A denied commercial property insurance claim can put a business in a difficult position. Property damage often disrupts operations, affects revenue, and creates immediate financial pressure. When an insurance company refuses to pay or delays payment indefinitely, the consequences can extend far beyond the physical damage itself.

While insurance providers may frame denials as routine coverage determinations, many commercial property claim denials are driven by narrow policy interpretations, procedural technicalities, or disputes over valuation. Understanding how commercial insurance claims work, what the filing process is, why denials occur, and what steps are available next can help business owners protect their interests.

Common Reasons Commercial Property Insurance Claims Are Denied

Commercial property insurance claim denials often stem from a handful of recurring issues. While insurance companies may frame these denials as straightforward applications of policy language, disputes frequently arise over how that language is interpreted and applied to the facts of a loss.

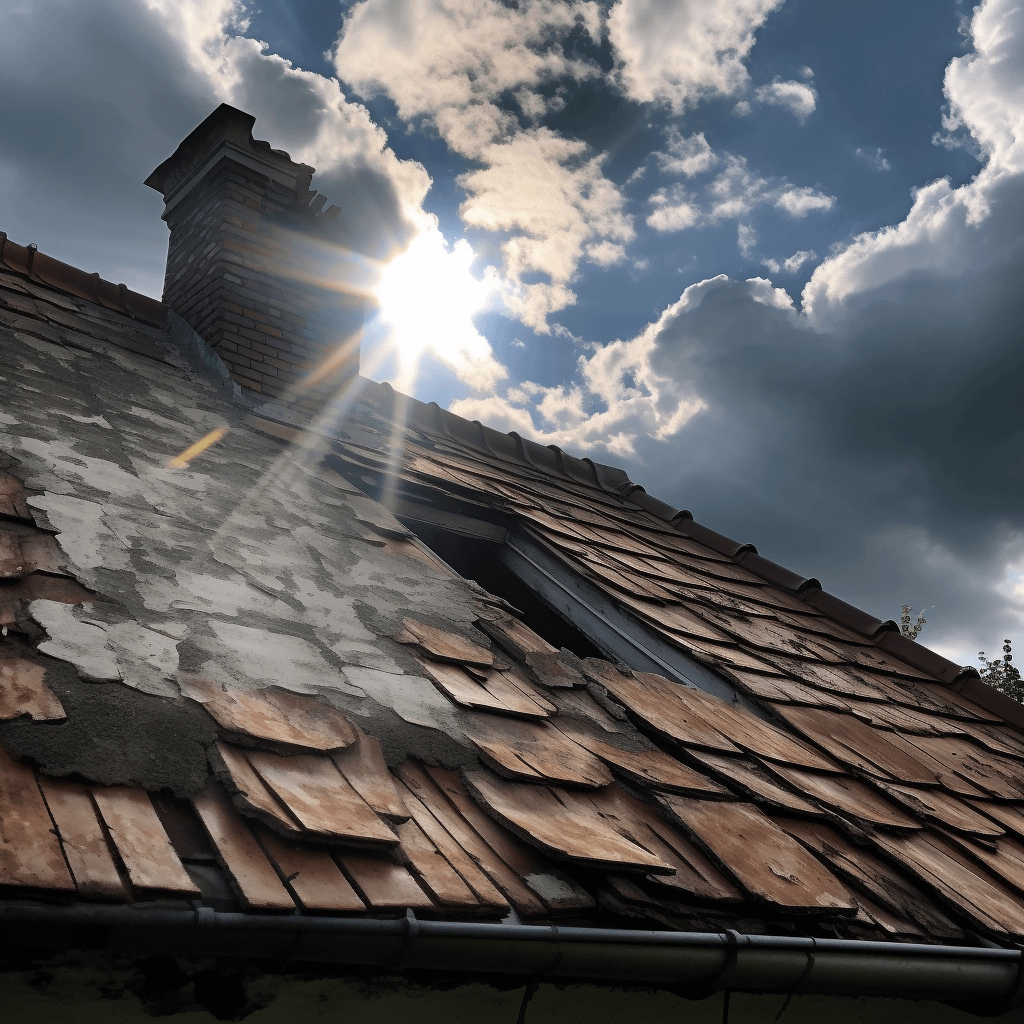

Disputes Over the Cause of Damage

One of the most common reasons a commercial property claim is denied is a disagreement over causation. Insurers may acknowledge that damage exists while disputing what caused it.

