Water damage can be a homeowner’s worst nightmare, ruining property and causing expensive repairs. Many homeowners’ insurance policies cover water damage, but navigating the claims process and dealing with insurance agencies is often challenging and chaotic.

In particular, while most insurance policies exclude water damage itself, oftentimes water damage is secondary to a roof problem, construction error, or other cause. If the water damage is an “ensuing loss”–that is, a secondary loss after a first event–it can be covered by insurance.

Sometimes, the insurer flat-out denies your claim or offers a low settlement. This is where a lawyer can step in to ensure you receive deserved compensation. At Wallace Insurance Law, we specialize in helping homeowners fight for fair outcomes in water damage insurance claims, relieving the stress of battling the insurance company on your own.

How Do You Know if You Have Water Damage in Your Home?

Timing is crucial when filing a water damage claim. Delaying your claim could lead to additional damage or even result in denial by your insurance company. It is important to file as soon as you discover the damage.

Insurers typically have strict deadlines for reporting claims, so acting quickly is in your best interest. Besides the urgency of filing, it is also essential to document the damage. To support your claim, taking explicit photos and getting other information like repair estimates and communication with contractors is critical. This information will assist your insurer to properly evaluate your case and deal with your claim as quickly as possible.

In addition, documenting any repairs you have done can be helpful to prevent further damage. Keeping receipts for any costs you incur regarding these repairs is also essential. This information may help support your case and prove that you handled the issue reasonably.

It is also helpful to seek legal advice from an insurance claim lawyer and to contact your insurance agent to help you with the claims process and answer any questions you may have regarding your policy. It is essential to keep the lines of communication open and ensure that all the necessary steps are followed.

When Should I File a Home Insurance Claim for Water Damage?

Filing for a water damage claim should be done at the right time to avoid complications, such as a delay that may lead to increased damage or denial by the insurance company. This is why it is recommended that you make a claim as early as possible once you notice the damage. Most insurers have a time frame within which you must report your claim, and it is advisable to do so immediately.

How to File a Home Insurance Claim for Water Damage

Filing a claim for water damage involves several essential steps:

- Document the Damage: You should have a record of all affected areas and items, so take photos or videos of all damaged areas. This evidence is critical for supporting your insurance claim.

- Review Your Policy: Do you know what your policy covers? Make sure you know your coverages and also any exclusions that may apply.

- Notify Your Insurance Company: Report the damage quickly to ensure your claim is filed within the required time frame.

- Mitigate Further Damage: Additional damage can quickly occur, so it is essential to prevent the damage from worsening, such as temporarily drying wet areas or patching leaks.

- Provide Evidence: Submit all necessary documentation, including repair estimates and receipts for mitigation efforts.

Water damage typically includes issues like burst pipes, roof leaks, or appliance overflows, but exclusions may apply to gradual damage, such as slow leaks.

Who Can You Sue for Water Damage?

Sometimes, your insurance policy might not cover water damage, or a third party may have caused the damage. For example:

- Neighbors: Sometimes, your insurance policy may not cover water damage, or a third party might have caused the damage. For instance, if your neighbor is causing water damage to your property, for example, by overwatering their lawn, you may be able to take legal action.

- Landlords: Renters experiencing water damage caused by negligence on the landlord’s part might be able to file a claim against the landlord’s insurance or pursue legal action.

