Experiencing a house fire is one of the most frightening and devastating events that someone can go through. However, many homeowners and tenants are unsure of what to do after a house fire. Making the right decisions can save you time, money, and stress.

What to Do if Your House Is on Fire

House fires are serious emergencies that require calm, focused, and quick action. If your house is on fire, do the following right away:

- Call 911 and let them know your name, your address, and the identities of anyone inside the house

- Drop to the floor to avoid toxic smoke and try to reach any persons or pets you can, being mindful that fires spread quickly and you may need emergency assistance to rescue others

- Before opening any doors, feel the doorknob and look for smoke to determine if a fire is behind the door

- If you are unable to escape the house, close the door to the room you are in and cover cracks, vents, and other openings to keep smoke out

- Use the stop, drop, and roll technique to extinguish any flames that get onto your clothing

- Once you and your loved ones and pets have escaped the fire, get medical attention right away, regardless of whether you believe there were any injuries (not everyone recognizes the signs of smoke inhalation right away)

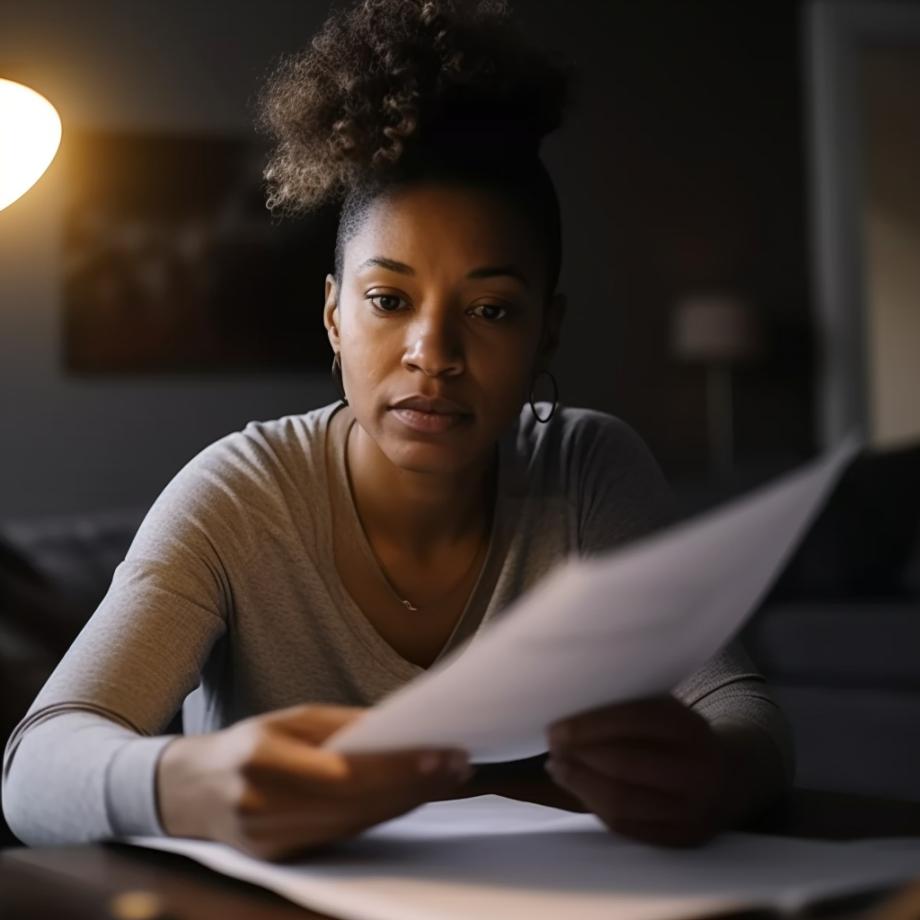

Once the fire is contained and medical services rendered, you should immediately contact your insurance company. Unfortunately, this is not always a straightforward process, as successfully pursuing a house fire insurance claim can be met with delays, resistance, and unreasonably low payouts from your insurer. The company may even attempt to deny your claim.

