Insurance claims are supposed to follow a predictable path. A loss occurs. The policyholder reports it. The insurance company investigates and either pays the claim or explains, clearly and promptly, why coverage does not apply. When that process breaks down because the insurer acts unreasonably or unfairly, the issue may rise to the level of bad faith.

A bad faith insurance claim is not simply about a denied claim. It focuses on how an insurance company handled the claim and whether it honored its legal duties to the policyholder. In first-party insurance cases, where a person or business seeks benefits under their own policy, those duties are especially important because the insurer controls the process from start to finish.

What Does Bad Faith Mean in Insurance Law?

Bad faith refers to conduct by an insurance company that violates its obligation to act fairly, honestly, and reasonably when handling a valid claim. Insurers are expected to investigate claims promptly, evaluate them objectively, and communicate accurately with their policyholders.

Bad faith may arise when an insurer places its own financial interests ahead of its contractual obligations. This can occur during the investigation, during coverage evaluation, or during payment decisions. Courts and statutes focus on the insurer’s conduct over time, not just the final decision on coverage.

A legitimate coverage dispute does not automatically amount to bad faith. The issue is whether the insurance company’s behavior was reasonable under the circumstances.

What Is a Bad Faith Insurance Claim Against an Insurance Company?

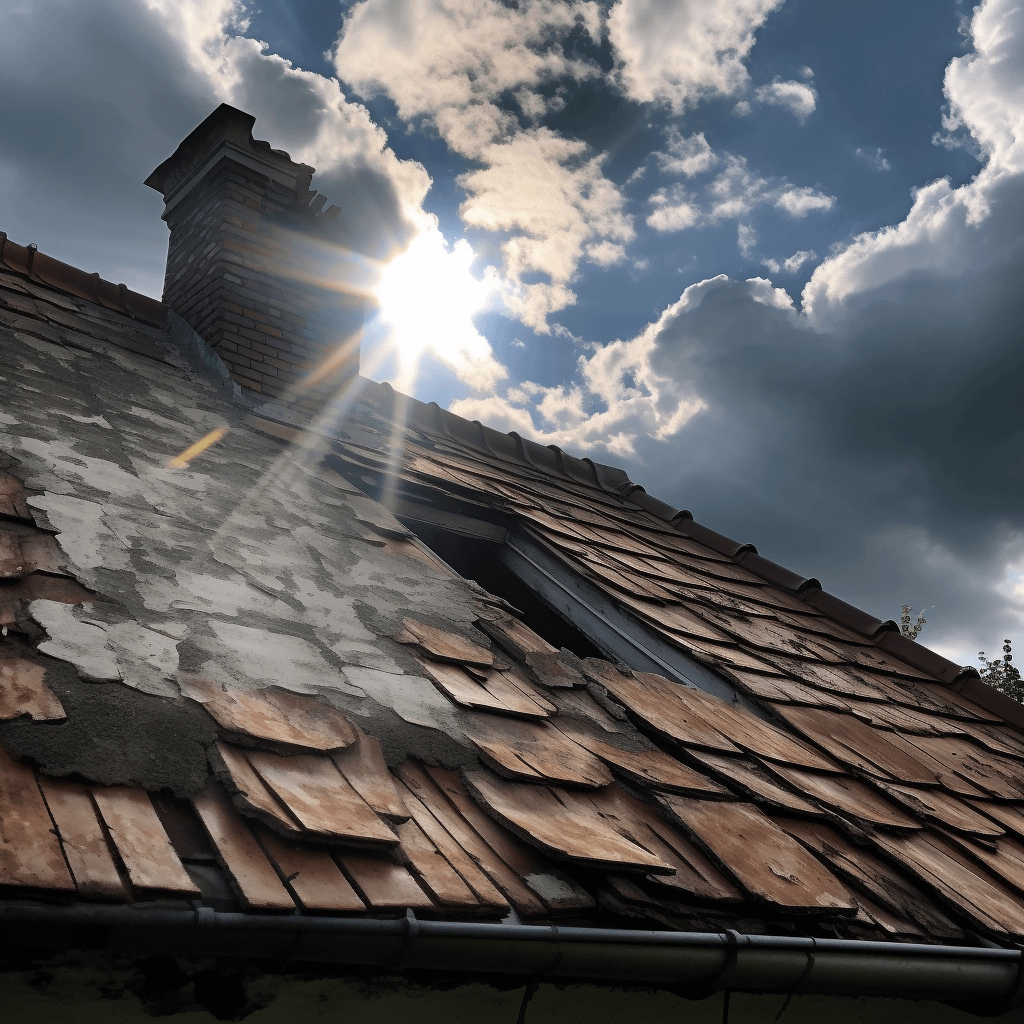

First-party insurance bad faith involves claims made directly by a policyholder against their own insurance company. These cases commonly arise in situations involving homeowners insurance, commercial property insurance, health insurance, disability insurance, or other policies where the insurer owes benefits directly to the insured.

In other words, policyholders can sue their own insurance companies if those companies violate their obligations.

First-party insurance bad faith is a priority area because policyholders often depend on timely claim payments to repair property, pay medical bills, or maintain business operations. Delays or improper denials can cause financial harm that extends well beyond the original loss.

Common Ways Insurance Companies Act in Bad Faith

Bad faith insurance claims often involve patterns of conduct rather than a single event.

Examples commonly cited in first-party cases include:

- Delaying claim investigations or payments without a valid reason

- Denying claims without conducting a thorough or fair investigation

- Misrepresenting policy provisions or selectively interpreting exclusions

- Ignoring evidence that supports coverage

- Making unreasonably low settlement offers without explanation

- Repeatedly requesting information that is unnecessary or already provided

