On June 12, 1899, the worst tornado in Wisconsin history struck the city, leaving a path of destruction in St. Croix County. The New Richmond tornado claimed the lives of 117 people and destroyed over 300 buildings. Even to this day, tornadoes continue to cause significant damage in Wisconsin. Wisconsin’s latest tornado hit on July 28, 2021, causing widespread power outages and property damage.

Tornado damage in Wisconsin can be devastating, leaving families and communities to pick up the pieces and rebuild their lives. Such disasters can also be challenging for commercial property insurance policyholders. In many instances, insurance companies may try to deny rightful claims, thereby generating additional stress and financial burden for people who are dealing with the aftermath of tornado damage.

If you are an insurance policyholder who is looking for legal support and guidance after being denied compensation for your tornado damage, you need a local legal team who will stand by you and protect your interests.

Our experienced Wisconsin tornado insurance dispute lawyers at Wallace Law are adept at handling tornado damage insurers, no matter how uncompromising they may seem. We will use our knowledge and skills to fight your insurer so you have one less thing on your plate after a Wisconsin tornado.

Are There Tornadoes in Wisconsin?

Yes, there are tornadoes in Wisconsin. While it may not be as notorious as Tornado Alley, Wisconsin experiences its fair share of tornado activity. The state’s unique geography and weather patterns contribute to the occurrence of tornadoes. With its proximity to the Great Lakes and the inevitable nature of warm and cold air masses colliding, Wisconsin is no stranger to severe storms. Wisconsin storms pose a significant threat to communities and have the potential to cause extensive damage.

In 2005, Wisconsin experienced a record-breaking number of 62 tornadoes in a single year. This reveals how tornadoes can strike at any time and cause extensive destruction. Certain areas of the state, such as Dodge, Grant, and Dane counties, have historically seen more tornado events than others. While the frequency of tornadoes may be lower than those in traditional Tornado Alley states, like Kansas and Oklahoma, a Wisconsin storm can still wreak havoc and cause significant damage to people and property.

How Many Tornadoes Per Year Touch Down in Wisconsin?

On average, Wisconsin experiences between 30 to 60+ tornadoes per year, according to the National Weather Service. Not all tornadoes in Wisconsin touch down on the ground; some tornadoes remain aloft, causing wind damage. While such tornadoes may not directly impact the earth’s surface, they can still cause strong winds that can damage buildings, trees, and other structures as they pass overhead.

Wisconsin Geography

Wisconsin’s geography plays a unique role in the occurrence of tornadoes in the state. The location of Lake Michigan, one of Wisconsin’s Great Lakes, to the east of the state helps to block the development and intensity of tornadoes, reducing their frequency. The vast body of water acts as a natural barrier, influencing the weather patterns and limiting the conditions necessary for tornado formation.

However, not all areas of Wisconsin benefit from this protection. Lake Geneva, for example, does not mitigate tornadoes in the same way. As a result, it has a higher tornado index compared to the state as a whole. This highlights the variability within the state’s geography and demands that Wisconsin residents remain vigilant and prepared for severe weather.

In addition, Wisconsin’s diverse landscape contributes to tornado activity. The state features rolling hills, valleys, and forests, creating a complex topography that can enhance wind patterns and atmospheric conditions. These variations in terrain can influence storm development and increase the potential for tornado formation.

Why You Need a Wisconsin Tornado Damage Lawyer

After a devastating tornado, many homeowners file for wind and hail damage. As these claims can be complex, many insurers may try to lowball the insurance payout or deny the claim altogether.

As of 2020, the average homeowners insurance premium in Wisconsin was $762. According to the data from the Insurance Information Institute, 22.2% of homeowners in Wisconsin spend 30% or more of their earnings on monthly owner costs. Policyholders who pay such substantial sums for insurance coverage want to ensure that they are adequately covered for property damage arising out of natural disasters like tornadoes. Unfortunately, insurance companies don’t always have their best interests at heart. Many use bad faith insurance tactics to delay or deny tornado damage claims in order to save money.

