Blog

Get Help Now

Recent Blog Post

What Does Commercial Property Insurance Cover for a Restaurant?

Restaurants are exposed to more physical risk than most businesses. Open flames, commercial ventilation systems, refrigeration units, plumbing lines, grease buildup, and heavy customer traffic create constant wear on the property. Add Wisconsin winters, hailstorms, wind damage, and spring flooding, and the exposure only increases. Having the right insurance coverage can mean the difference between […]

February 15, 2026

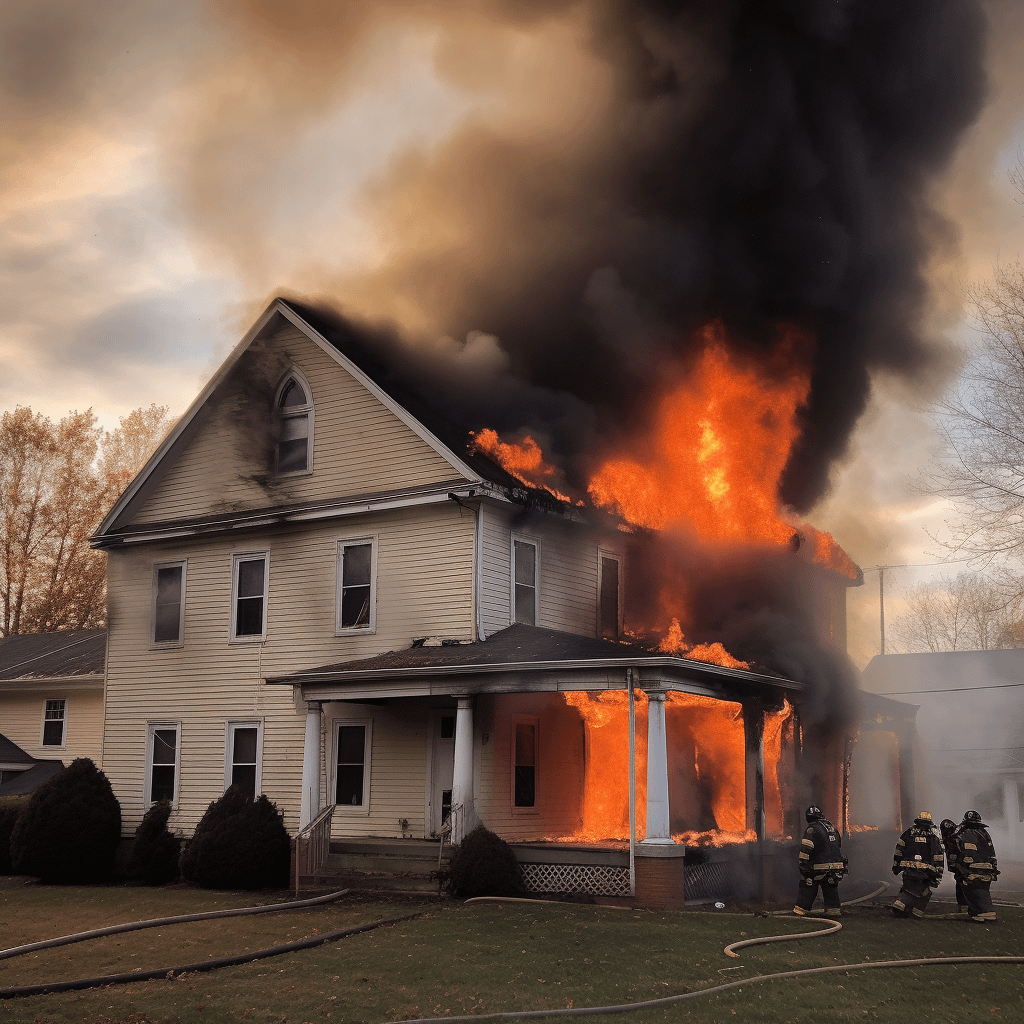

Different factors impact the success of your claim, and knowing how to deal with an insurance adjuster after a house fire is one of them.

