Wind-driven rain is a common issue many homeowners face, especially in areas with high winds and heavy rainfall, like the East Coast, Gulf Coast, and the Midwest. This type of rain is driven by strong winds and may enter your home through cracks and crevices present in your roof, walls, and windows. Wind-driven rain often leads to significant water damage, affecting various areas of your home, including the attic and basement.

Homeowners who expect their insurance company to cover wind-driven rain coverage damage are often left frustrated after learning that some insurers delay, deny, or underpay their claims.

In such situations, an experienced property insurance dispute lawyer can help you navigate the complexities of denied wind-driven rain coverage and get the compensation you need to repair or replace your damaged property. If you are facing problems with your wind-driven rain insurance claim, contact Wallace Law today for a free and confidential legal consultation.

Wind-driven rain often leads to significant water damage, affecting various areas of your home, including the attic and basement.

What is a Wind-Driven Rain Damage Claim?

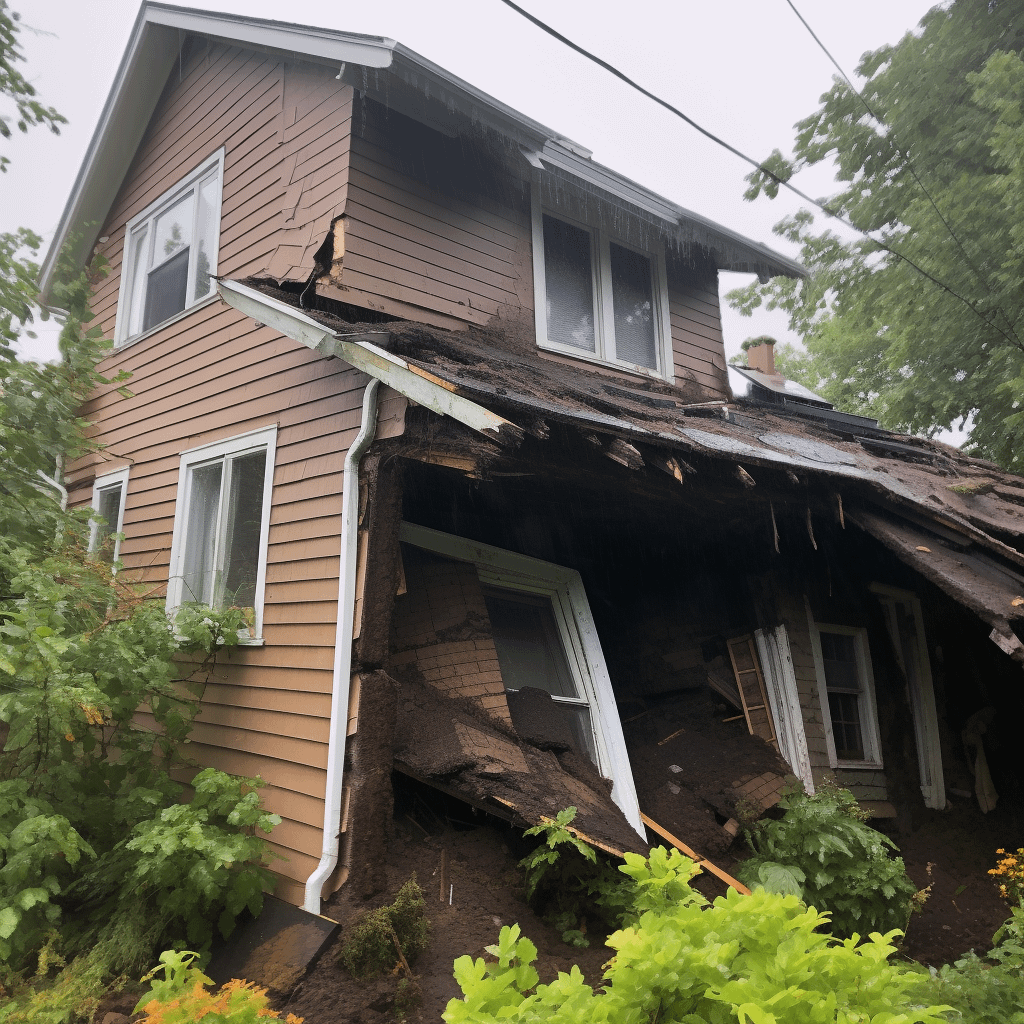

A wind-driven rain damage claim refers to the damage caused by rainwater that enters a property due to strong winds. Wind-driven rain can cause a significant amount of damage to a home, particularly to its exterior walls and roof.

Homeowners prefer to have coverage for wind-driven rain damage as it can lead to costly repairs and a lengthy restoration process. For example, in case of a severe windstorm, strong winds can push water into the smallest of openings in a roof or siding, causing it to penetrate through walls, ceilings, and floors, and resulting in mold damage and other structural issues.