At Wallace Law, our team of experienced tornado insurance dispute attorneys understand the challenges faced by the people of Wisconsin. We are committed to helping you navigate the insurance claims process and fight for the compensation you may deserve. When you retain Wallace Law as your legal advisor, you will have us by your side throughout the fight against insurers that have denied, delayed, or lowballed your tornado damage insurance claim.

The High Cost of Tornado Damage in Wisconsin

The costs of Wisconsin tornado damage can be astronomical. Devastating tornadoes have wreaked havoc on the state, causing not only loss of life but also significant financial burdens for individuals and communities. In July 1996, the Fond du Lac County tornado resulted in 12 deaths and $119,679,264.68 in total damage. Similarly, the Iowa County tornado in June 1984 caused $118,494,321.46 in damage (adjusting for inflation). These examples illustrate how the aftermath of a tornado can leave people facing a long and expensive road to recovery.

Here are some of the most common property damage claims filed after a Wisconsin tornado:

- Downed Trees: Wisconsin tornadoes often uproot trees or cause branches to fall, leading to extensive damage to houses, cars, and other structures. It then becomes a costly endeavor to clear fallen trees and repair the resulting damage.

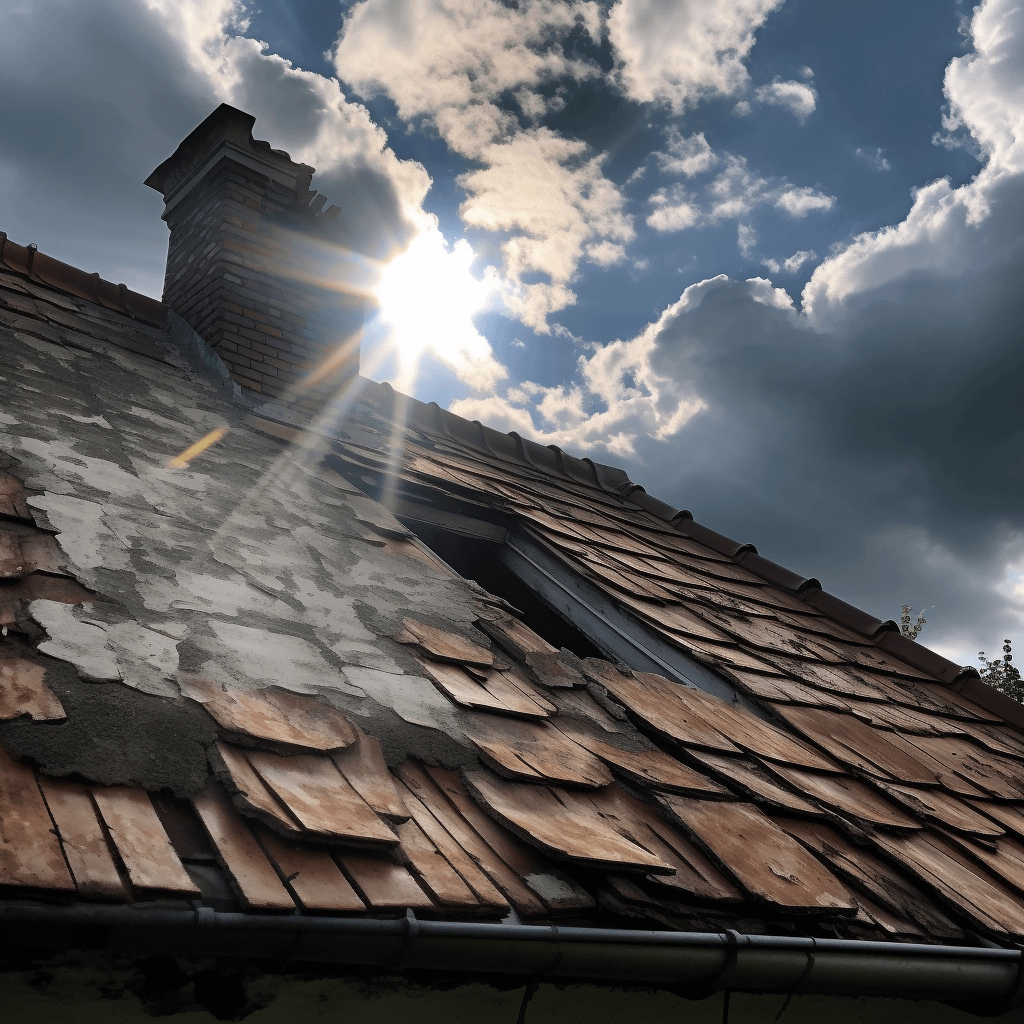

- Structural Damage: Tornadoes can rip roofs off houses, collapse walls, and weaken the structural integrity of buildings. Repairing or rebuilding damaged structures also warrants significant financial investment.

- Damaged Roofs: High winds and flying debris can cause severe damage to roofs, necessitating repair or replacement. The cost of fixing a damaged roof can quickly add up, making it a big financial burden for homeowners.

- Broken Windows and Doors: Tornadoes can shatter windows and doors, leaving homes vulnerable to further damage from the outside elements. It can be quite expensive to replace broken windows and doors, especially when there are custom-made or specialized materials involved.

- Faulty Electrical Systems and Possible Gas Leaks: Tornadoes can damage electrical systems, leading to power outages and potential fire hazards. Gas leaks can occur, posing a serious risk to residents.

- Damaging Plumbing and Flooding: Tornadoes can cause plumbing systems to fail, leading to flooding and water damage. Unfortunately, many homeowners’ insurance policies in Wisconsin have a 30-day waiting period before flood coverage becomes effective. This means that any damage caused by flooding within that time frame may not be covered, leaving homeowners to foot the bill for repairs.