If you need help starting a claim, you are having problems with your insurer, or you have had your house fire insurance claim denied, it’s time to speak with legal counsel.

What to Do After a House Fire

What you do in the aftermath of the fire is critically important both to your insurance claim and to preserving the value of your property. You can take the following steps:

- Contact an insurance agent: Provide your name, address, and policy number, and ask what steps to take next. Be sure to also read your policy closely to understand all deadlines and requirements.

- Mitigate further damage: The firefighters likely had to cut holes in your roof and break windows to extinguish the fire. You should take action to prevent further damage, for instance by covering holes with tarps and boarding up windows.

- Secure temporary housing: You will need someplace safe to stay, and it likely won’t be in your house due to structural damage and other problems. Find a place to stay and board your pets if necessary.

- Keep an eye on your property: Unfortunately, people will take advantage of house fire victims by breaking into their homes and looting or squatting. Have a neighbor watch over your property, drive by often to check on it, and report suspicious activity to police.

- Do not enter the property if it’s unsafe: The fire department will know whether the property is safe to enter. Utilities like gas and water may have to be cut off, and if so, do not turn them back on until repairs are completed.

- Take pictures, record videos, and make an inventory: You should take pictures and record videos right away to document the damage. Also, make a detailed inventory of items destroyed, damaged, and lost.

- Recover salvageable items: If you are able to recover clothing, personal effects, and other valuables, and it’s safe to enter the property, do so. However, you may have to clean or repair items due to smoke or fire damage.

- Replace valuable documents and items: Replace sensitive documents like birth certificates and financial records, along with valuables like jewelry. Work through this step with your insurance company.

- Contact your bank and mortgage company, or landlord: Let your bank know if you have lost credit or debit cards and how to have those replaced. Your mortgage company may offer payment assistance due to the disaster. If you rent, notify your landlord immediately.

- Keep records and receipts: In the days moving forward, you will likely spend money on items to protect your home, on hotel stays, and more. Keep records and receipts for both insurance and tax purposes.

- Let professionals clean up: House fires often leave hazardous substances behind in the ashes. These can poison you and your family, so let a professional debris removal and restoration company help.

- Do not consume or use anything unsafe: There are many items left after a house fire that are contaminated or damaged beyond repair. Throw away any unsafe food and, at least temporarily, set aside damaged items (they will later need to be thrown out) and document what was lost.

- Inspect and report potential damage to utilities: It’s a good idea to have an electrician inspect the wiring in your home to make sure it is safe to use electricity. (The same is true for water and septic systems.) If in doubt, don’t use these utilities and notify the appropriate officials.

Contact Your Insurance Agent

Before you contact your insurance agent, be sure you read over and understand your policy. When you call your insurer:

- Let the agent know you have read your policy

- Ask questions about anything in the policy that is unclear or confusing

- Offer to provide documentation, receipts, pictures, and videos concerning your loss and expenses

- Ask how to file a claim, both for the house itself and personal property inside

Although you may have questions, your agent must know that you have read and understood your homeowner’s insurance policy as it pertains to fire coverage.