Wind-Driven Rain: Common Issues Faced By Homeowners

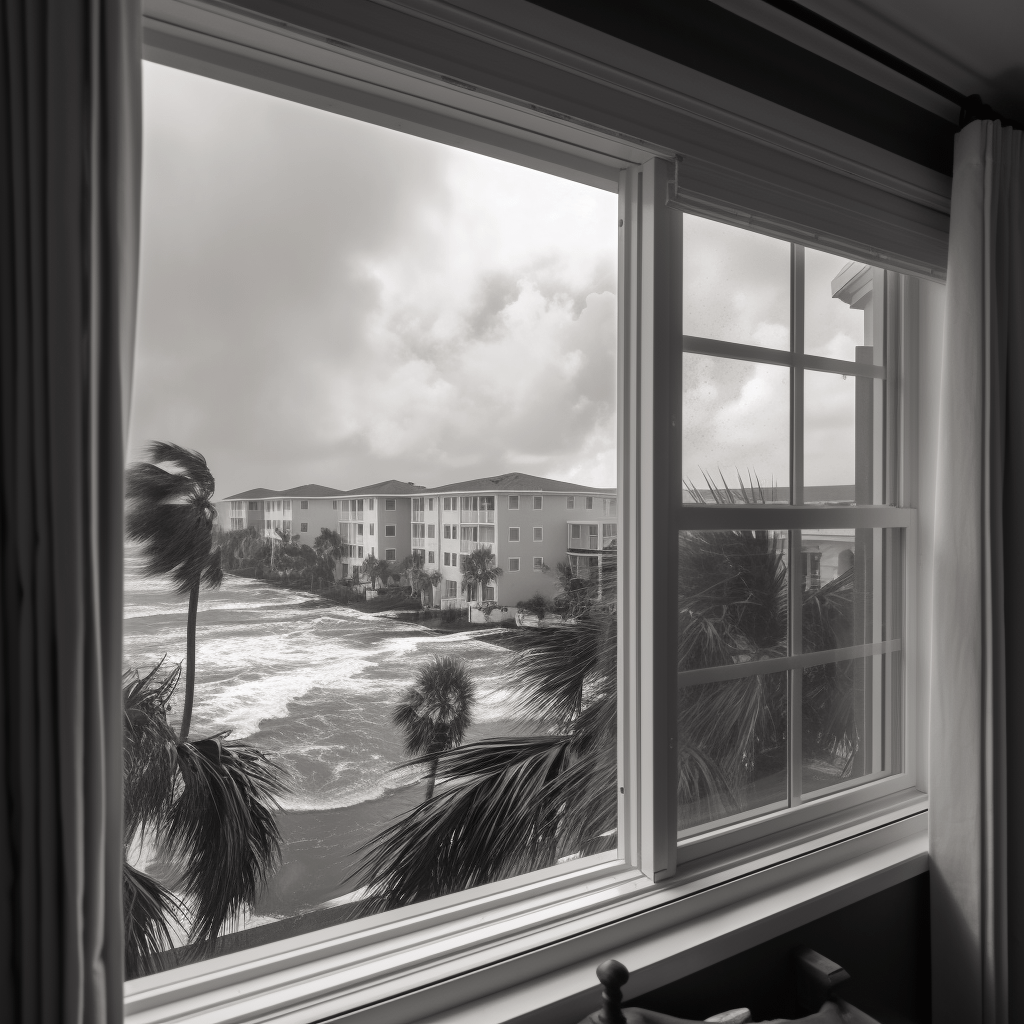

Wind-driven rain is common in areas that experience severe weather conditions, such as hurricanes, tornadoes, and strong thunderstorms. Some of the common wind-driven rain issues that homeowners face include:

- Wind-driven rain window leak: Rainwater can find its way through small openings or cracks in your windows and result in a window leak, causing damage to your window sills, walls, and floors.

- Wind-driven rain roof leak: Your roof is your first line of defense against wind-driven rain. A damaged or old roof may not prevent water from seeping through, causing water damage to your ceilings, walls, and attic.

- Wind-driven rain and chimney leaks: If your chimney lacks proper sealing, wind-driven rain may seep into the gaps, damaging your chimney as well as the surrounding areas.

- Wind-driven rain siding damage: High winds and driving rain can damage your home’s siding, resulting in water intrusion and damage to your walls, insulation, and electrical system.

- Wind-driven rain foundation issues: Wind-driven rain may cause a pool of water to surround your home’s foundation, leading to cracks and other foundation issues that may compromise your home’s structural integrity.

What Does Homeowners Insurance Cover?

Homeowners insurance policies generally provide protection for a variety of damages to home and property. Having a homeowners insurance policy is essential for managing the risks of homeownership, including natural disasters and accidents.

A standard homeowners insurance policy typically covers the cost of repairing or rebuilding the insured home in case of damage caused by fire, theft, vandalism, and other covered perils. Some of the common types of damages covered by standard homeowners insurance policy are:

- Damage caused by weather event: Homeowners insurance usually covers damage caused by weather events such as lightning, windstorms, water damage (from burst pipes or appliance failures), hailstorms, and mold. Standard homeowners insurance policies may not cover some types of water damages, like floods.

