Category: Bad Faith Insurance Dispute

Get Help NowRecent Blog Post

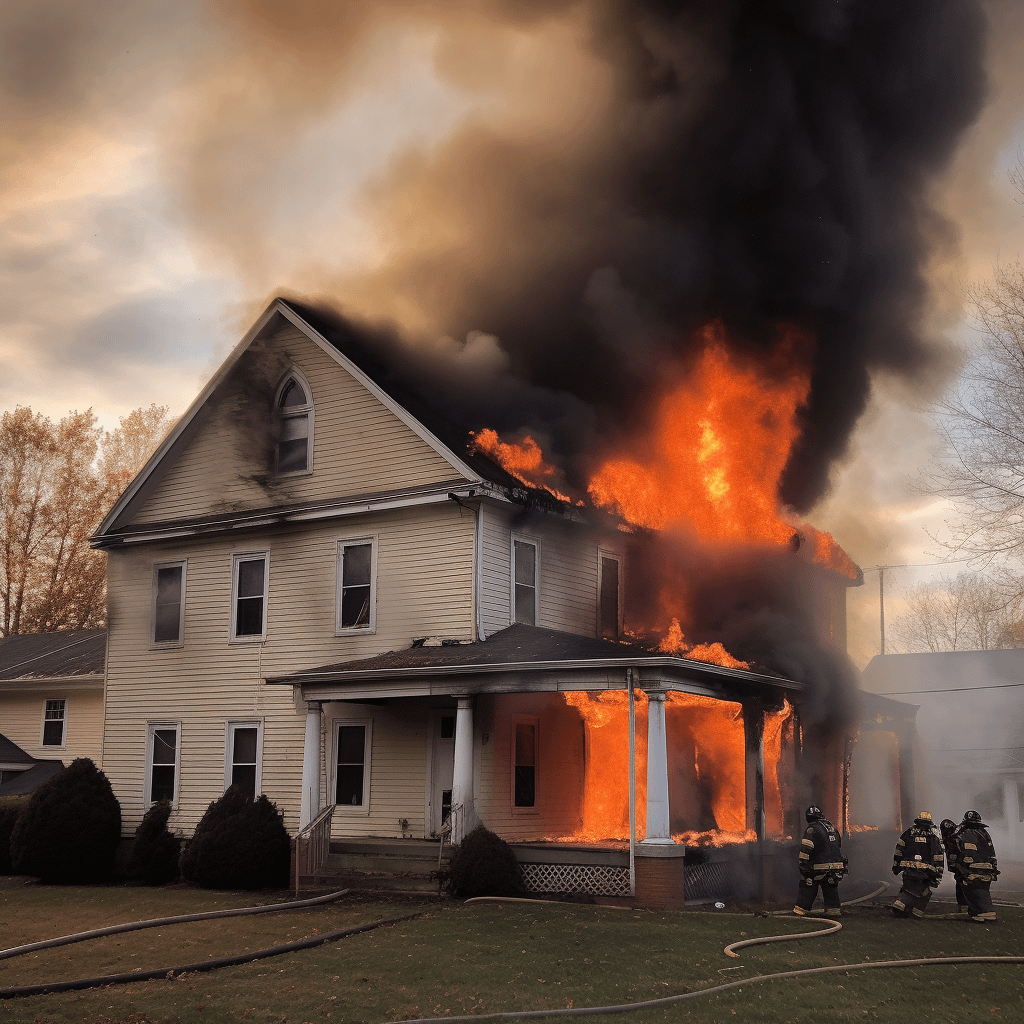

How to Deal with an Insurance Adjuster After a House Fire

Different factors impact the success of your claim, and knowing how to deal with an insurance adjuster after a house fire is one of them.

May 27, 2025

Mold that occurs due to ongoing water damage is typically not covered under your homeowners’ insurance policy.

What you do in the aftermath of the fire is critically important both to your insurance claim and to preserving the value of your property.

No matter what insurance provider you get your coverage through, there is always a chance that you will have to contend with denial. Familiarizing yourself with health insurance denial rates by company is part of the picture, but so is understanding how to push back against unjust claim denials.

It is not unusual for the claims process to take longer than expected. While Wisconsin laws mandate insurers to “promptly pay every insurance claim” within 30 days, some factors may cause your claim to take longer.

The short answer is that yes, filing a homeowner’s insurance claim may temporarily raise your rates. However, some types of claims can raise your rates more than others.

It may take up to 30 days for the insurer to review the claim and make a decision. Additional time may be necessary if the patient decides to appeal the insurance company's decision or take legal action.

