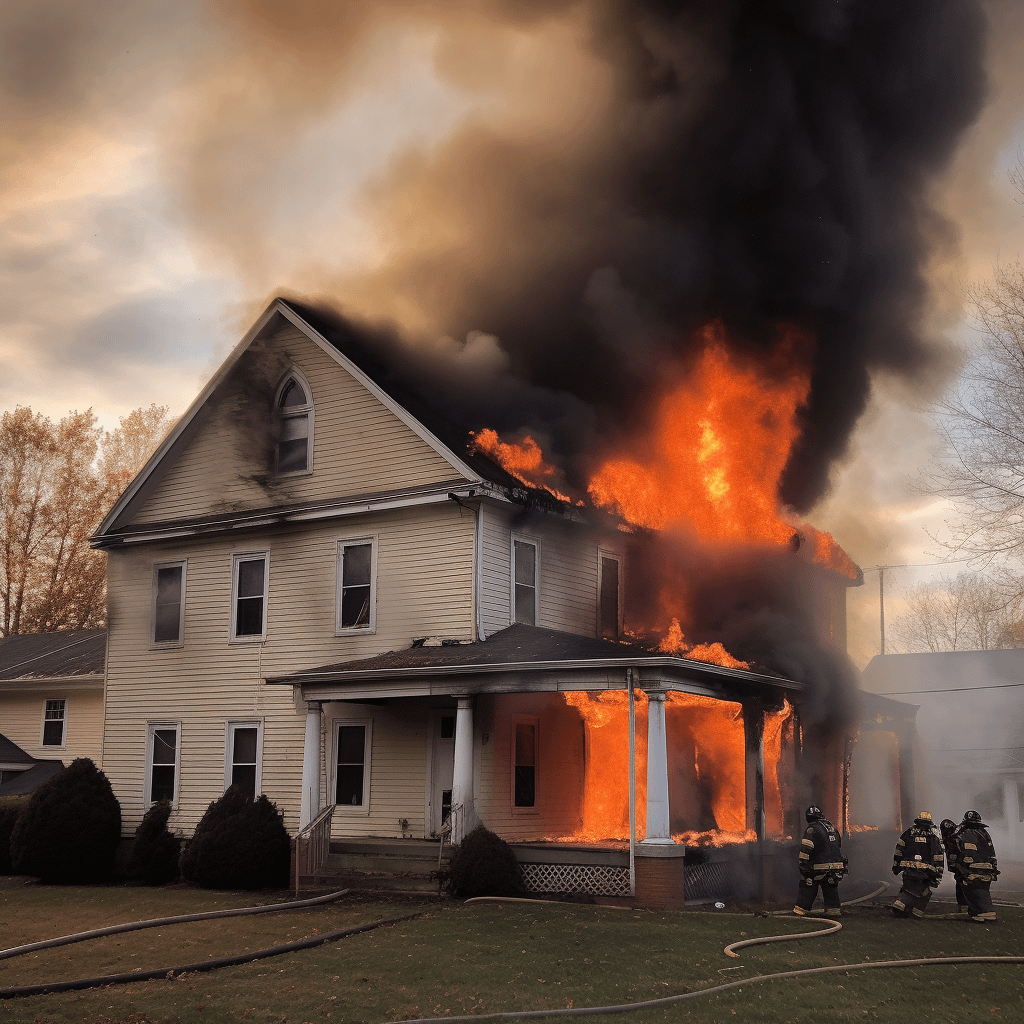

Whether your home has been destroyed or the damage was confined to a small area, a house fire can be devastating. Your insurance should be able to cover repairs, but as you may have already discovered, getting an insurance claim paid out is often much more difficult than it sounds.

Different factors impact the success of your claim, and knowing how to deal with an insurance adjuster after a house fire is one of them. Here is a look at how to navigate the claims process — and how to determine when you need to involve an attorney.

How Does a Fire Insurance Claim Work?

Many people do not think about how to handle a fire insurance claim until after they’ve experienced a house fire. Here is a quick breakdown of what to do in the event of a fire:

- Get yourself (and other occupants) to safety if possible.

- Call 911 to summon the fire department.

- Notify your insurance company to start the claim.

- Thoroughly photograph all fire damage.

- Take steps to prevent further damage (like boarding up broken windows).

- Finish filing your claim and include photos and other evidence.

- Be present when the insurer sends an adjuster to inspect the damage.

Fire damage claims work slightly differently depending on whether you own or rent your home. If you own your home, your homeowners’ insurance policy should cover structural damage.

Exactly what damage your insurance pays for (assuming your claim is approved) depends on the specifics of your policy. Standard home insurance policies cover the structure of the home itself. Depending on your policy, your personal belongings inside the home may or may not be covered.

If you do not own your home, you likely have renters’ insurance coverage, but does renters’ insurance cover property damage to the dwelling itself? The answer is no. Renters’ insurance protects your personal belongings, and it is your landlord’s responsibility to purchase homeowners’ insurance to protect the physical structure of the home.

Do Insurance Companies Deny Fire Claims?

Unfortunately, yes. The mere fact that your home caught on fire does not mean that your homeowners’ insurance will cover the damage. These are some of the most common reasons fire claims are denied:

- The fire was the result of arson (either by you or another person)

- Your negligence (like installing faulty wiring) caused the fire

- Your policy lapsed before the fire

- The insurer thinks that your claim is fraudulent or exaggerated

Some insurance companies may deny a legitimate claim. For instance, your insurance company might insist that your negligence caused the fire when you have clear evidence to the contrary. If you find yourself in an insurance dispute like this, our attorneys may be able to advocate for you.