How To Report Tornado Damage in Wisconsin and File a Claim

When dealing with the aftermath of tornado damage, knowing how to report Wisconsin storm damage and file a claim is crucial. Here are some steps you should consider following:

- Review Your Homeowners and Other Insurance Policies: Take the time to carefully review your insurance policy to determine if it covers tornado damage and other related issues. Familiarize yourself with the terms and conditions of your insurance contract so you know what to expect when filing an insurance claim.

- Collect Evidence: It is essential to document the damage properly for an insurance claim to be successful. Take photos and videos of the damage, both inside and outside of your property. Make a detailed list of all the damaged items and keep all receipts for repairs that need to be made. Do not dispose of any damaged items without waiting for the claim adjuster’s agreement.

- Hire a Wisconsin Tornado Insurance Claim Dispute Attorney: It may be challenging to navigate the insurance claims process, especially for denied or undervalued claims. Hiring an insurance claim dispute attorney who specializes in insurance damage claims dispute law is your best bet in making sure you get paid what you are due.

- Let Your Attorney Handle the Rest: Once you’ve hired an attorney, let them take over all communications with the insurance company. Your lawyer will know how to negotiate with your insurer. They should be able to thoroughly review and submit all paperwork, and fight for your rights in court, if it comes to a lawsuit.

- Rebuild Once Funds Have Been Secured: Once your insurance claim has been successfully settled, you can start the process of rebuilding. It’s important to keep in mind Wisconsin’s Storm Chaser Law, which protects homeowners from unscrupulous contractors. Your insurance dispute attorney can brief you on the law and help get the contract work started.

Will My Wisconsin Homeowner’s Policy Cover Tornado Damage?

Yes, the majority of homeowner’s insurance policies in Wisconsin should cover tornado and wind damage. However, you should understand the basic terms and conditions of your policy to be able to assess the extent of the coverage. There are two main types of coverage to consider: Actual Cash Value (ACV) and Replacement Cost Value (RCV).

