Category: Bad Faith Insurance Dispute

Get Help Now

Recent Blog Post

Is Wind Damage to A Fence Covered By Insurance?

Strong winds can cause more damage than many property owners expect. Fences are especially vulnerable to wind-related damage, whether from straight-line winds, severe storms, or gusts associated with larger weather events. When a fence is damaged or knocked down, one of the first questions property owners ask is whether insurance will cover the cost of […]

December 24, 2025

You purchase home insurance to protect yourself and your home. However, insurance companies primarily sell insurance to make money, so it is not surprising that most insurance policies have a laundry list of exclusions.

Typically, renters insurance may cover a number of expenses and losses stemming from sudden, accidental damage, provided that negligence was not the cause. Renters insurance is more likely to cover a sudden and unanticipated event that occurs in your dwelling like a burst water pipe (provided you were not somehow negligent). Generally, renters insurance will not cover water damage caused by a flood.

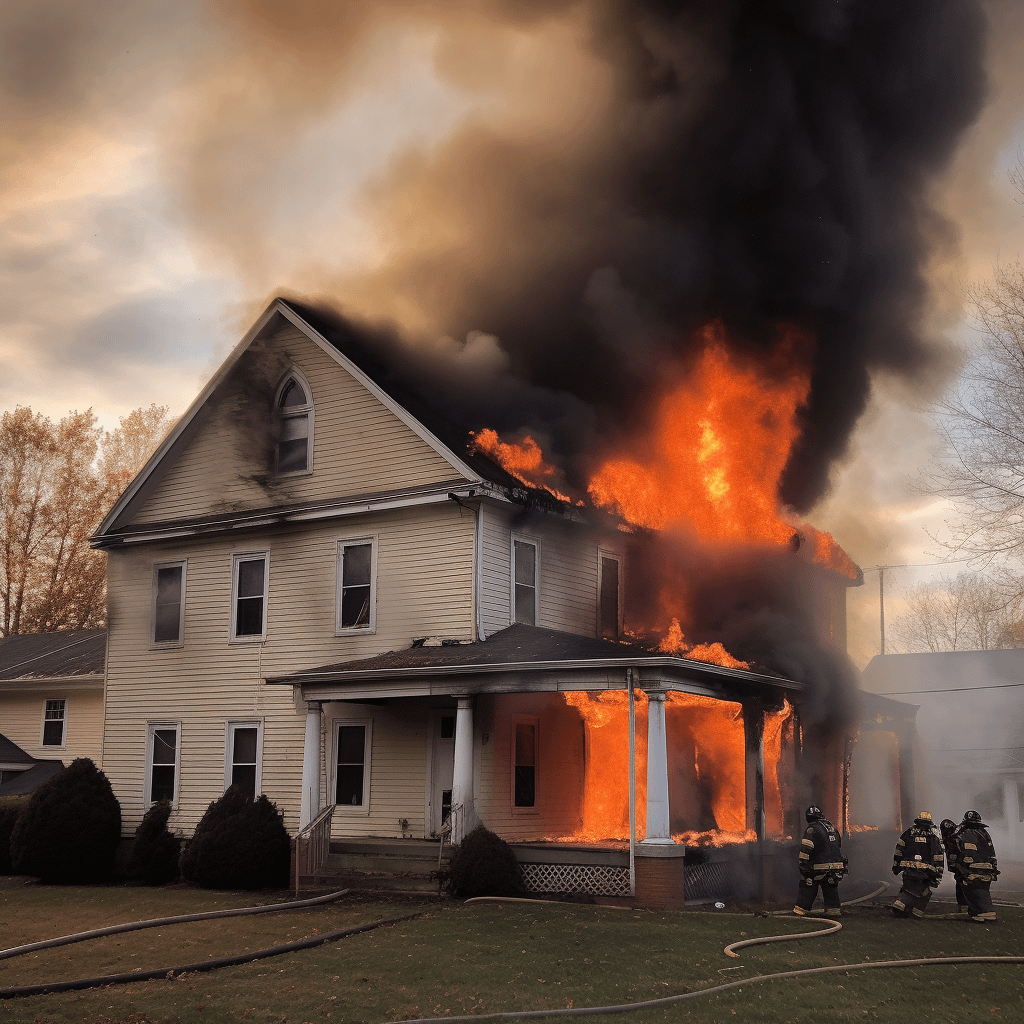

Fire insurance is crucial for protecting your home and belongings from devastating losses. However, having your fire claim denied can be distressing and add frustration to an already difficult situation. Understanding the common reasons why insurance companies deny fire claims can help you navigate the process and protect your rights. If you are facing a […]

No one likes to be lied to, especially by a professional who is responsible for determining whether your insurance claim is valid. If you have been injured in an accident and have a sizable claim, you may find the tactics used by an insurance adjuster to be accusatory, shrewd, and downright dishonest.

You can navigate the challenges of dealing with an insurance company by understanding your policy and gathering compelling evidence to support an appeal. For more insights into handling insurance disputes, visit the Wallace Law guide on Wisconsin insurance disputes.

Learning how to file a bad-faith insurance claim can help ensure that you are not taken advantage of by your insurance company during a difficult time. With Wallace Law, you are not alone in the fight.

Insurance is crucial for protecting a person’s assets. When the unthinkable happens and you need that insurance to cover the repair, replacement, or expenses associated with a loss, a denial of your claim can place you in an incredibly stressful position. Insurance companies may deny claims, but there are still steps you can take to […]

If you are tired of trying different courses of action to fight insurance companies that purposely avoid paying claims, come to Wallace Law for help.

When insurance companies act in bad faith, you could have legal recourse to set things right again. Read how Wallace Law fights insurance companies here.

Our insurance dispute attorneys see bad faith insurance cases often, and know how to fight bad faith insurers.

Insurance companies reject life, property, travel, and health insurance claims every day. Wallace Law can help.