What Is Property Damage Liability Insurance for Fires?

The liability portion of your homeowners’ insurance covers you if someone suffers an injury (or their property is damaged) on your property. Property damage liability coverage for fire is a separate (and rarely talked about) kind of coverage.

This kind of insurance protects you from legal liability if a fire starts on your property, spreads to a neighboring property, and causes damage there. If you have this coverage and your house fire damages someone else’s property, you should give them your policy information so they can file a property fire damage claim.

Steps to Take Before Speaking With the Insurance Adjuster

Insurance companies lose billions of dollars each year due to climate disasters like floods, wildfires, and tornadoes. Officially, insurance adjusters are supposed to objectively assess the value of the damage to your home. However, they are often pressured to undervalue your claims to save the company money.

It is important to be aware of this fact before dealing with the insurance adjuster. These are a few other steps to take beforehand:

- Review your policy

- Obtain several repair quotes

- Remind yourself to be polite and calm

- Refuse to provide a recorded statement

Does renters’ insurance cover damage to property outside your home? Can you be compensated for the loss of use of your home? Knowing your policy inside and out may help maximize your house fire insurance claim.

How to Speak to an Insurance Adjuster

How you communicate with your adjuster is an important part of your claim. While it may be tempting to see the adjuster as your adversary, do your best to avoid thinking this way. If you come across as hostile or uncooperative, it may jeopardize your claim.

However, you can advocate for yourself while remaining polite and clear. If you disagree with any part of the adjuster’s valuation of the damage, do not hesitate to show them photos, repair estimates, and other evidence.

Keep Records of All Interactions

If your claim is resolved quickly, you may not need to refer to your records. However, if the insurance company refuses to pay your claim and you need to pursue legal action, having clear and complete records will be essential.

Do Not Feel Pressured to Settle Quickly

Insurance companies often start with unfairly low settlement offers. Some may pressure you to accept immediately, but you should never accept an unfair settlement offer just because you feel pressured.

If you get a lowball settlement offer, present your evidence to the insurer and calmly argue your case. If the insurance company will not budge, our attorneys may be able to negotiate a fair settlement for you.

Common Mistakes to Avoid When Talking to an Insurance Adjuster

Are you unsure how to deal with an insurance adjuster after a house fire? Before you talk to your adjuster on the phone or in person, be mindful of some of the most common mistakes to avoid.

1. Accepting the First Settlement Offer

Some homeowners are so relieved to have a claim approved that they will accept the first settlement offered. Do not do this! Insurers almost always give policyholders a lowball offer first, so never accept a settlement before talking to a lawyer.

2. Not Hiring a Public Adjuster

Assessing fire damage can be somewhat subjective. If you think the adjuster is undervaluing damage, you might consider hiring a public adjuster. If the public adjuster believes the damage will be more costly to fix, their opinion may give you leverage when dealing with your adjuster.

3. Giving Inconsistent Information

You should be honest and consistent when talking with the adjuster. If they have any reason to suspect fraud, they might delay or deny your claim. You should not volunteer more information than you are asked for, but you should make sure everything you say is true.

4. Not Knowing Your Policy Terms

If you do not know what kind of compensation your policy entitles you to, you might unwittingly accept a lower payout. Always review your policy before talking to the adjuster. It may be helpful to have a copy on hand during your conversation as well.

5. Not Keeping a Record of Your Interactions

Disputes often arise during the claims process. To protect yourself, document all interactions with the adjuster. Keep a log of when each contact happened and what was said.

When to Involve a Fire Damage Insurance Claim Attorney in Your Case

In an ideal scenario, your insurance company will pay your claim in full after inspecting the damage. However, this does not always happen. If you are dealing with one of the following situations, it may be time to get in touch with a lawyer:

- Your insurer has denied your claim, but you believe your policy covers the damage.

- Your insurer is only willing to pay far less than your claim is worth.

- Your insurer is engaging in bad faith practices, like refusing to investigate or causing unreasonable delays.

If you are not sure whether you need an attorney to represent you, call to see how we could help.

How an Insurance Claims Lawyer Can Protect Your Rights

Insurance companies often deny or underpay claims because they believe policyholders will not fight back, or do not know how to. Property damage lawyers see through these dishonest tactics. Our lawyers can assess your policy, gather supporting evidence, and negotiate with the insurer on your behalf.

Advocate for a Fairer Settlement

Insurance lawyers are skilled negotiators. Your lawyer will likely present evidence to the insurance company and try to negotiate a reasonable settlement. If the insurer still will not cooperate, your lawyer may file a lawsuit on your behalf.

Contact Wallace Law for Help with Your Fire Damage Claim

Even when you know how to deal with an insurance adjuster after a house fire, you may still have trouble getting the compensation your policy entitles you to. Property insurance disputes are far more common than many people realize, and it often takes the help of an experienced insurance attorney to resolve them in your favor.

Standing up to insurance companies can be daunting, especially if you have just lost everything in a house fire. Fortunately, you do not have to face your insurance company alone. At Wallace Law, we understand that our clients turn to us after they have lost all hope of winning their insurance battles alone, which is why we are determined to hold bad-faith insurers responsible and secure the compensation that is rightfully yours.

If you are dealing with a denied insurance claim for fire damage to commercial or residential property, contact us for a free consultation.