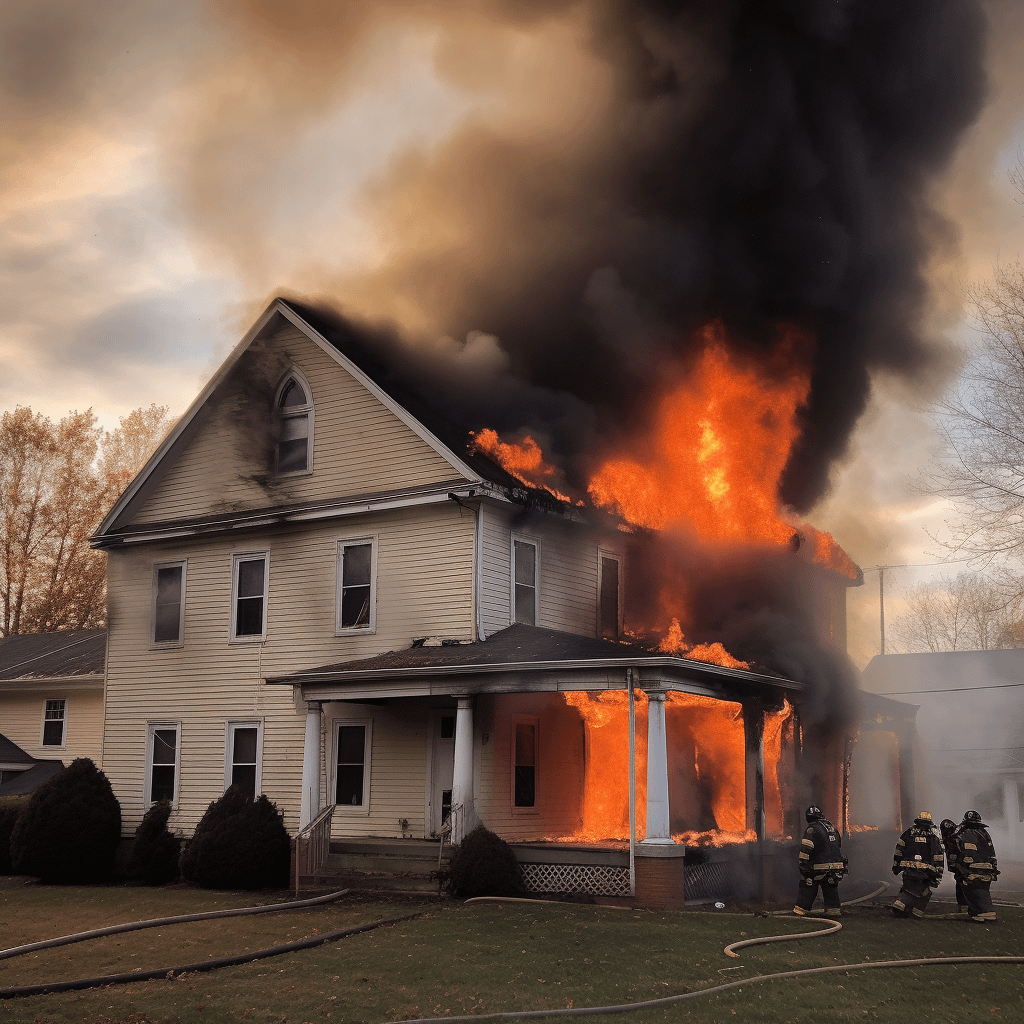

A fire in your rental home can be one of the most devastating events you’ve ever faced. Beyond the emotional trauma, there is the financial loss: belongings destroyed, displacement costs, maybe even liability exposure. If you have renters’ insurance, you may ask: Does renters’ insurance cover fire damage?

In most cases, yes. However, the specifics, including the types and amounts, depend heavily on your policy, the cause of the fire, the damage sustained, and whether you fulfill your obligations under your lease and state law. This guide explains what renters insurance typically covers, standard exclusions, what to do if your claim is delayed or denied, and when you might need a lawyer.

What Does Renters Insurance Typically Cover for Fire Damage

Under a standard renters’ insurance policy, several types of coverage usually come into play after a fire. First, personal property coverage helps pay to repair or replace your belongings, things like furniture, clothing, and electronics, up to the policy limit and minus any deductible. Because fire often brings smoke damage with it, most policies also extend protection to items harmed by smoke.

If the fire leaves your apartment uninhabitable, your policy may include loss of use coverage, sometimes called additional living expenses. This can cover the cost of temporary housing, hotel stays, meals, and other necessities while you’re displaced. Finally, renters’ insurance often provides liability protection. If you’re found responsible for the fire – for example, if it spreads to a neighboring unit or damages your landlord’s property – this coverage may help protect you from the financial fallout.

What Renters Insurance Usually Does NOT Cover

Knowing the limits and exclusions is just as important as knowing what is covered. Here are the most common scenarios where fire damage may be excluded or only partially covered:

- Structural Damage to Dwelling: The building structure (walls, roof, flooring, fixtures that belong to the landlord) is the landlord’s responsibility, not yours. Renters’ insurance does not cover damage to the building itself.

- Intentional Acts: If the fire was started intentionally by you (or someone covered under your policy), coverage is almost always denied.

- Perils Not Covered / Named vs Open Perils: Some events are excluded: floods, earthquakes, sewer backup, and mold from neglect are common examples. If a fire results from one of those perils, how the policy handles it depends on how your policy is written.

- High Value Items / Sublimits: There are often sublimits on specific high‑value property (jewelry, art, collectibles). If the replacement cost is significantly higher than those limits, you may only receive a portion unless you have endorsements or higher limits.