For example, an insurer may argue that damage resulted from:

- Wear and tear

- Long-term deterioration

- Poor maintenance

- An excluded peril rather than a covered event

These disputes often hinge on expert opinions, inspections, and reports prepared after the loss. Business owners may be surprised to learn how heavily insurance companies rely on causation theories to avoid coverage, even when damage becomes apparent after a specific incident.

Reliance on Policy Exclusions

Commercial insurance policies contain numerous exclusions, and insurers often rely on them as a basis for denial. Flood-related exclusions, earth movement exclusions, and mold or contamination exclusions are commonly cited, sometimes in situations where the policy also contains exceptions that may restore coverage.

Whether an exclusion applies is rarely as simple as the denial letter suggests. Coverage often turns on careful analysis of how exclusions interact with other provisions and how courts in the applicable state interpret that language.

Valuation and Scope Disagreements

Even when coverage is acknowledged, insurers may deny portions of a claim based on disputes over the scope or value of the loss, or by asserting that the claimed damages exceed applicable coverage limits. These disagreements can involve:

- The extent of necessary repairs

- Replacement versus repair costs

- Depreciation calculations

Valuation disputes are common in commercial claims because losses are often substantial and involve specialized property, equipment, or buildouts.

How to File a Commercial Insurance Claim

Understanding how to file a commercial insurance claim involves more than notifying the insurance company that damage occurred. Commercial policies impose specific duties on policyholders, and early decisions during the claims process can shape how the claim unfolds. Communication is typically controlled by the insurance provider, which evaluates coverage based on its interpretation of the policy.

Notice of Loss and Initial Reporting

Most commercial property policies require prompt notice of a loss. Although policies do not always define a precise reporting deadline, insurers frequently raise notice issues when they believe a claim was reported too late. After notice is provided, an insurance adjuster is often assigned to inspect the property and evaluate the claimed damage.

Providing notice as soon as practicable helps preserve evidence, allows timely inspections, and reduces disputes over whether the insurer was prejudiced by delay. Late notice is one of the most common technical defenses raised in commercial coverage disputes.

Duties After Loss

Commercial policies typically outline a series of duties that apply after a loss occurs. These may include:

- Taking reasonable steps to protect the property from further damage

- Allowing inspections and access to the damaged property

- Providing records, estimates, and other requested information

Failure to comply with these duties is often cited as a reason for denial, even when the underlying damage would otherwise be covered.

Documentation and Proof of Loss

Insurance companies often require extensive documentation to evaluate a commercial property insurance claim. Depending on the nature of the loss, this may include:

- Repair or replacement estimates

- Invoices, contracts, and vendor proposals

- Financial records supporting the claimed loss

- Sworn proof-of-loss forms

- Photographs or video documenting the damage

- Maintenance and inspection records

- Records showing the condition of the property before the loss

- Business interruption documentation, such as revenue and expense records

- Communications with contractors, engineers, or other consultants

Incomplete, inconsistent, or poorly organized documentation can delay the claim or provide insurers with a basis to dispute the amount owed, even when coverage is otherwise available. Maintaining detailed records throughout the claims process can help reduce disputes over scope, value, and compliance.

How Long Does a Commercial Insurance Claim Take?

There is no fixed timeline for resolving a commercial property insurance claim. The duration of the process depends on the complexity of the loss, the coverages involved, and how the insurer approaches the claim.

Factors That Extend the Timeline

Commercial policy claims often take longer to resolve when one or more of the following issues are present:

- The insurer disputes the cause of the damage and investigates alternative explanations

- Multiple coverages are implicated, such as property damage or extra expense

- Business interruption losses require analysis of revenue, expenses, and projected performance

- Engineers, accountants, or other consultants are retained to evaluate the loss

- Experts retained by the insurer reach conflicting conclusions

- The insurer requests additional documentation or clarification during the claim process

- An insurance adjuster or consultant revises earlier findings after additional inspections

- Issues that appeared resolved are reopened for further review

Each additional layer of investigation or review can extend the claim timeline, particularly in complex commercial losses.

Delay Versus Denial

Not all claim problems present as outright denials. In many cases, insurance companies delay resolution by requesting additional documentation, conducting repeated inspections, or reopening causation or valuation issues. Prolonged delay can have the same financial impact as a denied commercial insurance claim, especially when repairs or rebuilding cannot move forward. They place significant strain on businesses waiting for funds needed to repair property or resume operations.

The Role of State Law in Claim Timelines

State law often governs how promptly insurers must investigate and pay claims, and those standards can vary significantly by jurisdiction. For businesses operating in Wisconsin, Illinois, or Michigan, differences in state law may affect how delays are evaluated and what remedies may be available when an insurance company fails to act within a reasonable timeframe.