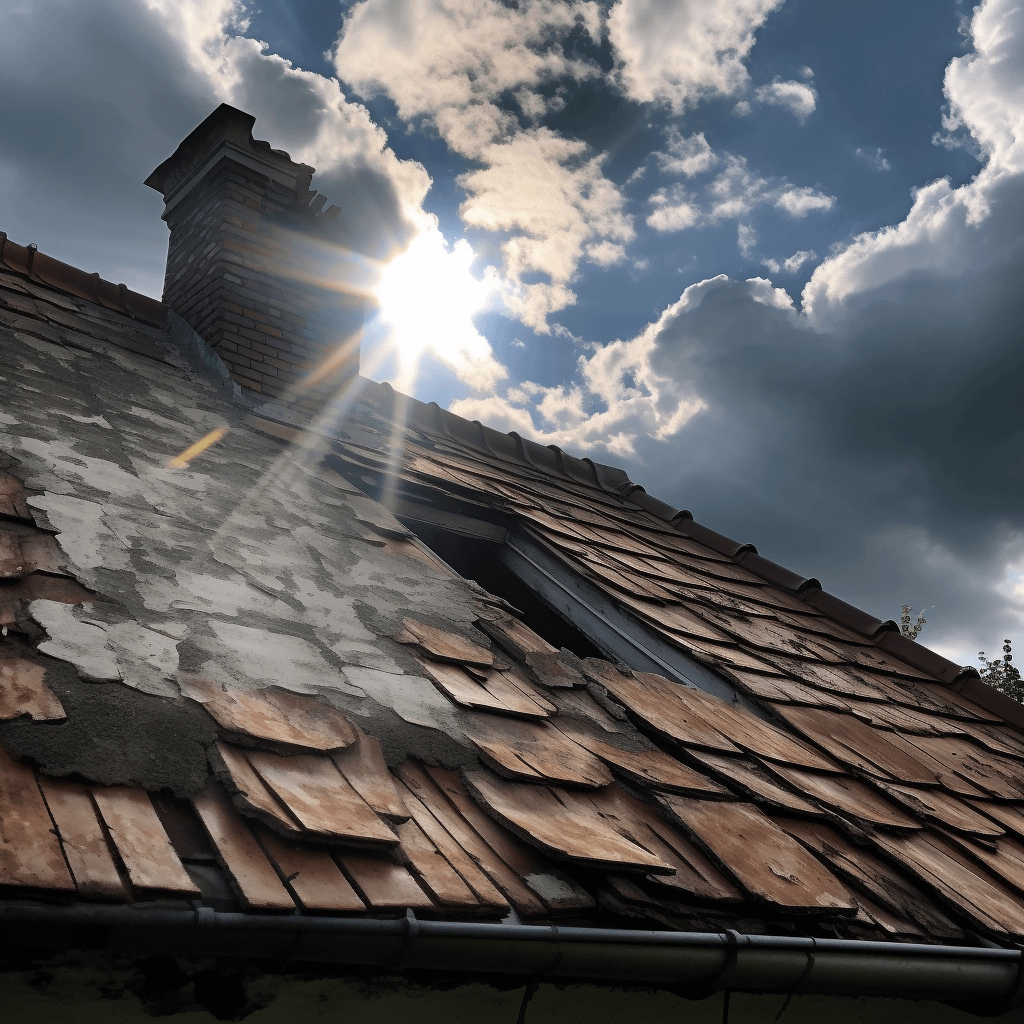

Check for Structural Damage

Before you enter your property, and assuming you have been given the all-clear by the fire department or other officials, do a visual inspection of the outside and look for anything that appears unsafe or questionable (e.g., broken or damaged gas lines, downed power lines, and foundation damage). Ask a building inspector or contractor to take a look inside and outside the property.

At some point, you will be able to enter the home, but there may still be danger. If a door is jammed, do not force it open, as it may be providing support. Note any missing or damaged structural components, like walls and support beams, and do not attempt to move anything that could be supporting the structure of your house.

You should continue to take pictures and document damage, especially since you may notice additional problems that you did not see before. Fortunately, an experienced lawyer can help you cover financial losses with a claim for fire damage.

How to Get the Smoke Smell Out of the House After a Fire

The smell of smoke could persist in your home and make the residence unpleasant to live in. Smoke odor can cling to just about any surface in your home, so removing the smell will require time and patience. These approaches will help as you work to rid the odor:

- Wear a mask and gloves to protect yourself as you clean up.

- Remove damaged or destroyed items immediately.

- Open doors and windows to provide proper ventilation and let the house air out.

- Use specialized cleaning substances and equipment.