ACV coverage takes into account the depreciated value of your property and possessions at the time of the tornado damage. This means you may receive less than the full cost of replacing or repairing your damaged items. On the other hand, RCV coverage provides reimbursement for the full cost of replacing or repairing your property and possessions, without factoring in depreciation. This type of coverage generally comes at a higher premium, but it ensures that you are fully compensated for your losses.

To ensure you are fairly compensated for tornado damage in Wisconsin, you may want to consult a tornado damage claims attorney who can review your policy, assess the damage, and advocate on your behalf with the insurance company. A qualified attorney will have the knowledge and expertise to deal with the nuances of the insurance claims process and help you obtain the maximum possible payout for your tornado damage claim.

What Is Covered By Wisconsin Homeowners Insurance and What Isn’t?

It is crucial to understand what is covered by your homeowner’s insurance policy when dealing with tornadoes in Wisconsin. Homeowners insurance typically consists of several different types of coverage, including dwelling and personal property coverage, personal liability coverage, and additional living expenses coverage.

Dwelling and personal property coverage protects the structure of your home and your personal belongings in the event of tornado damage. This can include damage to your roof, walls, and other parts of your house, as well as damage to your furniture, electronics, and other personal items. Certain types of damage, such as flood damage, may not be covered under standard homeowners insurance policies. However, these can be purchased separately.

Additional living expenses coverage can help cover the cost of temporary housing and other living expenses if your home becomes uninhabitable due to tornado damage. This can include hotel stays, restaurant meals, and commutes.

Standard homeowners insurance should cover damage caused by tornadoes, including structural damage, roof damage, and damage to personal belongings. However, certain factors may affect the extent of this coverage. For example, if a policyholder fails to maintain their property and neglects necessary repairs or improvements, the insurance company may deny coverage for any resulting damages. Additionally, flooding caused by a tornado may not be covered by a typical homeowners insurance policy, as it usually requires separate coverage.

Remember that negligence on the part of the insurance company can also affect your coverage. So, if an insurance company acts in bad faith by undervaluing or wrongfully denying a valid claim, then a policyholder may have grounds for legal action.

Why Was My Tornado Claim Denied?

Having your tornado claim denied can be incredibly frustrating and stressful, especially when you’re already dealing with the aftermath of a devastating tornado. While each denial may have its individual reasons, several common factors may lead to a denied claim:

- You took too long to report the damage: You should report tornado damage to your insurance company as soon as possible. Waiting too long can raise suspicion and lead to a claims denial.

- There wasn’t enough documentation of the damage or condition of the building before the tornado: Insurance companies often require detailed documentation to support your claim. If you do not have sufficient evidence to show the pre-existing condition of your property or the extent of the tornado damage, your claim may be denied or undervalued.

- There is suspected policyholder fraud: Insurance companies are vigilant when it comes to detecting potential fraud. If they suspect any fraudulent activity or false information in your claim, it can result in a denial.

- You did not pay your premiums, and/or the policy did not cover the specific damage: It is important to make sure all insurance premiums are paid on time. If you haven’t paid your premiums or your policy does not cover the specific damages caused by the tornado, then your claim may be denied.

- Bad faith insurance practices: In some cases, insurance companies may act in bad faith by denying valid claims without proper justification. This can be in the form of wrongful denial, delay tactics, or undervaluing of damages. If you suspect bad faith practices, then you should seek legal assistance to protect your rights.

For Tornado Damage in Wisconsin, We Can Help

We understand the pain points of people dealing with the aftermath of a tornado in Wisconsin. At Wallace Law, we’re here to help. Our experienced tornado damage lawyers will advocate for your rights and work hard to help you receive the compensation you deserve.

Contact us today to learn more about how we can assist you in recovering from tornado damage in Wisconsin.