Category: Property Insurance Claim

Get Help NowRecent Blog Post

Types of Health Insurance Coverages

If you suspect that your insurer is playing games to dodge payments, contact Wallace Law for help. We understand how health insurance claims (and companies) work and can help you get the compensation you deserve.

August 27, 2024

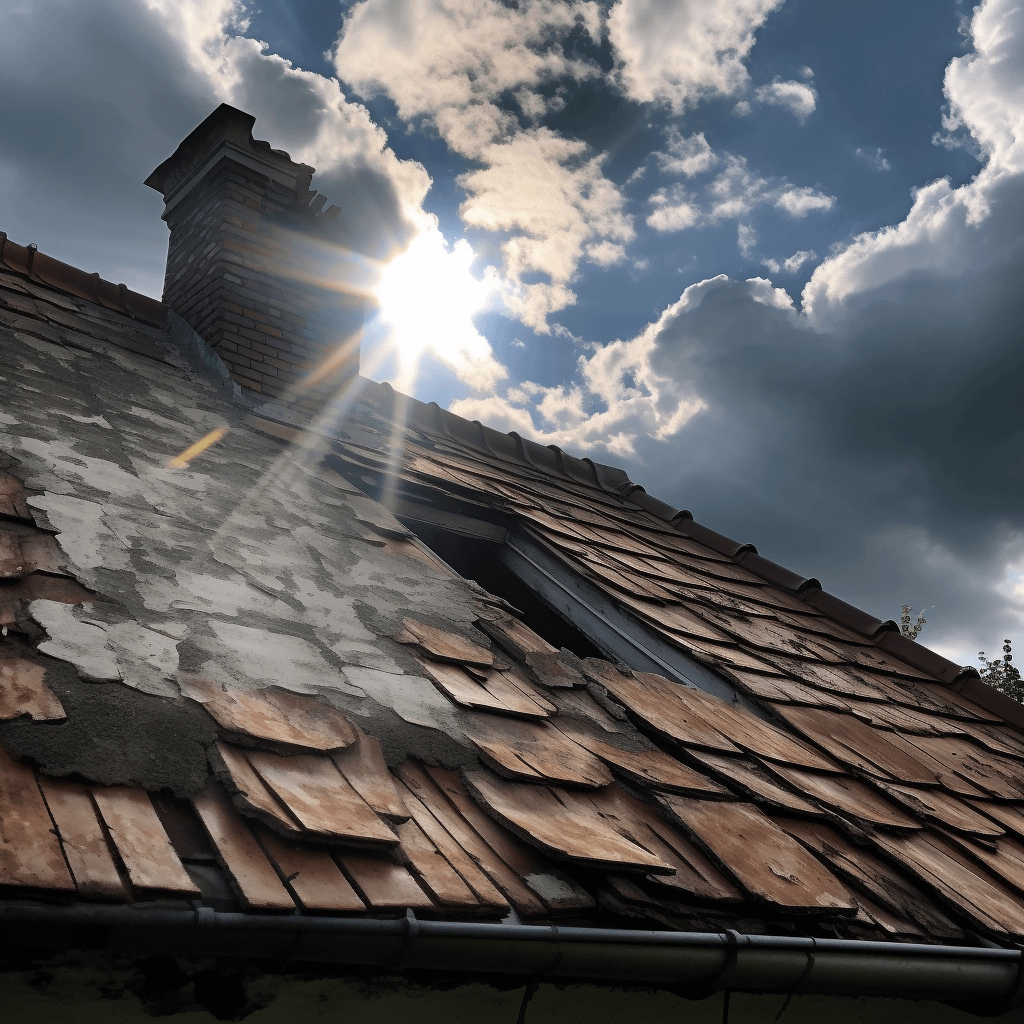

If you've been affected by a tornado, there's no time to waste. While most basic homeowners policies do cover damage from tornadoes, an insurance company may deny your coverage for all the wrong reasons.

Having your tornado damage insurance claim denied can be incredibly frustrating in the aftermath of a damaged home. Wallace Law can help.

While they may seem harmless, ice dams can cause serious exterior and interior issues during the winter months in Wisconsin.

