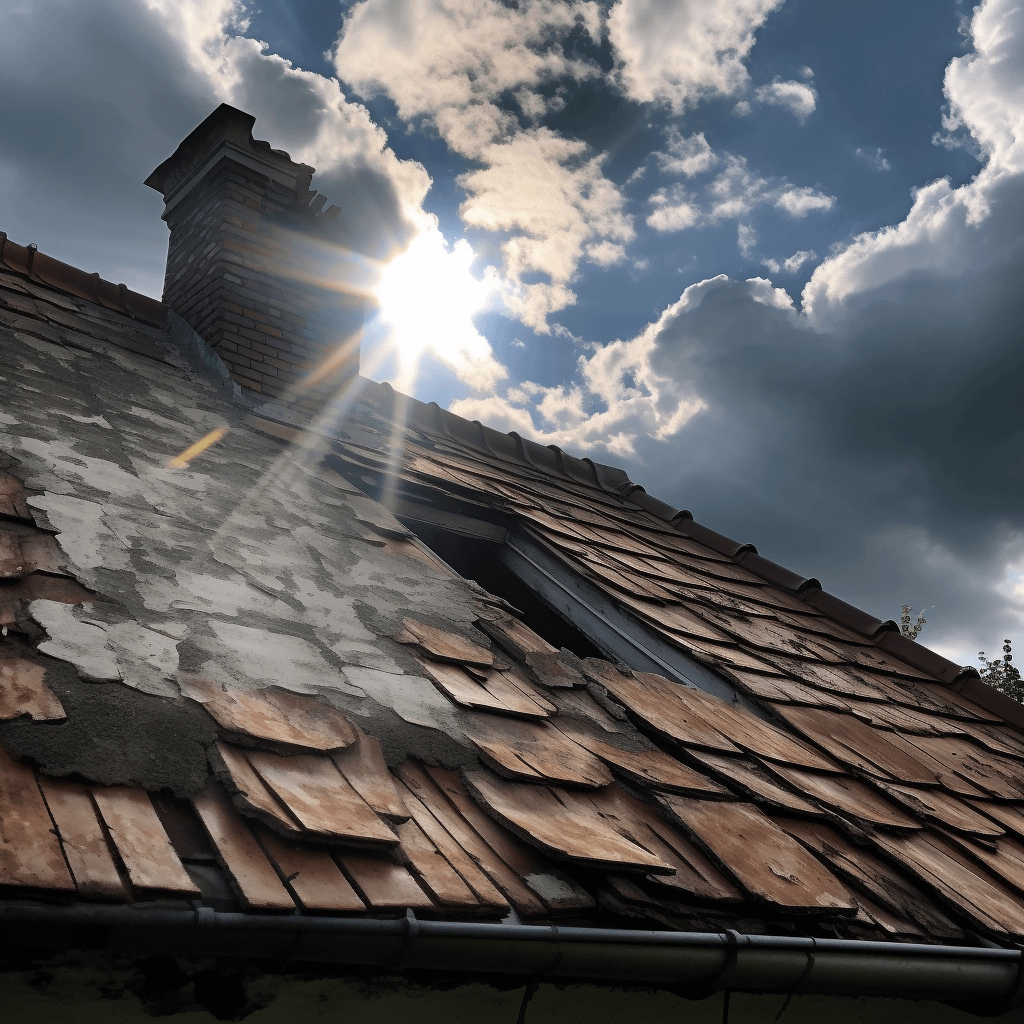

- Roof Damage: Lightning can cause direct hits to a roof which may lead to significant damage, such as punctures, cracks, and even total destruction.

- Tree Damage: Lightning strikes frequently damage trees, leading to the loss of branches and splitting of tree trunks.

- Structural Damage: A lightning strike can cause significant damage to walls, floors, and other structural components of your home.

- Water Damage: A lightning strike near your home can cause electrical surges that lead to water damage from burst pipes or faulty appliances.

- Electrical Damage: Lightning strikes can overload electrical systems, causing them to fail and damaging wiring, appliances, and other electrical components in your home.

Types of Insurance Claims

Commercial Property Insurance Dispute Lawyer

Property Insurance Dispute Lawyer

Does Homeowners Insurance Cover Lightning Damage?

A typical homeowners policy covers the structure of the home and personal property such as furniture, appliances, electronics, and other items that could likely be damaged or destroyed by a lightning strike. Some homeowners insurance may provide coverage for additional living expenses if your home becomes temporarily uninhabitable due to lightning damage. This includes hotel stays, food costs, and any other expenses you incur while your home is being repaired.

While standard homeowners insurance policies cover damages caused by lightning strikes, the type of coverage and claim amount may vary. This is why you need to review your policy thoroughly and contact your insurance provider for any questions regarding coverage.