- Blow out the air in each room by using a high-speed fan and closing all but one opening (e.g., a door or window) to force out soot and odor.

- Clean all solid surfaces using a mixture of dish soap, white vinegar, and warm water.

- Thoroughly wash and clean all clothing and furniture.

- Don’t forget to clean your carpet and wash doors and walls.

- Have an HVAC specialist inspect and clean your system, and replace all air filters.

How to File a Claim with Your House Fire Insurance Agency

Wisconsin insurance laws affect house fire claims and the amount of your potential claim payout. Insurers must follow all applicable laws and regulations by avoiding bad faith and unethical practices such as:

- Making unreasonable demands upon the policyholder

- Demanding unnecessary documents, asking unnecessary questions, and requiring the homeowner to complete excessive paperwork

- Being unresponsive to policyholder requests

- Unreasonably delaying communications with the policyholder

- Making partial payments or unreasonably low settlement offers to try to close the claim prematurely

- Trying to rescind coverage or cancel the policy abruptly

- Conducting poor investigations, ignoring evidence, or trying to pressure the homeowner into making unwise decisions

You do not have to tolerate these and other unfair insurance tactics. If you have questions about your insurer’s behavior or the settlement amount that is offered to you, let an attorney help you navigate the insurance claims process.

How to Prove Your Losses in a House Fire Claim

It will be up to you, the homeowner, to prove what you have lost in your house fire and how much it was worth. We advise that you collect the following:

- Invoices, receipts, and bank and credit card statements to prove you purchased items and at what price

- Warranties and other records from the manufacturers of larger, more expensive items (including vehicles)

- A home inventory list, if you made one before or after the fire

- Any photos or videos of your property that were taken before the fire

How Do Insurance Companies Pay Out Claims for a Fire?

Knowing how insurers pay out on insurance claims can help you better prepare for the process. After your claim is filed, the insurer will need to validate the submission by making sure your policy is active and will pay for the damage. The insurance company will review any supporting documentation, such as photos and receipts, that you submit.

The company will also conduct its own investigation as it determines whether to approve or reject your claim and how much it is worth.

Common Reasons Why Insurance Claims Are Denied for House Fires

There are various reasons why insurance companies deny fire claims, not all of which are legitimate. If the policy has lapsed or it is determined that the policyholder made material misrepresentations in obtaining coverage, the insurer will deny the claim. Waiting too long to report the incident or the discovery of pre-existing damage to the home may also cause problems.

The insurer may also deny the claim if the fire was set intentionally or was the result of the homeowner’s neglect, like failing to repair faulty wiring. But there are also more questionable reasons that insurance companies deny claims. The insurer may assert that you have provided insufficient documentation of the damage or evidence about the value of the property that was lost, or the insurance company might engage in bad faith tactics like those listed above.

If you believe your house fire insurance claim was unfairly denied, speak to a lawyer.

Can You Sue Your Insurance Company for Denying Your Fire Claim?

Yes, you can sue the insurance company for improperly denying your fire claim. Just because the insurer denied the claim does not mean that is the last word. Talk to an experienced insurance dispute attorney for assistance.

What to Do When Your House Fire Insurance Claim Is Denied

A lawyer can help you appeal a claim denial by working with you to:

- Read and understand the terms of your insurance policy

- Carefully reviewing the insurance denial letter and identifying legal or factual errors in it

- Communicating with the insurance company for clarification and more information

- Collecting additional documentation and evidence that will support your claim

- Negotiating with the insurance company for a reversal of the claim denial and a higher payout

- Filing a lawsuit and taking your insurance company to court if necessary

A Lawyer Can Walk You Through the House Fire Insurance Claim Process

The last thing that any homeowner wants to deal with after a house fire is an uncooperative insurance company that engages in bad faith and dishonest tactics. Fortunately, you do not have to walk this path by yourself. For questions about your coverage and to make sure you receive a fair and reasonable payout, talk to a knowledgeable lawyer right away.