When you file a health insurance claim, you expect your insurer to pay for your medical care. However, insurance companies deny claims more often than people think, and those denials are not always for legitimate reasons.

When choosing a health insurance provider, it is important to take its denial rates into consideration. Understanding health insurance denial rates by company can help you make an informed choice.

No matter what insurance provider you get your coverage through, there is always a chance that you will have to contend with denial. Familiarizing yourself with health insurance denial rates by company is part of the picture, but so is understanding how to push back against unjust claim denials.

How Health Insurance Denial Rates Differ by Plan Type

While healthcare providers are seeing an increase in claim denials across the board, denial rates vary considerably between private and public payers.

Private Payers

Private payers are insurers who fund their own plans, either privately through the health insurance marketplace or collaboratively through employer-sponsored health plans. Some of the country’s largest private payers include:

- Aetna

- Cigna

- Elevance Health

- Humana

- UnitedHealth Group

Public Payers

Public payers, on the other hand, fund their plans through the federal government. Here are some of the most common public payers:

- Medicaid

- Medicare

- Veterans Administration (VA)

- Children’s Health Insurance Program (CHIP)

One might think claim denial rates would be fairly similar across private and public payers. However, a 2023 analysis found that private payers denied claims at nearly twice the rate of public payers. The analysis polled consumers and found the following denial rates:

- Employer-Sponsored Health Plans: 21%

- Marketplace Health Plans: 20%

- Medicare: 10%

- Medicaid: 12%

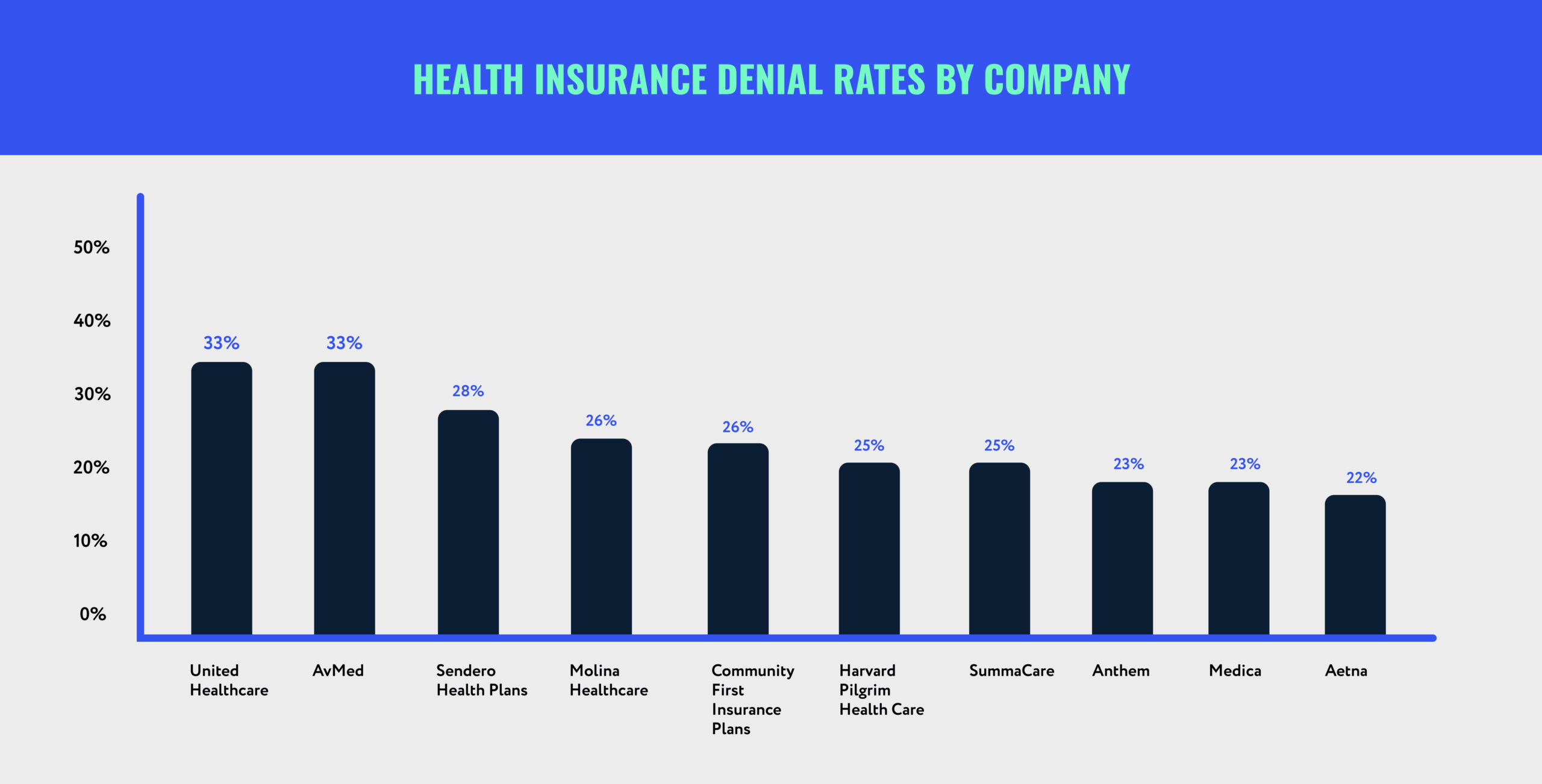

Denial Rates by Company

Another analysis, this time polling healthcare providers instead of patients, found that for private-payer-operated Medicare and Medicaid plans, the initial claim denial rate was similar to the rate for claims submitted to private payers. Specifically:

- Nearly 15% of private payer claims were initially denied.

- 8.4% of Medicare claims were initially denied.

- 16.7% of Medicaid claims were initially denied.

- 15.7% of Medicare Advantage (Medicare plans run by private payers) claims were initially denied.

- 15.1% of Managed Medicaid (Medicaid plans run by private payers) claims were initially denied.