More and more, pet owners are coming around to the value of pet insurance. Owning a pet unfortunately means that there can be many unexpected healthcare costs for your furry friend. Not only will routine checkups be much more affordable, but if your pet ever needs a lifesaving procedure that costs thousands of dollars, pet […]

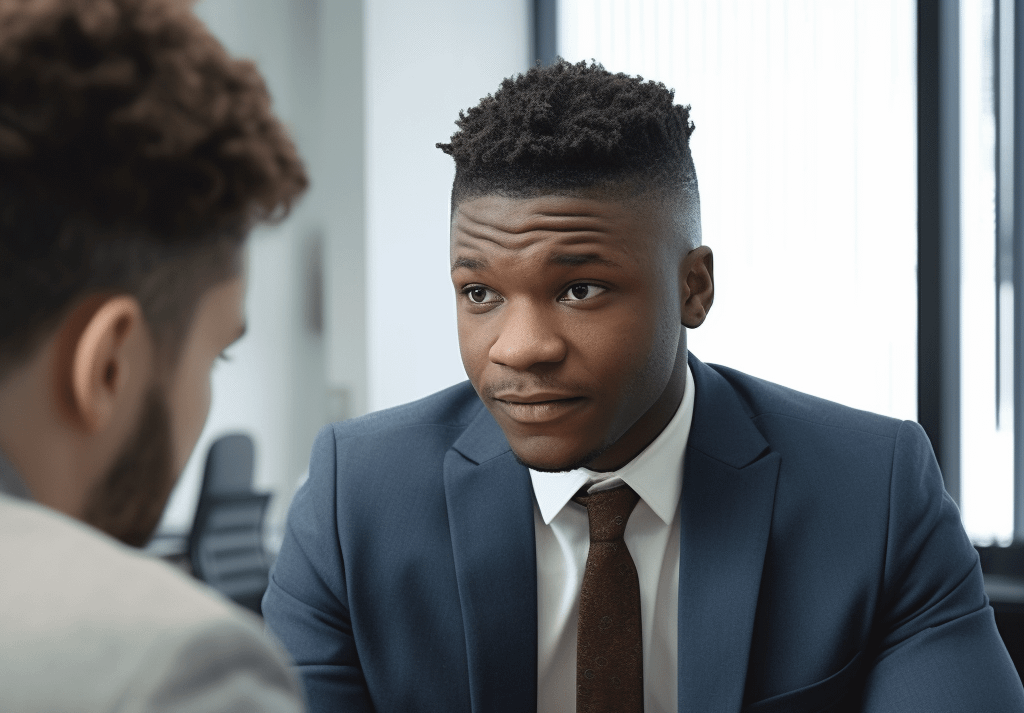

Sometimes, the insurer flat-out denies your claim or offers a low settlement. This is where a lawyer can step in to ensure you receive deserved compensation.

You purchase home insurance to protect yourself and your home. However, insurance companies primarily sell insurance to make money, so it is not surprising that most insurance policies have a laundry list of exclusions.

Typically, renters insurance may cover a number of expenses and losses stemming from sudden, accidental damage, provided that negligence was not the cause. Renters insurance is more likely to cover a sudden and unanticipated event that occurs in your dwelling like a burst water pipe (provided you were not somehow negligent). Generally, renters insurance will not cover water damage caused by a flood.

Fire insurance is crucial for protecting your home and belongings from devastating losses. However, having your fire claim denied can be distressing and add frustration to an already difficult situation. Understanding the common reasons why insurance companies deny fire claims can help you navigate the process and protect your rights. If you are facing a […]

No one likes to be lied to, especially by a professional who is responsible for determining whether your insurance claim is valid. If you have been injured in an accident and have a sizable claim, you may find the tactics used by an insurance adjuster to be accusatory, shrewd, and downright dishonest.

You can navigate the challenges of dealing with an insurance company by understanding your policy and gathering compelling evidence to support an appeal. For more insights into handling insurance disputes, visit the Wallace Law guide on Wisconsin insurance disputes.

Learning how to file a bad-faith insurance claim can help ensure that you are not taken advantage of by your insurance company during a difficult time. With Wallace Law, you are not alone in the fight.

Insurance is crucial for protecting a person’s assets. When the unthinkable happens and you need that insurance to cover the repair, replacement, or expenses associated with a loss, a denial of your claim can place you in an incredibly stressful position. Insurance companies may deny claims, but there are still steps you can take to […]

If you are tired of trying different courses of action to fight insurance companies that purposely avoid paying claims, come to Wallace Law for help.