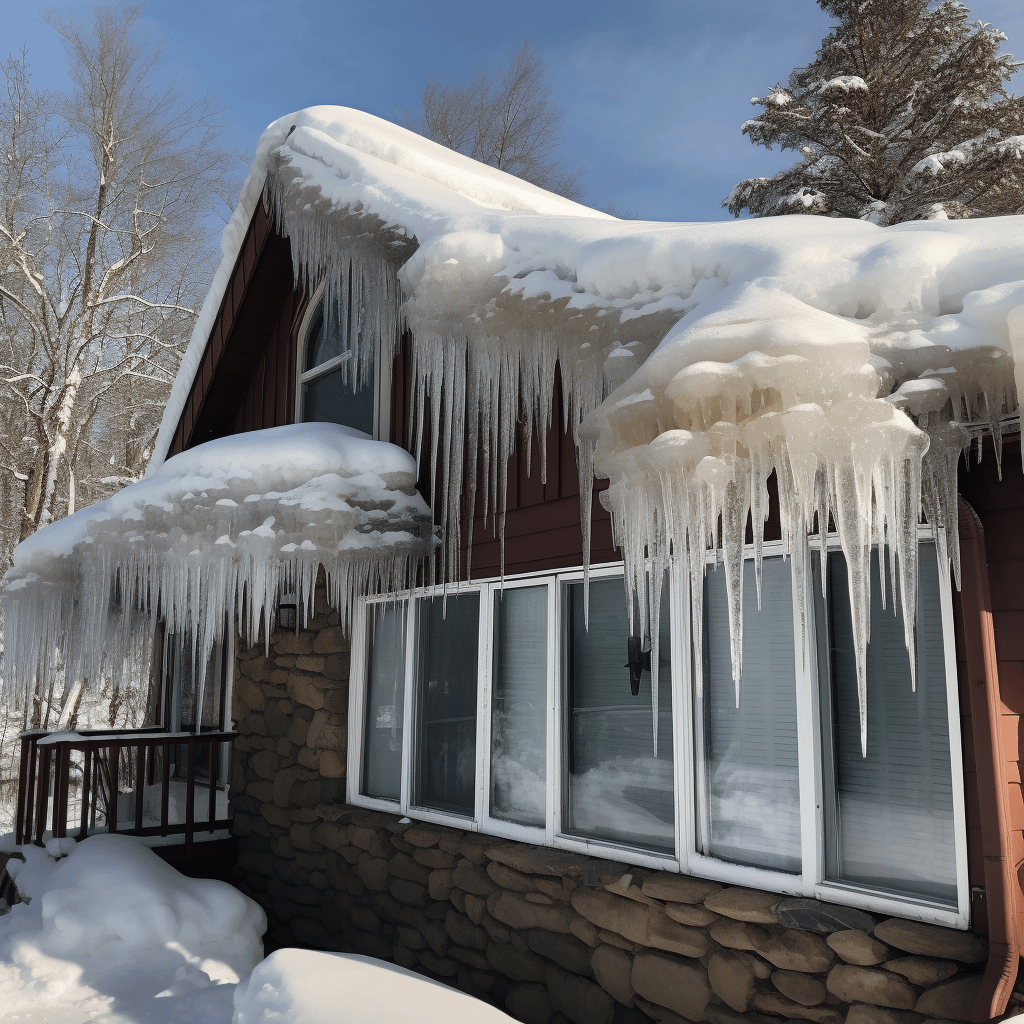

Winter is full of seasonal surprises, like snow, sleet, and ice dams. When ice and snow collide and mix with warm interior heat, they cause a vicious cycle of melt and refreeze of ice. This results in water seeping into the ceilings, walls, floors, and insulation system of a property. If overlooked, ice dams can cause serious structural problems like buckled floors, damaged walls, collapsed ceilings, and weakened walls.

Preventative home maintenance can save homeowners thousands of dollars in repairs, but sometimes, this is not enough to stop ice dams and other weather-related damage. Filing an ice dam insurance claim might be necessary to cover unexpected costs related to repairs or replacement.

If your insurer has denied, delayed, or provided meagre coverage for ice dam damage, it might be time to speak to a Wisconsin insurance dispute attorney. Wallace Law can help you with everything you need to know to file an ice dam claim effectively, and take your case to court if necessary.

What is an Ice Dam?

An ice dam is a build-up of ice that forms at the edge of a roof. Ice dams occur when heavy snow melts during the day and refreezes as the temperature drops. Ice dams can leak water into homes and cause mold, rot, and other damage during the melting phase when water penetrates your walls, ceilings, insulation, and other areas.

What Causes Ice Dams?

Ice dams are a build-up of ice in a home’s gutters due to a mix of rising heat and freezing temperatures. Once formed, ice dams prevent water from flowing off the roof as they pool and refreeze in large chunks.

Ice dams are not a natural occurrence like some homeowners might think. They are mainly preventable.

Typically, the leading cause of ice dams is poor attic insulation, as the heat escapes from the home and causes the roof ice to melt. The other ways in which ice dams form are through clogged gutters and heavy snow accumulation.

Can Ice Dams Cause Roof Damage?

While they may seem harmless, ice dams can cause serious exterior and interior issues during the winter months in Wisconsin. For instance, they might cause structural damage due to untreated water damage, or cause water to back up under loosened shingles and drain into the house.