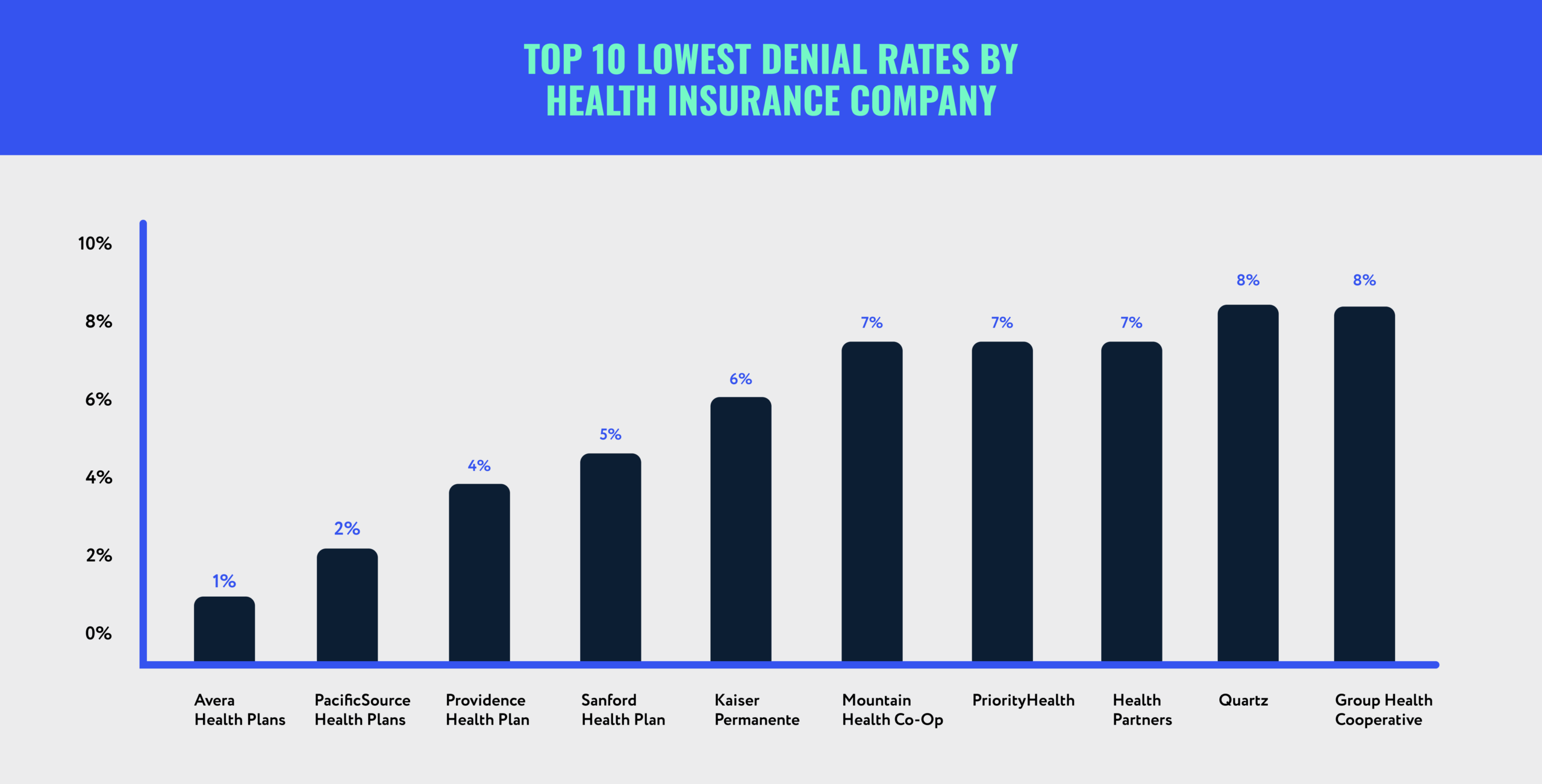

Insurance companies generally do not make data on denied claims available to the public. However, an analysis based on federal health insurance marketplace data found the following health insurance denial rates by company:

- UnitedHealthcare: 33%

- AvMed: 33%

- Sendero Health Plans: 28%

- Molina Healthcare: 26%

- Community First Insurance Plans: 26%

- Harvard Pilgrim Health Care: 25%

- SummaCare: 25%

- Anthem: 23%

- Medica: 23%

- Aetna: 22%

- Cigna: 21%

- CareSource: 21%

- BlueCross BlueShield: 20%

- Oscar Health: 17%

- Ambetter: 14%

- Group Health Cooperative: 8%

- Quartz: 8%

- HealthPartners: 7%

- PriorityHealth: 7%

- Mountain Health Co-Op: 7%

- Kaiser Permanente: 6%

- Sanford Health Plan: 5%

- Providence Health Plan: 4%

- PacificSource Health Plans: 2%

- Avera Health Plans: 1%

Seeing health insurance denial rates by company can be illuminating. However, it is important to note that rates vary not just by company but also by state.