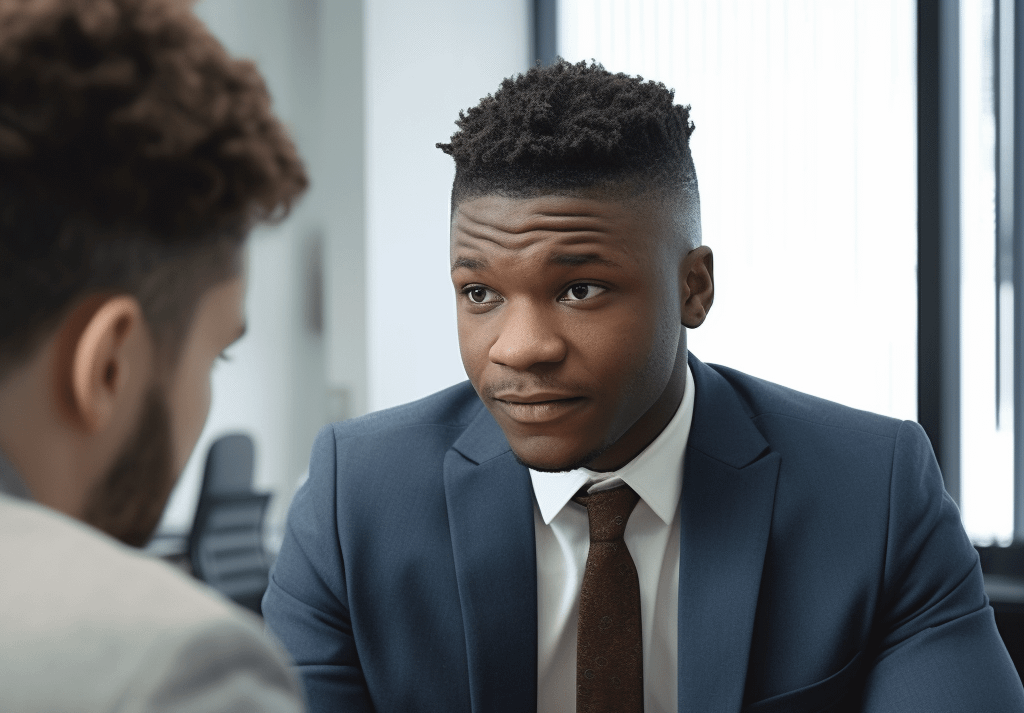

While insurance adjusters are essential to the insurance claims system, it is important to remember that their primary goal when fulfilling these duties is to save the insurance company as much money as possible, meaning they may be motivated financially to deny your claim.

Mold that occurs due to ongoing water damage is typically not covered under your homeowners’ insurance policy.

What you do in the aftermath of the fire is critically important both to your insurance claim and to preserving the value of your property.

No matter what insurance provider you get your coverage through, there is always a chance that you will have to contend with denial. Familiarizing yourself with health insurance denial rates by company is part of the picture, but so is understanding how to push back against unjust claim denials.

Applying for long-term care insurance can be frustrating because there is often a short window of time between when a person starts displaying a need for long-term care and when their condition or age has progressed to the point of becoming ineligible for long-term care insurance.

The short answer is that yes, filing a homeowner’s insurance claim may temporarily raise your rates. However, some types of claims can raise your rates more than others.

It may take up to 30 days for the insurer to review the claim and make a decision. Additional time may be necessary if the patient decides to appeal the insurance company's decision or take legal action.

More and more, pet owners are coming around to the value of pet insurance. Owning a pet unfortunately means that there can be many unexpected healthcare costs for your furry friend. Not only will routine checkups be much more affordable, but if your pet ever needs a lifesaving procedure that costs thousands of dollars, pet […]

Sometimes, the insurer flat-out denies your claim or offers a low settlement. This is where a lawyer can step in to ensure you receive deserved compensation.

When alcohol consumption ties into the death of the policyholder, life insurance claims can and do get denied. Many states allow life insurance companies to add exclusions to their policies when deaths result, either directly or indirectly, from alcohol use.

You purchase home insurance to protect yourself and your home. However, insurance companies primarily sell insurance to make money, so it is not surprising that most insurance policies have a laundry list of exclusions.

Many factors affect when you will hear from your adjuster after filing an initial claim. Some companies return calls within 24-48 hours, while other, smaller companies may take longer to contact you.

Typically, renters insurance may cover a number of expenses and losses stemming from sudden, accidental damage, provided that negligence was not the cause. Renters insurance is more likely to cover a sudden and unanticipated event that occurs in your dwelling like a burst water pipe (provided you were not somehow negligent). Generally, renters insurance will not cover water damage caused by a flood.

Fire insurance is crucial for protecting your home and belongings from devastating losses. However, having your fire claim denied can be distressing and add frustration to an already difficult situation. Understanding the common reasons why insurance companies deny fire claims can help you navigate the process and protect your rights. If you are facing a […]

No one likes to be lied to, especially by a professional who is responsible for determining whether your insurance claim is valid. If you have been injured in an accident and have a sizable claim, you may find the tactics used by an insurance adjuster to be accusatory, shrewd, and downright dishonest.