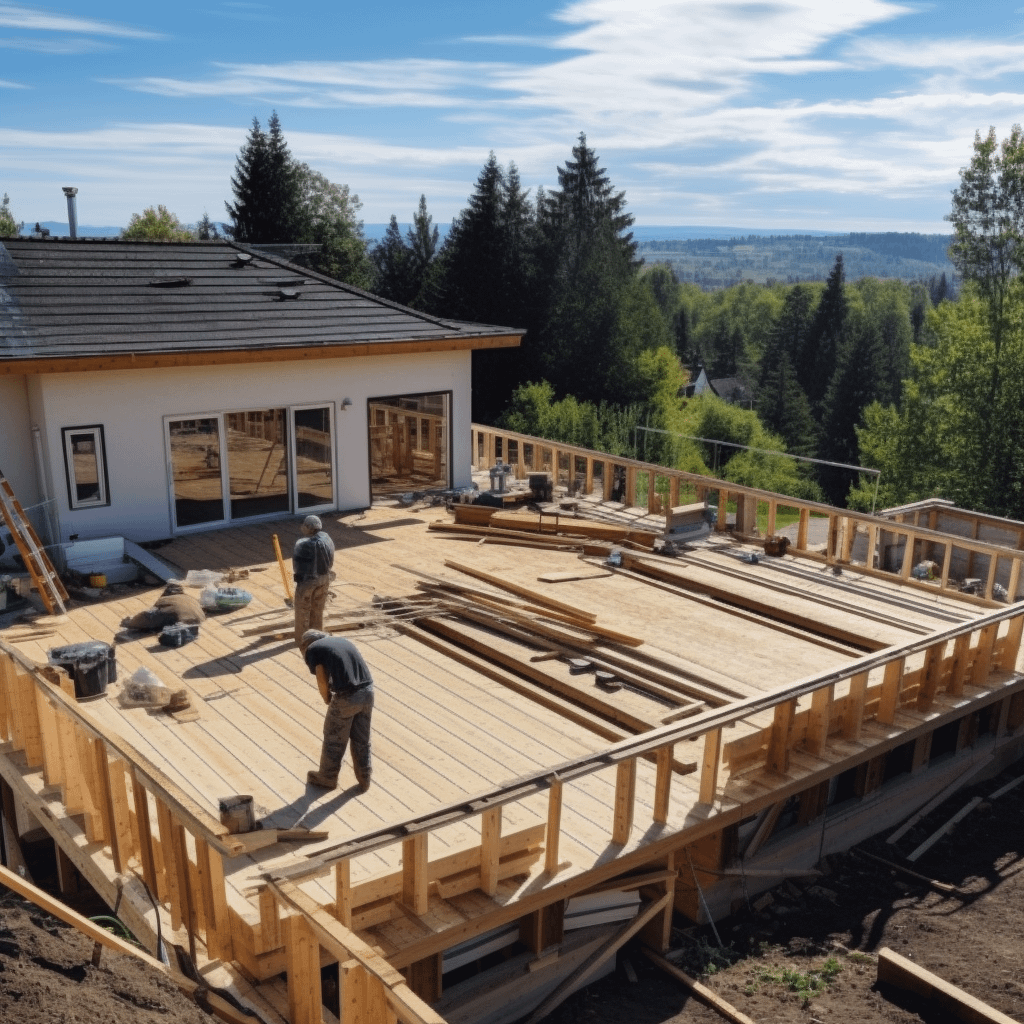

- Contractors or Builders: If poor construction or defective materials contributed to water damage, you might have a case against the responsible party.

Types of Water Damage Claims You Can File

Homeowners’ insurance policies categorize water damage claims into several specific types, each with its own coverage rules and requirements. Understanding these categories is essential for homeowners seeking to file a claim successfully. Below are the main types of water damage claims.

Burst Pipes

No matter how careful one is, burst pipes are bound to happen at some point and are among the leading causes of water damage. Burst pipes are often caused by sudden and accidental events like freezing temperatures or over-pressurization of the plumbing system. Such damage is covered by insurance only if the homeowners can prove that the pipe burst due to accidental reasons and not because of neglect or lack of maintenance.

To substantiate a claim, it is essential to record the events, for instance, the date and cause of the burst, as well as any measures taken to contain the damage.