Why Do Insurance Companies Deny Claims

Insurers can deny lightning property damage claims for a number of reasons, including the failure to follow the correct procedure for filing the claim or for not meeting the insurer’s requirements. Some common reasons why an insurer may deny a lightning property damage claim are:

- The damage is too minor to qualify for coverage.

- The policyholder failed to provide adequate proof that lightning caused the damage.

- The policyholder failed to provide adequate documentation of the loss and/or any repairs.

- They did not report the incident on time.

- They did not file their claim correctly.

- They failed to meet the insurer’s specific requirements for filing a lightning property damage claim.

- The insurer believes the damage was caused by something other than lightning, such as an act of vandalism or normal wear and tear.

How Can I File a Claim for Lightning Damage?

Lightning can cause a wide range of damage to your property, ranging from minor issues like roof and shingle damage to major problems like structural damage and complete destruction. Depending on the extent of the damage, filing a lightning property damage claim with your homeowner’s insurance may be necessary to get the help you need to repair or replace your damaged items. Here are the steps to take if you need to file a claim for lightning damage:

- Contact your insurance company as soon as possible. After lightening causes damage to your property, you should contact your insurance company as soon as you can. Let them know that you plan to file a claim and provide all the necessary information about the incident.

- Take pictures of the damage. As soon as it is safe to do so, take pictures of the affected area and any visible damage. Photos will help you document the claim and give your insurance company a better idea of the extent of the damage.

- Get an estimate of the cost of repairs or replacements. You should get a written estimate from a professional contractor or repair person who has seen the damage firsthand. Be sure to keep copies of all the estimates and itemized bills you receive.

- Gather documentation and proof of ownership. Make sure you have documentation and proof of ownership for any items that were damaged so that your claim is properly processed.

- File your claim. Once you have all the necessary information, you can file your claim with your insurance company that will review your claim and process it accordingly.

Steps to Take if Your Lightning Damage Claim is Denied

Sometimes, insurance companies may deny a lightning damage insurance claim. If your insurance claim has been denied, here are some steps you can take:

- Review Your Insurance Policy: Take a look at your insurance policy to make sure you understand the coverage it provides for lightning-related damage. This will give you a better understanding of why the claim was denied and what the insurer is responsible for paying.

- Request an Explanation: Request an explanation of why your lightning damage insurance claim was denied in writing. Keep a paper trail of the communication between you and the insurance company.

- Gather Proof: If you disagree with the denial, collect all evidence and documentation that could help prove the damage was caused by lightning. This could include photos of the damage, witness statements, and reports from professionals such as electricians or contractors.

- Appeal the Denial: Once you have collected all necessary documentation, appeal the denial with your insurance company. Provide them with evidence of why the damage should be covered and explain how it meets the criteria stated in your policy.

- Seek Legal Help: If all else fails, you may need to seek legal help to challenge the denial of your claim. An insurance dispute lawyer can help you determine if you have a valid case against your insurance company and guide you through the process of challenging the denial.

How To Prove Lightning Damage

Proving that your property damage was caused by lightning can be difficult because it may be hard to detect evidence of lightning. After lightning strikes your property, you should first check for any physical evidence of the lightning strike, like a charred area on the roof. It may be helpful to get an inspection from a certified electrician who can look for signs of electrical damage, such as melted wiring, to determine if your damage was due to lightning. You may also need to provide photographs of the property and any other documentation showing the extent of the damage. Finally, if you have a lightning protection system installed, you should include proof of its maintenance and functioning at the time of the strike.

Does Homeowners Insurance Cover Lightning Strikes to Trees?

Most homeowners insurance policies cover trees that fall down after being struck by lightning, as well as the damage caused by the tree and the contents of any structure damaged. However, it is important to note that there may be some exceptions depending on your policy that you should verify with your insurance provider. There may also be additional costs involved, such as for the removal of the tree and its debris, repairing any damage to the property or landscaping, or replacing the tree itself.

Does Homeowners Insurance Cover Lightning Damage to Electronics?

Lightning may cause significant damage to personal property and electronics, including TVs, computers, and appliances. Fortunately, most homeowners insurance policies provide coverage for lightning-related damage, so you should be covered for damage caused to your electronics due to a power surge resulting from a lightning strike.

Since coverage may vary depending on your insurer, you may have some limitations on your policy. Make sure to review your policy carefully to determine the specific coverages available. Additionally, document all of your damaged property to maximize the amount of compensation you receive if you file a claim.

Speak With a Denied Lightning Damage Claim Lawyer

If your insurer denied, delayed, or attempted to underpay your lightning damage claim, you should consult with a denied property insurance claim lawyer. An experienced attorney will review the details of your case, examine your policy language, and fight for the maximum possible compensation for you. At Wallace Law, our attorneys are dedicated to helping policyholders receive a fair and just settlement. Contact us today for a free consultation.