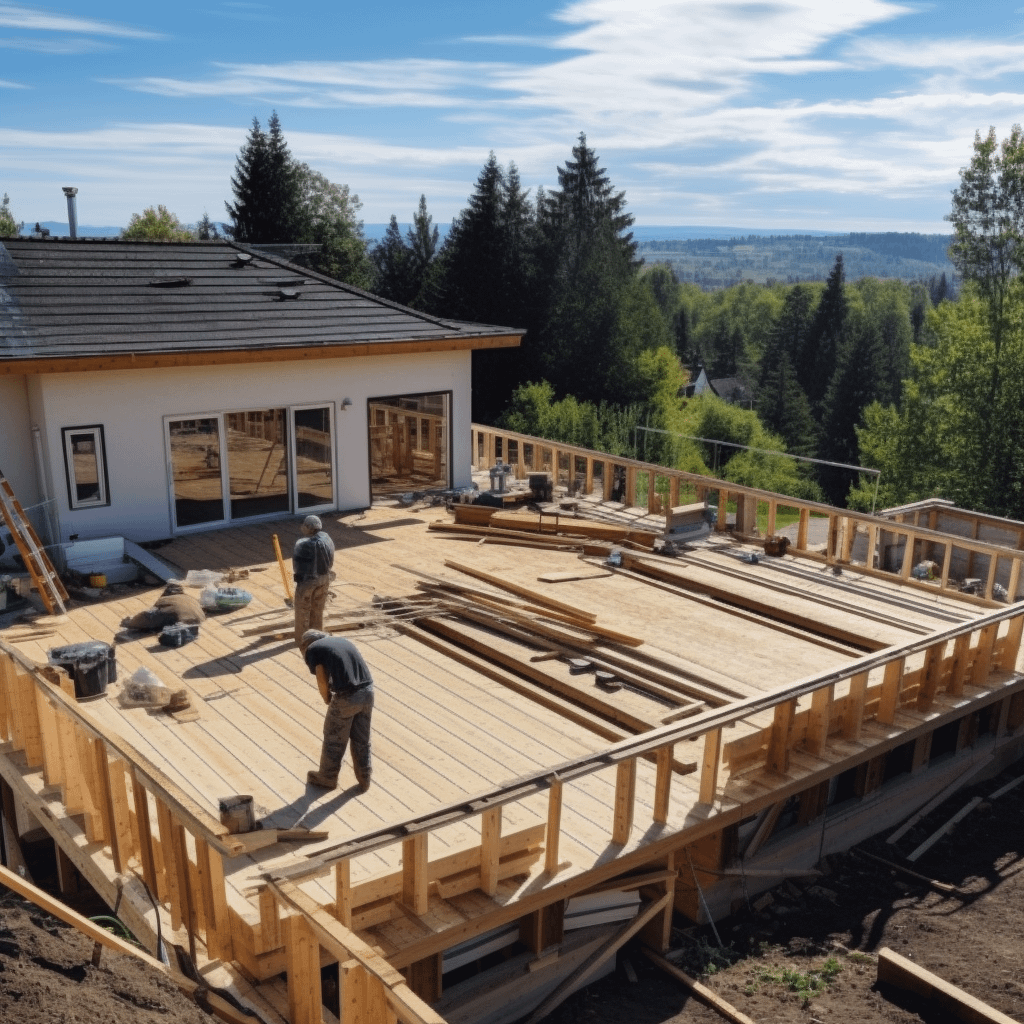

Wind and rain can cause severe damage and, sometimes, insurance policies refuse to pay what they owe. Discover what options are available to homeowners for rebuilding their properties.

Tornadoes hit more than 1,000 homes in a year, making it all the more important for your insurance company to cover your property damage. When a tornado hits your home and pocket, Wallace Law is here to help.

Choosing and working with a contractor for storm damage can be a daunting task, especially if you’ve never done it before. Read on to learn more.

If your insurance company has delayed, underpaid, or refused to pay for your property damage claim, consult an insurance dispute lawyer to hold your insurers accountable.

Make sure your property insurance claim is as successful as possible by avoiding these five common pitfalls.