- Neglect or Poor Maintenance: If the fire damage was caused or made worse by neglect (for example, not fixing faulty wiring you reported, or ignoring smoke alarms), the insurer may reduce or deny the claim. Policies often require you to take reasonable steps to protect from damage. While not always clearly stated, this kind of condition shows up in many cases.

- Wear and Tear / Gradual Damage: Damage due to gradual deterioration, rust, mold, and other similar causes is typically excluded. If poor upkeep contributed substantially, the insurer might argue it is not covered.

How Coverage Depends on Cause and Policy Language

Whether your fire damage is covered often depends on:

- Whether the fire was caused by a covered peril (accident, electrical issue, lightning, etc.)

- Whether it was a named peril policy vs an open peril

- What the deductible is, what your limits are, and whether you bought endorsements

- What your policy says about loss of use and liability

- Whether smoke or soot damage is treated separately or as part of fire damage

For instance, if fire is started by another peril (like a lightning strike), it is likely covered even if the peril that triggered the fire is excluded (flood, for example) as long as the fire itself is a covered loss.

What You Should Do if You Have Fire Damage

After a fire, your top priority is safety. Make sure everyone is out of danger, call the fire department, secure temporary shelter, and seek medical help if needed. Never re-enter the building until it has been declared safe.

Once you’re secure, begin documenting everything. Take photos and videos of the damage, including smoke damage, and create a detailed inventory of what was lost or destroyed, along with estimated values. If you have receipts, warranties, or serial numbers, keep those organized as well.

The next step is to notify your insurer promptly. Most policies have deadlines, so don’t wait. When you call, be honest and detailed about what happened, and provide as much information as possible.

While you’re in touch with your insurer, review your policy closely to understand what is covered, what may be excluded, your policy limits, deductibles, and whether you have coverage for additional living expenses or endorsements for high-value items. As you start to recover, gather estimates for repairs or replacements and keep receipts for temporary housing, meals, or any extra expenses caused by the fire. When you file your claim, follow the insurer’s instructions carefully, provide all the documentation you’ve collected, and keep copies of everything you submit.

Throughout the process, track every communication with your insurance company. Note who you spoke with, when, and what was said. If inspections are requested, cooperate, but make sure you understand any paperwork before you sign, especially if it could affect your rights to future claims.

What to Do if Your Fire Damage Claim Is Delayed or Denied

Sometimes, insurers drag their feet or deny claims unfairly. Here is what to know and what actions you can take:

- Read the denial letter carefully.

- Request a written explanation if anything is unclear.

- Appeal internally.

- Have a public adjuster evaluate your damage.

Consider consulting with a fire damage claim lawyer, especially if the settlement is significantly smaller than what you believe you are owed, or if the denial appears to be based on an arguable interpretation or omission.

Fire Damage & Renters Insurance FAQ

Q: Does renters’ insurance cover fire damage to furniture, electronics, and clothing?

A: Yes, usually. Your personal property coverage protects most of your belongings, such as furniture, clothing, electronics, etc, lost or damaged by a fire, subject to your policy limits and deductible. But high-value items may have lower sublimits or require endorsements.

Q: If I have smoke damage but no flame touched my items, will I be covered?

A: Often yes. Smoke damage is frequently treated similarly to fire damage under a renters’ insurance policy. Still, you need to check your policy wording because some policies treat smoke damage differently or have special requirements.

Q: Will my renters’ insurance cover temporary housing if my place is uninhabitable?

A: Usually, yes, under loss of use (also called additional living expenses). It covers hotel or temporary lodging, meals, and sometimes transportation or storage costs while repairs are underway. But these benefits have limits and time constraints.

Q: What if the fire was caused by something excluded, like electrical system neglect, flood, or wildfire?

A: If the fire is caused by a peril excluded in your policy, the insurer may deny coverage or reduce payout. But sometimes even if the triggering event (for example, flood) is excluded, damage directly from fire may still be covered depending on how the policy defines “cause of loss”. Always read policy definitions and speak with an agent.

Q: Can my landlord’s insurance help me with fire damage?

A: The landlord’s insurance covers structural damage to the building, common areas, and things owned by the landlord. It does not cover your personal property, your liability, or your cost of living elsewhere. That is why renters’ insurance is essential even though the landlord has insurance.

Q: What steps should I take if my claim is denied?

A: Review the denied renters insurance letter carefully; gather documentation; appeal internally; consider hiring a fire damage claim lawyer if the denial seems wrongful; check your state’s insurance commissioner resources or consumer protection laws for policyholder rights.

How to Make Your Coverage Stronger / Prevent Problems

It helps to be proactive. Here are things to do before a disaster:

- Buy enough personal property coverage

- Add endorsements for high-value items

- Ensure you have loss of use coverage and understand its limits

- Install smoke alarms, fire extinguishers, and maybe sprinkler systems if allowed

- Keep receipts, take pictures of your property, and update your inventory regularly

- Be aware of what perils are excluded in your policy

Wallace Insurance Law Can Help

In short, renters’ insurance does cover fire damage in many typical circumstances. It usually protects your personal property, provides help when you need temporary housing, and may even protect you from liability if you accidentally cause fire damage to others, but it does not cover everything. The building (structure) is typically not covered, intentional acts are excluded, high-value items may be underinsured, and specific causes of fire may be excluded depending on policy language.

If you ever face a situation where your fire damage claim is delayed or denied, do not assume there is nothing you can do about it. Review your policy, gather all documentation, appeal, and if needed, reach out to a fire damage claim lawyer. Knowing your rights ahead of time can help protect you and your family.

If you want help understanding your specific policy or state law, feel free to contact us. Wallace Insurance Law stands ready to help those who need counsel as they navigate fire damage and renters’ insurance disputes.