- Damage from external forces: Your homeowners insurance may provide coverage if your property sustains damage by an external force, such as a fallen tree or damage caused by a vehicle. Keep in mind that damage caused by poor maintenance or neglect is typically not covered.

Damage from fire, smoke, theft, or vandalism: Homeowners insurance may provide coverage for damage caused by fires, smoke, theft, or vandalism.

Does a Standard Homeowners Insurance Policy Cover Wind-Driven Rain?

The answer depends on your policy and how your insurance company interprets it. Generally, most insurance policies contain an exclusion for water damage unless caused by a windstorm. In other words, if your property suffers damage from wind-driven rain, you will likely have coverage under your homeowners insurance policy.

However, wind-driven rain coverage varies from policy to policy and insurer to insurer. Some policies may have more specific limitations on wind-driven rain coverage, such as requiring a specific wind velocity or only covering damage that occurred due to a named storm.

When filing a claim for wind-driven rain damage, your insurer may ask several questions to determine coverage, including:

- What caused the damage?

- Was the damage caused by wind-driven rain or flooding?

- Was the property adequately maintained?

- Was the damage foreseeable?

- Were any preventative measures taken?

Wind-Driven Rain Coverage: Limitations

Insurance policies are often written in complicated legal language, making it difficult to understand exactly what is covered. When it comes to filing a claim for wind-driven rain damage, your insurance company may deny the claim if they find that pre-existing issues caused the damage, such as a leaky roof.

Maintaining your property and addressing any necessary repairs before a storm hits is essential to ensure your coverage remains intact.

Wind-Driven Rain: FAQs

1.What is the difference between wind-driven rain and flood?

Homeowners should be aware that wind-driven rain and flood are two separate damage categories. Wind-driven rain refers to water that enters a property due to strong winds, often causing leaks and water damage to homes. Flood damage, on the other hand, is caused by a natural disaster and results in excessive water entering a property, usually due to rising water levels.

While wind-driven rain may be covered by homeowners insurance, flood damage typically requires separate flood insurance. However, homeowners insurance policies may exclude both wind-driven rain and flood damage, so you should review your policy and discuss any potential coverage gaps with your insurance provider.

2.What does a typical homeowners policy not cover?

While a standard homeowners insurance policy may cover a range of damages and losses, there are certain events and circumstances that are typically not covered.

Examples of what a standard homeowners policy may not cover include:

- Routine maintenance and repairs: Homeowners insurance protects against unexpected damage, not regular wear and tear. As such, routine maintenance and repairs are generally not covered by a standard policy.

- Intentional damage: If you intentionally damage your own property, you cannot request coverage under your homeowners insurance policy.

- Certain types of personal property: Homeowners insurance typically provides limited coverage for high-value items, such as jewelry, artwork, or electronics. If you have expensive items, you may need additional coverage.

3.Does homeowners insurance cover wind-driven rain roof leak?

In most cases, homeowners insurance covers wind-driven rain damage to your roof if caused by a covered peril, such as a windstorm.

However, coverage may be limited or excluded if the damage is due to wear and tear, lack of maintenance, or gradual deterioration. It is best to thoroughly review your policy to understand your homeowners insurance coverage and any limitations or exclusions.

4.Does hurricane insurance cover wind-driven rain damage?

While some policies may provide coverage for wind-driven rain damage, it ultimately depends on the specific terms of your policy. In general, hurricane insurance protects against damage caused by high winds and flooding, which often go hand-in-hand with hurricanes. Some policies may provide coverage for all types of damage caused by hurricanes, including wind-driven rain, while others may have limitations or exclusions.

5.What is the average cost of homeowners insurance?

Homeowners insurance cost varies depending on the location of the home, its age, construction type, and several other factors. According to the latest data, the average cost of homeowners insurance in Wisconsin is $1,084 per year, or $90 per month.

6.What type of water damage is covered by homeowners insurance?

Homeowners insurance policies typically cover sudden and accidental water damage. This may include:

- Damage from burst pipes

- Water damage from an appliance malfunction (such as a dishwasher or washing machine)

- Damage caused by a roof leak

- Damage caused by an overflowing toilet or bathtub

- Damage caused by a sudden, unexpected and non-repetitive leaking or overflowing of a plumbing or heating system

7.When should I file a homeowners insurance claim for wind-driven rain damage?

You should file a homeowners insurance claim as soon as you become aware of damage due to wind-driven rain. Some insurance companies have deadlines for filing claims, which may be as early as 30 days after the damage. It is best to take photos and extensively document all of your damage before contacting your insurer to ensure a smoother claims process.

Contact a Homeowners Insurance Dispute Attorney at Wallace Law

If your wind-driven rain damage insurance claim was denied or underpaid, it may be time to consult with a homeowners insurance dispute attorney. At Wallace Law, we specialize in insurance dispute resolution and helping homeowners navigate the complex legal process to pursue the compensation they deserve.

Contact us today for a free legal consultation.