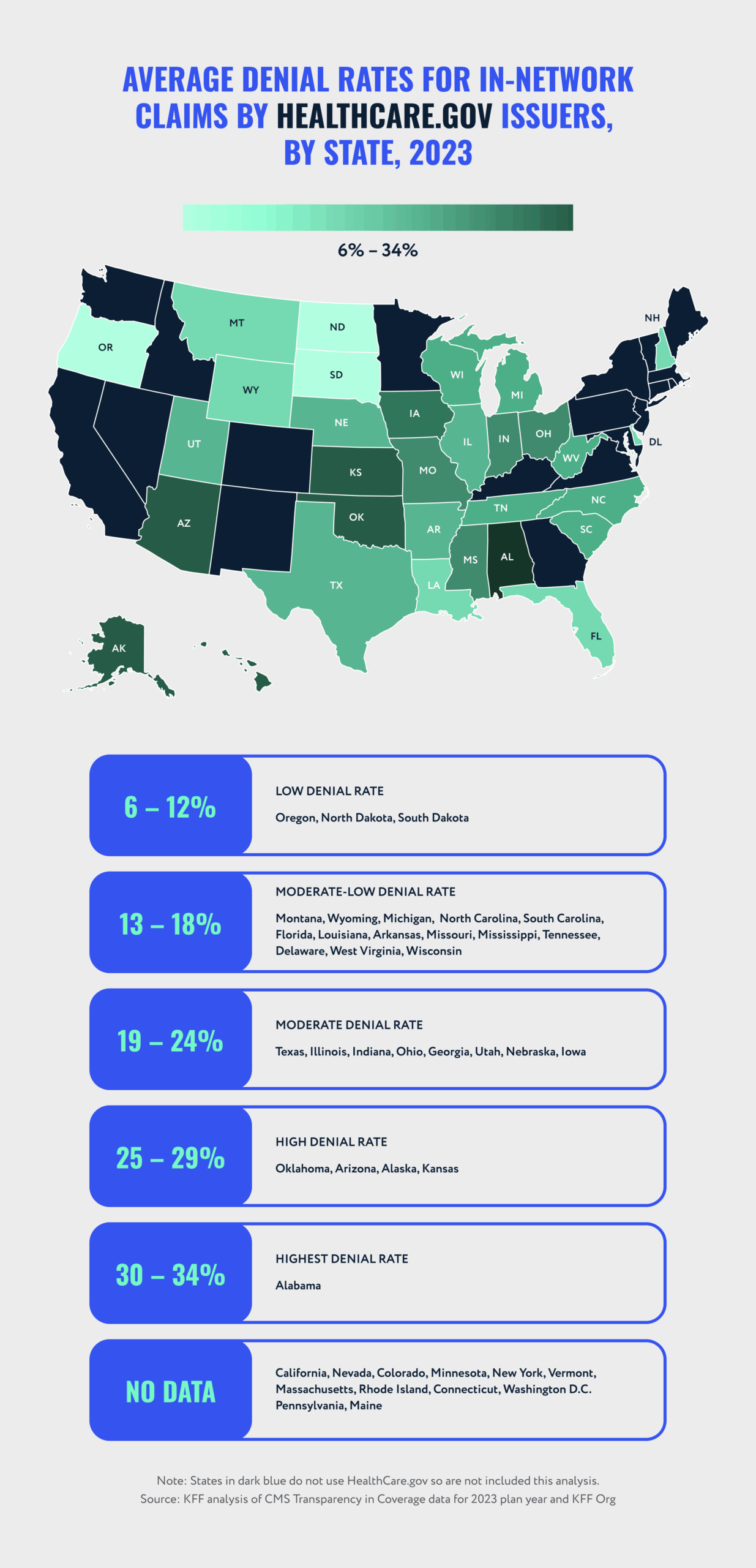

State Denial Rates

Wisconsin has fairly middle-of-the-road denial rates compared to other states. The average in-network denial rate for Wisconsin’s health insurance marketplace plans is 16%. The lowest single-issuer in-network denial rate is 7%, and the highest is 27%.

For the sake of comparison, Alabama (the state with the highest denial rates in the country) has an average marketplace in-network denial rate of 34%. The lowest single-issuer rate is 17%, and the highest is 42%.

High-Profile Lawsuits Involving a Denied Health Insurance Claim

Unfortunately, acting in bad faith is common in the health insurance industry. There have been several recent high-profile lawsuits against insurance companies that unfairly deny claims that were filed on behalf of patients, providers, and employers. They all allege that the insurers have violated contractual, legal, and ethical duties in the interest of enriching themselves.

BlueCross BlueShield

In October 2024, BlueCross BlueShield (BCBS) settled the largest antitrust lawsuit in healthcare history. The company violated antitrust laws by dividing the country into “service areas” where it agreed not to compete. It also illegally fixed prices.

Although BCBS denied all allegations, it agreed to a $2.8 billion settlement.

Cigna

Another lawsuit targets Cigna’s use of AI to deny claims. The law firm handling the suit alleges that Cigna uses an AI-based claim-review system that spends 1.2 seconds on each claim review. Using that system allowed the company to reject more than 300,000 claims in two months.

The lawsuit is not just about Cigna cutting corners. The case references two instances where patients were sent home early because Cigna would not pay for a provider’s recommended length of treatment.

Both patients died shortly thereafter.

Government Lawsuits

The U.S. Department of Justice sued six health insurance plans in March 2024. The lawsuit alleges that the plans knowingly concealed a calculation error that inflated rates.

Additionally, multiple employers have begun suing their health insurance providers after discovering that their plans deliberately overpaid providers while concealing plan data.

Common Reasons Why Insurance Claims Get Denied

When you take a look at health insurance denial rates by company, it is easy to see why insurance claim denials are on the rise. To reduce the risk of having your own claim denied, it can help to be aware of some of the most common reasons for denial.

Your Provider Claimed “Unnecessary Procedures”

This is one of the most frequently cited reasons for health insurance claim denials. It can be frustrating to learn that your insurance company believes an essential procedure or medication is medically unnecessary.

These denials can often be resolved by submitting additional medical documentation. Healthcare providers deal with denials like this on a near-daily basis, so your doctor will likely have an idea of how to prove medical necessity.

You Filed a Late Insurance Claim

All health insurance policies have deadlines for filing insurance claims. Many medical offices will handle claim submissions for you. If you have to submit a claim yourself, make sure you understand your policy’s deadline and do your best to adhere to it.

The Insurance Company Made a Billing Error

Sometimes, insurance companies deny claims without meaning to. Medical billing codes are incredibly complex, and a single mistyped digit can lead to a completely legitimate claim being rejected.

Most people are not familiar with medical billing codes and how they work, but your healthcare provider’s office (or specific billing department) may be able to help.

You Experienced a Policy Lapse

If you do not pay your health insurance premium on time and later try to file a claim, you may find that it gets denied. Many health insurance policies have a grace period (usually around 30 days) in which you can pay your premium late without a policy lapse.

However, if you exceed your provider’s grace period, it will not cover any claims until you reinstate your policy. One of the best ways to avoid a lapse is to set your premiums on autopay so you do not mistakenly miss one.