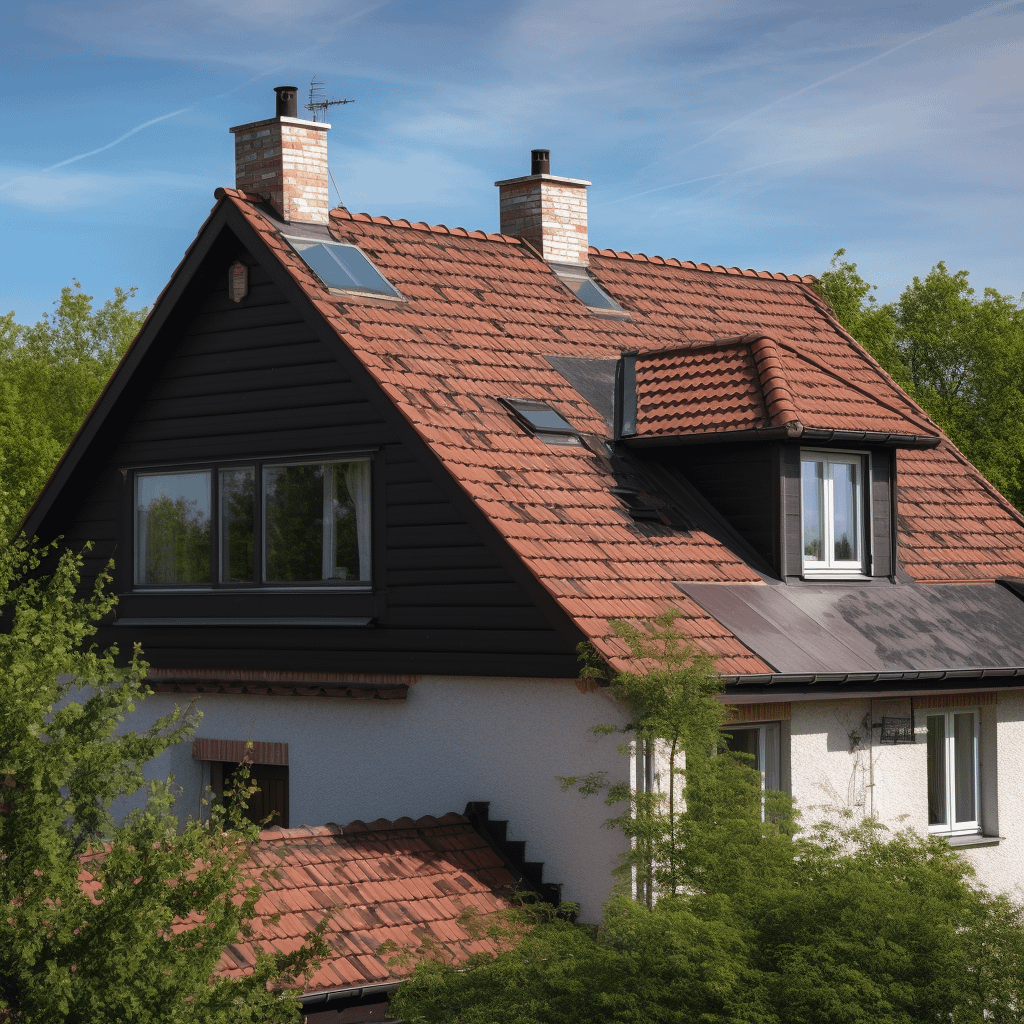

Storm Damage

Severe weather conditions, including heavy rain, strong winds, or snow storms, can cause severe water damage in homes. Coverage will also cover damages resulting from such conditions as floors in the basement after a storm or rainwater infiltrating the house through a damaged roof due to wind.

Homeowners need to know their policy and what it covers; some policies may have exclusions or limitations on the coverage during certain weather conditions. This can include things such as the date of the storm, meteorological data, and pictures of the damage. It is also advisable to report the loss to your local police if the break-in occurred during the storm.