These actions may occur gradually. A policyholder may initially believe the insurance company is simply being slow or disorganized, only to realize later that the delays or shifting explanations are part of a larger problem.

What Does Not Qualify as Bad Faith

Insurance companies are permitted to investigate claims, verify losses, and request reasonable documentation. They are also allowed to deny claims when coverage genuinely does not apply under the policy.

Bad faith generally requires more than a disagreement over how policy language should be interpreted. It focuses on whether the insurance company’s conduct fell outside reasonable claims handling practices. Understanding where that line is drawn helps distinguish a legitimate coverage dispute from conduct that may violate the law.

Examples of situations that typically do not, by themselves, amount to bad faith include:

- A denial based on a policy exclusion that is clearly stated and reasonably applied

- A delay caused by the need to obtain records, inspections, or expert evaluations relevant to the claim

- A good-faith dispute over the value or scope of a loss when supported by evidence

- An insurer requesting additional documentation that is reasonably related to the claim

- A coverage decision that is unfavorable but explained clearly and supported by the policy language

These situations can still be frustrating for policyholders, but they do not automatically indicate bad faith. During your consultation with Wallace Law, we can review your situation and offer guidance about your options.

How State Law Affects Bad Faith Insurance Claims

Bad faith insurance claims are governed by state law, and the standards vary by jurisdiction. Some states recognize it as a separate cause of action, while others limit remedies or define insurer duties through statutes rather than common law.

For policyholders in Wisconsin, Illinois, and Michigan, state law plays a significant role in determining how bad faith claims are evaluated. Differences may exist in the proof required, the types of damages available, and the procedural steps that must be followed before a claim can proceed.

Because of these variations, the same insurer conduct may lead to different outcomes depending on where the policyholder is located and which law applies.

What Damages Are Available in a Bad Faith Insurance Claim?

The damages available may extend beyond the benefits owed under the insurance policy. The purpose of these remedies is to address harm caused by the insurance company’s improper conduct.

Depending on the jurisdiction and facts, damages may include compensation for financial losses caused by delayed or denied benefits, interest on unpaid amounts, or other losses linked to the insurer’s handling of the claim. In certain cases, additional remedies may be available under state law.

These outcomes depend on the specific legal framework governing the claim and the evidence of insurer misconduct.

