Category: Property Insurance Claim

Get Help Now

Recent Blog Post

Can You Contest A Life Insurance Policy?

Life insurance denials are common, but many can be overturned. Learn why claims get denied, what evidence you need, and how to challenge the decision effectively.

November 22, 2025

Insurance companies deny claims for many reasons—from policy exclusions to bad-faith tactics. Here’s how denials happen and what legal steps you can take to challenge them.

Renters’ insurance protects tenants of rental property from damages related to smoke, fire, explosions, and other acts of god. It exists to help tenants in the event of a major accident to recover any financial losses. Renters’ insurance can cover a wide variety of accidents, natural disasters, and vandalism, though exactly what is covered depends […]

Wind damage to your roof is serious. Without proper repairs or replacement, your entire property could be at risk, costing you thousands of dollars in structural damage down the road. Don’t let your insurance company leave you with unsafe conditions or expensive repairs you shouldn’t have to pay for.

Don’t let your insurance company leave you with unsafe conditions or unfair bills. If your claim has been denied or underpaid, you have options. Contact Wallace Law today for a free case evaluation, and we’ll get to work reviewing your coverage and picking up your claim exactly where it is.

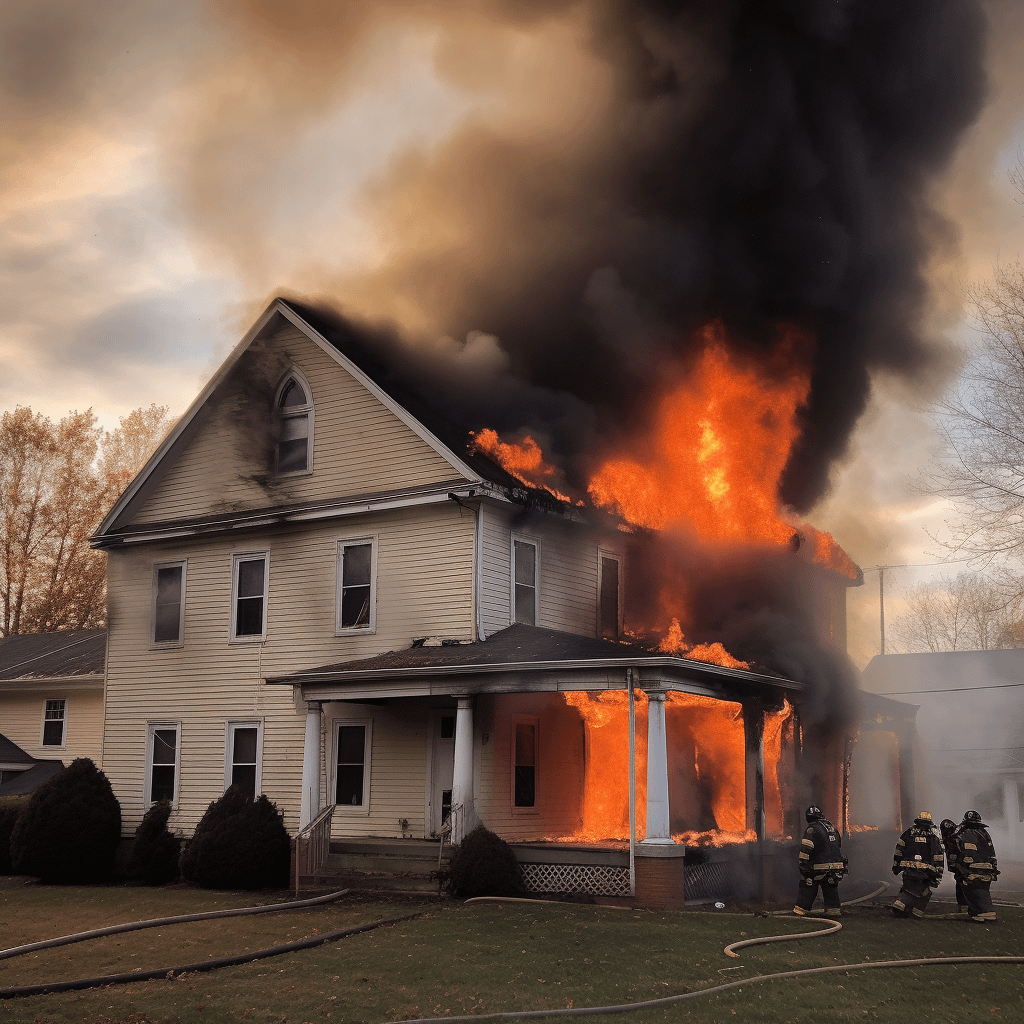

If you ever face a situation where your fire damage claim is delayed or denied, do not assume there is nothing you can do about it. Review your policy, gather all documentation, appeal, and if needed, reach out to a fire damage claim lawyer. Knowing your rights ahead of time can help protect you and your family.

You pay your insurance premiums expecting protection in your time of need. But when a hailstorm tears through your neighborhood and damages your roof, the last thing you want to hear is that your claim has been denied. Sadly, that is precisely what happens to many homeowners and business owners across Wisconsin. At Wallace Law, […]

One hailstorm can create thousands of insurance claims on a single insurer, so it’s no surprise that they try to minimize payouts for hail damage when they can.

Mold that occurs due to ongoing water damage is typically not covered under your homeowners’ insurance policy.

What you do in the aftermath of the fire is critically important both to your insurance claim and to preserving the value of your property.

The short answer is that yes, filing a homeowner’s insurance claim may temporarily raise your rates. However, some types of claims can raise your rates more than others.

It may take up to 30 days for the insurer to review the claim and make a decision. Additional time may be necessary if the patient decides to appeal the insurance company's decision or take legal action.

Sometimes, the insurer flat-out denies your claim or offers a low settlement. This is where a lawyer can step in to ensure you receive deserved compensation.

You purchase home insurance to protect yourself and your home. However, insurance companies primarily sell insurance to make money, so it is not surprising that most insurance policies have a laundry list of exclusions.

Typically, renters insurance may cover a number of expenses and losses stemming from sudden, accidental damage, provided that negligence was not the cause. Renters insurance is more likely to cover a sudden and unanticipated event that occurs in your dwelling like a burst water pipe (provided you were not somehow negligent). Generally, renters insurance will not cover water damage caused by a flood.

Fire insurance is crucial for protecting your home and belongings from devastating losses. However, having your fire claim denied can be distressing and add frustration to an already difficult situation. Understanding the common reasons why insurance companies deny fire claims can help you navigate the process and protect your rights. If you are facing a […]

No one likes to be lied to, especially by a professional who is responsible for determining whether your insurance claim is valid. If you have been injured in an accident and have a sizable claim, you may find the tactics used by an insurance adjuster to be accusatory, shrewd, and downright dishonest.