Category: Storm Damage

Get Help NowRecent Blog Post

How to Deal with an Insurance Adjuster After a House Fire

Different factors impact the success of your claim, and knowing how to deal with an insurance adjuster after a house fire is one of them.

May 27, 2025

The short answer is that yes, filing a homeowner’s insurance claim may temporarily raise your rates. However, some types of claims can raise your rates more than others.

You can navigate the challenges of dealing with an insurance company by understanding your policy and gathering compelling evidence to support an appeal. For more insights into handling insurance disputes, visit the Wallace Law guide on Wisconsin insurance disputes.

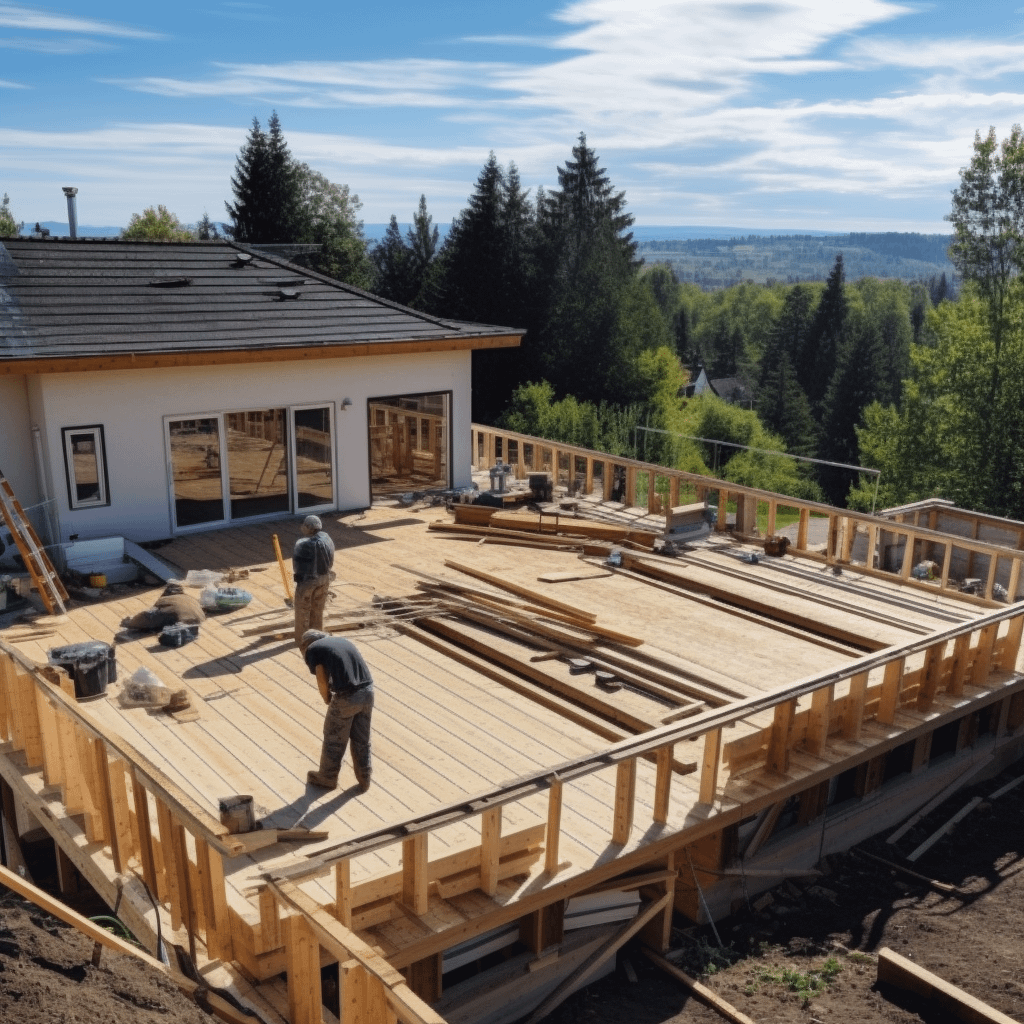

Choosing and working with a contractor for storm damage can be a daunting task, especially if you’ve never done it before. Read on to learn more.