How to File a Bad Faith Insurance Claim

The process of filing a claim typically goes like this:

1. We Complete and Lock Down the Insurance Claim Record

Before filing a bad faith claim, we make sure the underlying insurance claim process is complete. That usually means the insurer has issued a denial, underpaid the claim, or delayed resolution long enough that its position is clear. We gather the full claim file, including correspondence, adjuster reports, internal appeal decisions, and any explanations the insurer provided.

This step matters because bad faith claims are based on what the insurer did during the claims process. The record created at this stage often becomes the foundation of the case.

2. We Determine Whether State Law Allows a Bad Faith Claim

Next, we analyze the applicable state law to confirm whether a bad faith claim can be filed and what legal standards apply. Some states recognize bad faith as a standalone cause of action. Others require specific prerequisites, such as written notice to the insurer or exhaustion of policy remedies, before a claim can proceed.

If the law requires advance notice or a waiting period, we prepare and send the required notice before filing suit.

3. We File a Lawsuit Alleging Bad Faith

A bad faith insurance claim is typically filed by bringing a lawsuit against the insurance company in the appropriate court. The lawsuit alleges that the insurer violated its duty to act in good faith and fair dealing by the way it investigated, evaluated, delayed, or denied the claim.

This filing is separate from the original insurance claim. It is not an appeal to the insurer. It is a legal action that asks the court to evaluate the insurer’s conduct.

4. We Litigate the Bad Faith Claim

Once the lawsuit is filed, we use the litigation process to obtain evidence of how the insurer handled the claim. This may include internal claim notes, guidelines, training materials, and communications that were not previously disclosed. This discovery phase is often where patterns of unreasonable conduct become clear.

5. We Pursue Available Remedies Under the Law

If we prove bad faith, we pursue the remedies allowed under state law. Depending on the jurisdiction and the facts, this may include damages beyond the policy benefits that were originally owed. The goal is to hold the insurer accountable for improper claim handling, not just to revisit the coverage decision.

If you believe your insurance company has acted unscrupulously or in violation of the law, then it’s time to call an attorney; these are complex cases, and your claim can be denied if you make a mistake. Wallace Law may be able to help.

When to Call a Bad Faith Insurance Claim Lawyer at Wallace Law

Questions about bad faith often arise after a claim has stalled or been denied without a clear explanation. Legal guidance may be appropriate when an insurer’s conduct goes beyond a routine coverage dispute and begins to reflect unreasonable claim handling. This can include prolonged delays, shifting explanations, or denials that do not appear to align with the policy language or the facts of the loss.

It may be time to speak with a bad faith insurance lawyer from Wallace Law if you are experiencing:

- Repeated or unexplained delays in investigating or paying a claim

- Denials issued without a thorough or fair investigation

- Inconsistent explanations for coverage decisions over time

- Communications that misstate, oversimplify, or selectively apply policy provisions

- Requests for information that appear unnecessary, duplicative, or designed to delay resolution

- Settlement offers that do not align with the scope or value of the loss and lack a clear explanation

- Situations where evidence supporting coverage is ignored or discounted without justification

- Claims handling that appears driven by internal guidelines rather than the policy language

Wallace Insurance Law represents policyholders in first-party insurance disputes. The firm focuses on evaluating how a claim was handled from start to finish, with close attention to the insurer’s investigation, communications, and coverage determinations. This work includes analyzing insurance policy language, reviewing claim files, and assessing whether the insurer complied with its legal obligations.

By concentrating on first-party insurance bad faith, Wallace Law helps policyholders understand whether an insurer’s conduct may warrant further legal action and what steps make sense based on the specific circumstances of the claim.

Holding Insurance Companies Accountable for Bad Faith

Bad faith insurance claims exist to enforce accountability. They protect policyholders from unfair practices and help ensure that insurance companies honor the obligations they assume when issuing policies.

If you have questions about how your insurance claim was handled, Wallace Insurance Law can review your situation and explain your options. Contact the firm today for a free consultation.