It is important to understand that an initial denial does not necessarily mean your provider will not pay your claim. If your claim is denied for any of the aforementioned reasons, you can file an appeal.

How Do You Know if an Insurance Company Is Stalling?

It can be vexing to discover that your insurance company is stalling. While it may seem like the company is simply overwhelmed with other paperwork, that is rarely the case.

Even if your insurer ultimately pays your claim, stalling enables it to pad its profits. Every day that an insurance company can hold onto its money is a day that that money can earn interest.

Many medical claims are only worth a few hundred dollars or slightly more, so the amount of interest a single claim can generate might not seem like much. However, when you multiply that by thousands (or even millions) of policyholders, it becomes clear why this strategy is so profitable.

What to Do if Your Claim Is Being Delayed

Here are some steps you can take if your health insurance company is unreasonably delaying your claim:

- Ask to speak to a supervisor if an agent will not give you a clear answer.

- Mention that you believe the company is acting in bad faith.

- File a claim with the Office of the Commissioner of Insurance.

If you are unsure what makes a delay reasonable, it can be helpful to research how long an insurer can delay a claim and how to determine whether it is acting in bad faith.

How Long Can an Insurance Company Delay a Payout?

Wisconsin law requires insurance companies to pay claims within 30 days (unless the insurance company has proof that it is not responsible for covering the loss). If an insurer fails to pay a claim within that time frame, it may be responsible for paying you the value of the claim plus interest.

Signs Your Insurer Is Acting in Bad Faith

It is not always obvious when an insurance company is acting in bad faith. The following signs may suggest that your health insurance company is deliberately failing to meet its contractual obligations:

- It asks for unrelated medical documentation.

- It says your policy has lapsed when you have been paying premiums on time.

- It says your policy does not cover your claim (even though the policy language indicates that the claim is covered).

- It does not acknowledge the evidence you and your doctor have submitted.

If your insurer is acting in bad faith and you have tried the strategies above to no avail, it might be time to consult one of our experienced attorneys.

How Can You Prevent Your Claim from Getting Denied?

Insurance companies routinely deny many types of health insurance coverage, including those for routine care, emergency care, and pre-planned surgeries. While you may not be able to prevent insurance claim denial entirely, you can take certain actions to reduce your risk:

- Keep and submit all relevant medical bills with your claim.

- Keep and submit itemized receipts for out-of-pocket costs.

- Keep and submit copies of prescriptions, as well as receipts for them.

- If your insurer requires referrals, include a copy with your claim.

Any time you send documentation with a claim, you should keep copies of your own. If the insurance company loses your documentation (or claims that it did), having a backup is essential.

The Importance of Medical Documentation in a Health Insurance Claim

If your healthcare provider files your claims for you, you likely will not have to gather and submit medical documentation yourself. Even so, it is wise to keep records and receipts for all expenses in case there are unforeseen issues with processing your claim.

What Is Your Legal Recourse for a Denied Claim?

It is easy to feel discouraged if your health insurance company denies your claim. Keep in mind, however, that an initial denial is just that — initial.

Most people have had to appeal a denied health insurance claim at least once. When your insurance company rejects a claim, it will send you a denial letter with instructions on how to appeal. These strategies will improve your chances of a successful appeal:

- Contact your insurer to ask why the claim was rejected if the denial letter does not clearly state a reason.

- Review the documentation initially submitted with your claim.

- Gather additional evidence, such as medical records and/or statements from your doctor.

- File an internal appeal with the insurance company.

- If the appeal is denied, file an external claim for a third-party review.

If your insurer continues to deny a claim you believe is valid, Wallace Law may be able to assist you. We have helped countless people stand up to insurance companies who refuse or delay claims in bad faith.

How Long Do You Have for Appealing a Health Insurance Claim Denial in Wisconsin?

When appealing a health insurance claim denial, you should be mindful of both your insurer’s appeal deadline and the deadline for external appeals. If you need to file an external appeal with the Department of Health Services, you will generally have 60 days from the date of your insurer’s final denial.

An Insurance Dispute Lawyer Can Help You Fight Back Against a Denial

Insurance companies have teams of legal professionals at their disposal to help them preserve their profits. You deserve the same committed representation. Getting a qualified insurance dispute lawyer in your corner can increase your chances of a successful appeal.

The team at Wallace Law has recovered millions of dollars for clients whose insurance companies unjustly denied or underpaid their claims. Do not take on your insurance company alone — contact us today for a free consultation.