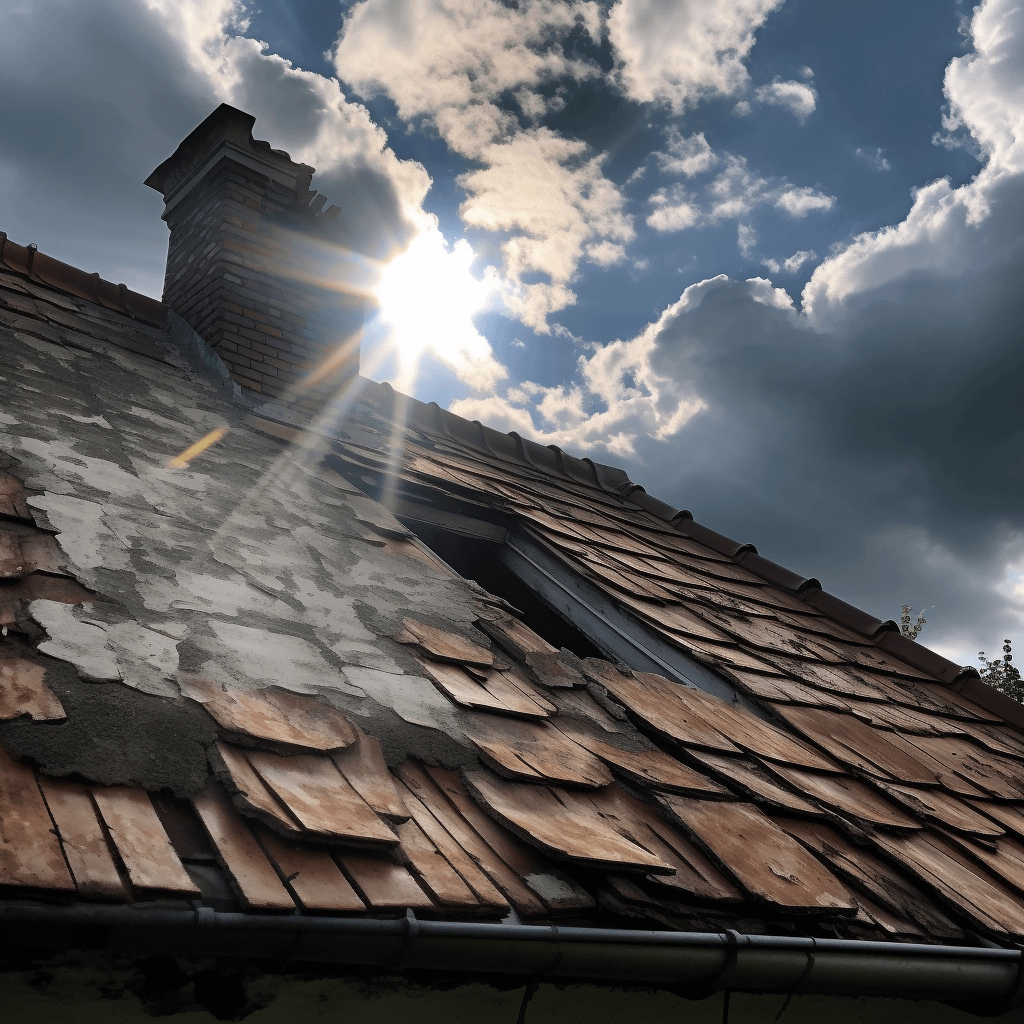

Roof Leaks

Water infiltration from roof leaks, often caused by storm damage or wear and tear, is generally covered under homeowners’ insurance policies. To qualify for coverage, the leak must typically stem from a covered peril, like a fallen tree limb during a storm. Homeowners should maintain documentation of roof maintenance and any repairs made, as insurers may scrutinize the roof’s condition before approving a claim.

Identifying and addressing leaks promptly can help minimize damage and strengthen the claim.

Appliance Failures

Sometimes, against our best efforts to keep them in impeccable working appliances such as washing machines, water heaters, and dishwashers, they can fail and cause significant water damage when malfunctioning. Homeowners ‘ insurance policies usually cover the loss caused by appliance failures, provided that the loss is not a result of neglect or wear and tear.

It is advisable to keep a file with receipts for all major appliances because these are essential documents that can be used to support an insurance claim in a case of water damage. Further, taking photos of the damage can help process claims faster.

To ensure a successful outcome when filing a water damage claim, homeowners should familiarize themselves with their insurance policy and understand the specific requirements for each type of claim. It may also be helpful to consult with a professional insurance agent or attorney for guidance.

Will the Insurance Company Replace My Water-Damaged Floor?

Replacing water-damaged flooring is a common concern for homeowners. Coverage depends on the cause of the damage and your policy’s terms. For example:

- Covered Events: Flooring damaged by a burst pipe or storm is usually covered.

- Exclusions: Gradual damage, such as long-term leaks, may be excluded.

Legal assistance can make a significant difference if your insurance company denies or undervalues your flooring replacement claim.

Do I Need a Lawyer for an Insurance Claim?

While filing a water damage claim independently is possible, hiring a lawyer can often lead to a more favorable outcome. Lawyers can:

- Maximize Compensation: Insurance companies are known for undervaluing claims. A lawyer can negotiate to ensure you receive the full amount you are entitled to.

- Handle Complex Paperwork: Filing a claim involves extensive documentation, and any errors can result in delays or denials.

- Ensure Timely Filing: Missing deadlines can jeopardize your claim. A lawyer will keep track of all necessary time frames.

What to Expect When Filing a Lawsuit for Water Damage

If your claim has been denied or you received a settlement offer that doesn’t adequately compensate you for your losses, know you have options. Filing a lawsuit may be the next step to seeking a fair resolution. Here’s a more detailed breakdown of what to expect during this process.

Investigation

The first phase includes detailed case research. Your lawyer will work to gather all the evidence that can strengthen your case. This can involve the collection of medical records; police accident reports witness statements, and photographs of the incident scene.

It can also affect the use of experts, such as medical professionals or accident reconstruction specialists, to give their opinions and assessments. This approach enables you to create a strong base for your case while at the same time making sure that no vital information is left out.

Negotiation

Not all cases have to go to court since negotiations can resolve them. This step can include conferences between your lawyer, the insurance company, or the other side.

At this stage, your lawyer will put your case together with the evidence gathered during the investigation and seek a reasonable settlement that would include all your losses, such as the medical bills, loss of income, and the suffering you went through. Applied communication skills are essential since your lawyer will try to settle the case out of court rather than going through the stress of a trial.

Litigation

If the parties cannot come up with a solution and a settlement is not achieved, the case will be heard in court. During a trial, motions are examined and expert witnesses testify as to the facts of the case. Your attorney will work to ensure that your rights and needs are protected in court and will help you fight for maximum compensation.

If You Have a Water Damage Insurance Claim, Let Us Help

No one wants to deal with the burden of navigating the insurance claims process, especially when stressed out by water damage. At Wallace Insurance Law, we fight for your rights and aim to get you the compensation you deserve. Whether your claim has been denied undervalued or you are unsure where to begin, we are here to help.

Contact us today to schedule a consultation and take the first step toward resolving your water damage claim.