What to Do Immediately After a Claim Is Denied

If your commercial property insurance claim is denied, review the denial letter carefully. These letters often cite the policy provisions, exclusions, or alleged failures to comply with conditions.

Key steps typically include:

- Identifying the stated reason for denial

- Reviewing the cited policy language

- Noting any appeal or proof deadlines

- Preserving all correspondence and documentation

At this stage, it is important not to assume the insurer’s decision is final or correct.

Understanding Commercial Property Policy Language

Commercial property policies are contracts, and coverage disputes often hinge on how specific provisions are interpreted.

Issues frequently arise around:

- Definitions of “direct physical loss or damage”

- Exclusions and exceptions to exclusions

- Notice and proof-of-loss requirements

- Appraisal and dispute-resolution clauses

Insurers may rely on technical readings of policy language that do not align with how business owners reasonably understood their coverage when purchasing the policy.

When Coverage Disputes Involve State Law Differences

Commercial property insurance claims are generally governed by state law, and the applicable rules can vary depending on where the property is located and where the policy was issued.

For businesses operating in states such as Wisconsin, Illinois, and Michigan, differences may exist in:

- How policy language is interpreted

- Standards governing claim investigation and payment

- Remedies available when claims are denied or delayed

- Whether insurer conduct violates state insurance regulations

These differences can affect both the strategy for challenging a denial and the potential outcomes of a dispute.

Appealing a Denied Commercial Property Insurance Claim

Some commercial property insurance policies provide mechanisms for appealing or reconsidering a denial, as well as procedures, such as appraisal, for resolving certain disputes. These options can offer a way to address disagreements without immediately resorting to litigation, but they are typically governed by detailed policy terms and procedural requirements.

Appeal deadlines are often short, and missing them can limit further options. In addition, appraisal clauses may restrict how valuation disputes are handled by requiring the parties to follow a specific process that focuses on the amount of loss rather than broader coverage issues. Once invoked, appraisal can affect what arguments remain available later in the dispute.

Procedural missteps during appeals or appraisal can have lasting consequences. Choices made at one stage of the claims process can affect what options remain available later. Understanding how these provisions work — and how they interact with other policy terms and applicable state law — can help business owners avoid unintended limitations when challenging a denied commercial property insurance claim.

When a Denial Is Not the End of the Road

A denied commercial property claim does not necessarily mean coverage is unavailable. In many cases, disputes arise because:

- The insurance company relied on incomplete information

- Experts disagreed on causation or scope

- Policy terms were interpreted narrowly

Commercial insurance disputes often require a closer examination of the policy, the facts, and the governing law before a coverage position can be properly evaluated.

When to Contact a Lawyer About a Denied Commercial Property Claim

Not every claim denial requires legal involvement. However, legal guidance may be appropriate when a business insurance claim involves significant losses, technical coverage issues, or prolonged delays.

- The claim involves substantial losses

- The insurer relies on exclusions or technical defenses

- Delays continue without resolution

- Loss-of-income or extra expense coverage is at issue

By the time many business owners seek help, they have already attempted to resolve the dispute directly with the insurer without success.

How Wallace Insurance Law Helps With Commercial Property Claim Disputes

Wallace Insurance Law represents commercial property owners in insurance coverage disputes, including denied and delayed commercial property insurance claims.

The firm’s work often involves:

- Communicating with the insurance provider regarding coverage positions and claim handling

- Reviewing commercial property insurance policies and endorsements

- Analyzing denial letters, reservation-of-rights letters, and stated coverage positions

- Evaluating whether policy conditions were properly applied or enforced

- Assessing causation, scope, and valuation disputes

- Reviewing insurance company investigations and expert reports

- Identifying issues under applicable state law that affect coverage or claim handling

- Advising clients on procedural options, including appraisal or further review

With experience handling first-party insurance disputes, the firm focuses on enforcing the coverage businesses paid for.

Protecting Your Business After a Claim Denial

Commercial property insurance is intended to help businesses recover after property damage. When claims are denied, delayed, or underpaid, the financial impact can compound quickly.

Understanding what to do if your commercial property claim is denied, how claims are evaluated, and when state law may affect your options can help business owners make informed decisions. When policy disputes cannot be resolved through ordinary channels, legal guidance may help clarify available paths forward.

If your commercial insurance claim has been denied or delayed, Wallace Insurance Law can review your situation and explain your options. Contact us today for a free consultation.