Roofs experience the most damage because of varying conditions. Examples of roof damage include:

- Attic condensation

- Damaged roof sheathing

- Roof leaks

- Wall water stains

- Ceiling water damage

- Mold and mildew

- Attic framing rot

- Sagging drywall

- Roof collapse

Roof damage can lead to serious expenses in home repair and other costs. If you believe that you have a valid claim that your insurer refuses to adequately compensate you for, contact a roof damage insurance lawyer today.

Does Insurance Cover Ice Dams?

Most insurance providers do not consider ice dam damage a covered peril or an eligible event. However, insurers will likely cover certain types of property damage due to ice dams that were abrupt and unexpected. An insurance policy should help with situations involving damage to the interior of your home from melting ice, roof damage, and loss of use if your home is no longer livable and you need to temporarily relocate.

Be prepared, as some insurance companies will try to deny coverage. Insurers might claim the ice damage occurred over a long period, or the home was not adequately cared for or maintained, which caused the damage and not the covered event. This is why it is important to stay updated about your insurance policy and possible avenues in case of claim denial.

When is Ice Dam Damage Not Covered by Insurance?

While your insurance might cover certain types of property damage due to ice dams, most homeowner’s policies exclude coverage for certain structures impacted by water or ice, including:

- Fences

- Swimming pools

- Patios

- Foundations

- Retaining walls

- Piers or docks

Are Ice Dam Insurance Claims Successful?

Insurance companies tend to put homeowners through a rigorous process before they agree to cover certain ice dam damages, if at all. Certain things can hinder or help obtain a successful claim. For instance, homeowners with a history of frequent insurance claims can be a red flag to insurers. In contrast, a homeowner with extensive roof damage and thorough proof of repairs likely has a higher chance of getting a claim approved.

Generally, when you file an ice dam damage claim, your insurer will consider your claims history, the promptness of premium payments, and the length of time you have been with the insurance provider. Factors such as preventative measures taken to mitigate ice dam damage play an important role as well.

Even if you do all the right things, sometimes, an insurance claim gets denied or needlessly derailed. In such scenarios, it is best to know your legal options so you may get the coverage amount you need for your expenses.

What to Keep in Mind While Filing Ice Dam Insurance Claim

Before you file an ice dam insurance claim, you should ensure that you have taken good care of your home and done everything possible to prevent ice dams and associated hazards. With a major incident like an ice dam, it is important to consult with an experienced contractor or roofing professional who may remove the ice dam, document all changes (before and after removal), and get an insurance assessment done by the provider.

Here are some additional tips to consider while filing an insurance claim for ice dam damage:

- Keep your home’s gutters and downspouts clear of debris: Homeowners must ensure that all gutters and downspouts are free of snow and icicles, and other debris.

- Keep snow and ice off your roof: It is best to shovel or rake snow off the roof to reduce heavy snow loads and ice dam formation. You may seek professional help for clearing icicles as they might cause damage to spouts and roofs.

- Protect personal property from ice dam leaks: Since a roof leak can cause serious damage to your assets, you should store all valuable personal belongings carefully, such as inside a safe.

- Check your attic’s insulation and ventilation: You may want to defer to insulation and ventilation experts regarding good airflow, venting techniques, and proper insulation to avoid heat loss that can cause ice dams.

- Look for signs of inadequate ventilation: A well-ventilated attic is part of a healthy and functional home. The first sign of poor ventilation is uncomfortably hot rooms, which creates uneven temperatures and hinders fresh air.

- Inspect your chimney: Sometimes, ice forms around the base of the chimney, near the roof. You should patch any sealing issues to mitigate ice dam damage.

- Document all damages to your property: Written records and documentation like videos or photos go a long way in the claims process in damage assessment.

- Review your insurance policy thoroughly: Insurance policies contain inclusions, exclusions, conditions, and coverage limits. Your policy will indicate what events are covered. This is why it is important to review your insurance documents from cover to cover.

- File an ice dam insurance claim: If you still experience ice dam damage, it might be time to file an ice dam insurance claim to recover your losses. An insurance dispute attorney is well-positioned to help with denied coverage.

- Maintain all correspondence: Any communication involving the claim should be thoroughly documented as a reference point. This includes emails, summaries of in-person meetings, and phone call transcripts.

When Should I Call an Ice Dam Insurance Claim Attorney?

Sometimes, insurers drag out or deny valid property damage claims, and homeowners get stuck in the middle. Insurers may also offer unfair settlements to close the claim faster and retain corporate profits.

Unfortunately, you cannot put extensive repairs or bills on hold because an insurer is holding up the claims process or denying communication regarding your claim. When insurers fail to meet their obligations, an experienced insurance dispute lawyer can help negotiate on your behalf or take additional legal action if needed. An ice dam insurance claim attorney based in Wisconsin will be aware of local weather events, state policies, insurance companies, as well as the state justice system. They understand what tactics work and what don’t. With an insurance dispute law firm such as Wallace Law on your side, you can relax and allow them to take over the reins and fight bad faith insurance schemes on your behalf.

Ice Dam Insurance Claim: Contact Wallace Law for Help

Ice dams can impact more than one area in a home. They can cause issues with interior walls and ceilings, attic insulation, framing, and window casings. Many homeowners suffer losses amounting to thousands of dollars when insurance companies refuse to pay their legitimate claims.

Wallace Law is an insurance dispute law firm helping homeowners take on insurance companies when they fail to fulfill their contractual obligations. From denied to stalled and underpaid claims, our team is a respected, go-to resource for navigating tricky insurance disputes. Connect with us today, and we will review your case, no strings attached.